HBAR, the native cryptocurrency of the Hedera Hashgraph network, has recently experienced a significant decline, further extending the bearish trend that has been in play for several weeks.

The altcoin is now facing a challenging period, with signs pointing to potential further losses in the coming weeks.

HBAR Can Not Catch A Break

The most alarming technical indicator for HBAR traders right now is the formation of a Death Cross, which occurred at the end of May. This is the second time in just six weeks that HBAR has seen this bearish pattern. The Death Cross occurs when the 200-day Exponential Moving Average (EMA) crosses above the 50-day EMA, signaling a potential shift to the downside.

This recent crossover follows a similar pattern noted in the second half of May when HBAR experienced a short-lived Golden Cross, a bullish pattern, which lasted only slightly over two weeks before it reversed course. The latest Death Cross suggests that the price is now more susceptible to a correction, continuing the downward pressure on the altcoin.

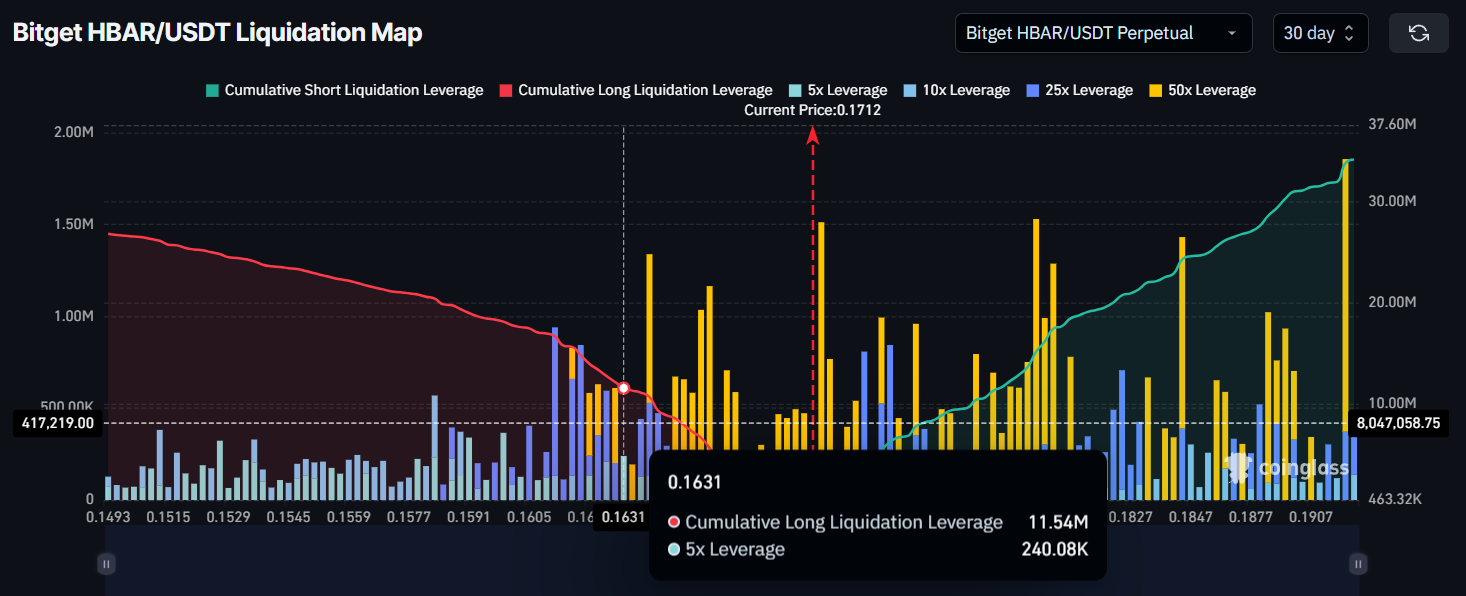

The current liquidation map further underlines HBAR’s macro momentum, highlighting the potential risk for traders if the price continues to decline. If HBAR falls below its current support at $0.163, it could trigger $11.5 million in liquidations, further amplifying the bearish momentum.

This liquidation pressure could extend if the price continues its downward trajectory, exacerbating the losses for traders expecting a price rise. The current market sentiment for HBAR indicates a lack of strong buying pressure, suggesting that the bearish trend could persist unless a reversal occurs.

HBAR Price Aims At Breaching Resistance

At the time of writing, HBAR is trading at $0.171, attempting to recover the 18% losses from the previous week. To reverse its current downtrend, HBAR would need to secure the $0.200 level as support. However, the prevailing technical factors suggest that a decline remains more likely.

If HBAR fails to breach the $0.172 level, the altcoin is likely to consolidate above the $0.163 support. Should this support level break, HBAR could see a further drop toward $0.154, amplifying the selling pressure and triggering more liquidations.

On the other hand, if HBAR can flip the $0.172 level into support, there is a chance for the altcoin to bounce back toward the $0.182 resistance level. A successful breach of this resistance would invalidate the bearish thesis, signaling a potential recovery for HBAR.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.