The crypto market saw a brief correction following the release of the US Federal Reserve’s May policy meeting minutes. Bitcoin and Ethereum fell by around 2% on Tuesday evening, while Solana and XRP dipped by 4%.

The corrections came after the Fed revealed that officials are increasingly concerned about a difficult economic outlook.

FOMC Minutes Indicate Inflation Fears and Policy Paralysis

Policymakers discussed the risk of rising inflation and unemployment happening simultaneously. This scenario could force the Fed into tough tradeoffs on interest rates.

The minutes, published three weeks after the May 6–7 meeting, highlighted rising uncertainty due to tariff threats from the Trump administration.

Although Trump delayed the planned 145% tariffs on Chinese imports, the Fed noted that policy risks remain elevated.

Officials said financial volatility, including surging bond yields before the meeting, warranted ongoing monitoring. Some noted the potential impact on the US dollar’s global standing and Treasury market stability.

Fed staff also presented a weaker growth outlook. They projected a notable rise in inflation this year and a sustained increase in the unemployment rate above 4.6%—the Fed’s estimate of full employment.

During the meeting, the central bank left its benchmark interest rate unchanged at 4.25% to 4.5%. Chair Jerome Powell said the Fed would likely stay sidelined until the full effects of trade policy became clearer.

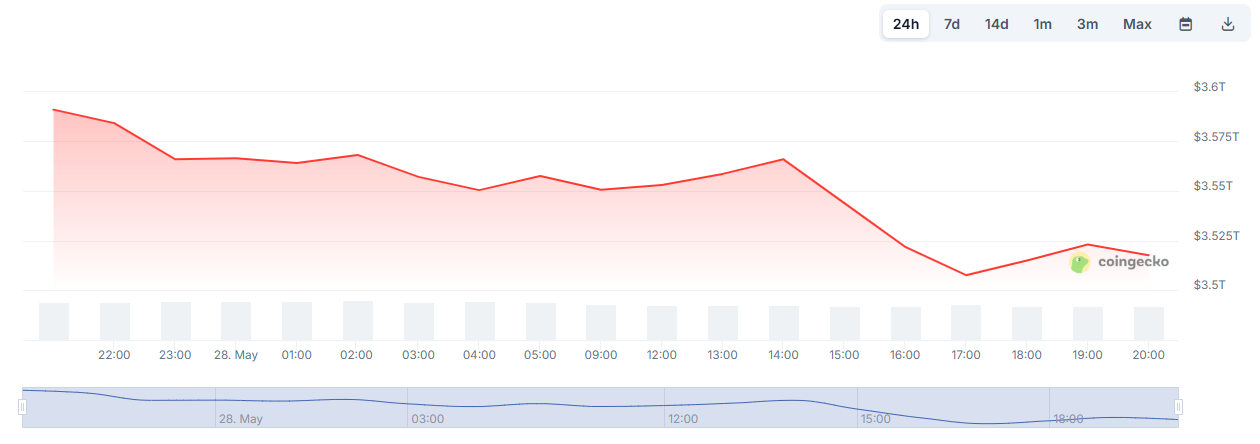

Crypto traders responded by cutting risk, with total market capitalization slipping and funding rates turning mixed.

The market appears to be pricing in slower growth but persistent inflation, a scenario that leaves digital assets vulnerable to rate uncertainty.

The next FOMC meeting is scheduled for June 17–18. Until then, crypto markets may remain volatile, especially if new data reinforces concerns about stagflation or delayed rate cuts.

Market participants now await updated economic projections and clues on how the Fed may react if both inflation and joblessness worsen together.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.