Ripple’s XRP has gained 3% in the last 24 hours, riding the wave of renewed optimism in the broader cryptocurrency market.

While the increase may appear modest, underlying technical indicators suggest the XRP token rally has more room to run. This analysis holds the details.

XRP Clears Key Resistance—Technical Indicators Point to More Upside

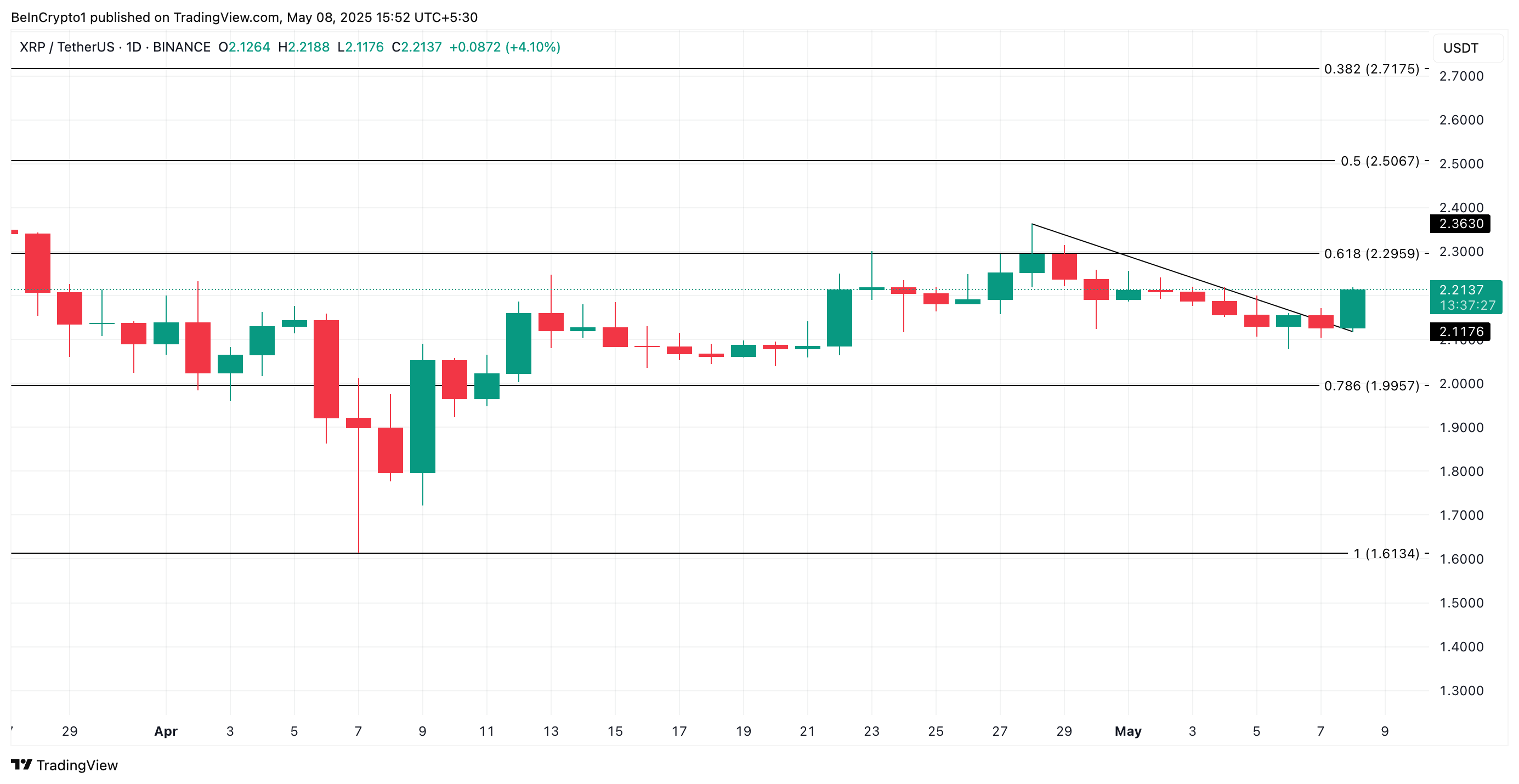

XRP has successfully broken above a descending trendline, overcoming a key resistance level that had capped its upside since the end of April. This move signals a trend reversal and puts XRP in a favorable position for further gains.

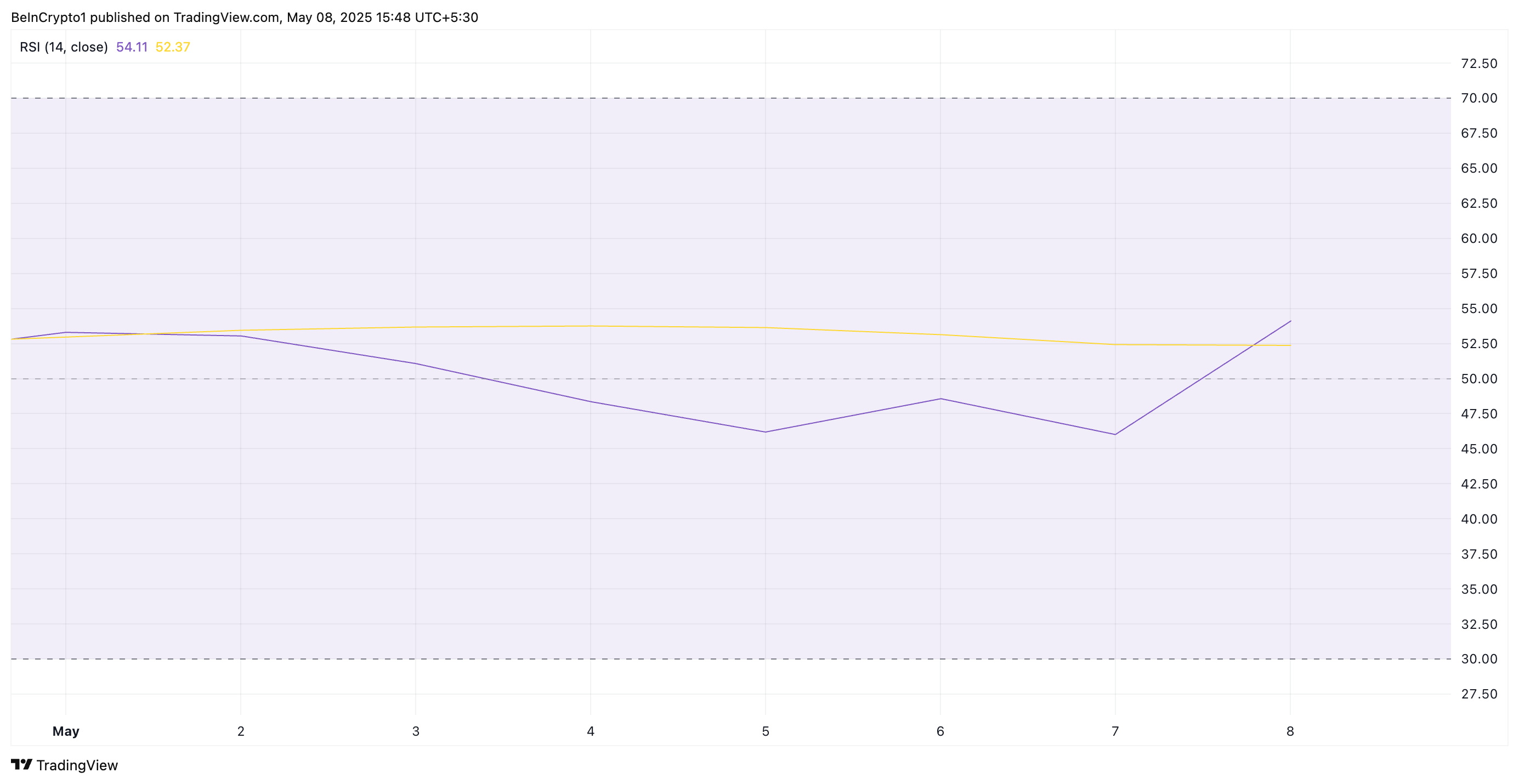

Readings from XRP’s Relative Strength Index (RSI) support this bullish outlook. At press time, the momentum indicator is at 54.11, noting a steady uptick.

The RSI indicator gauges whether an asset is overbought or oversold. It ranges from 0 to 100, with readings above 70 typically signaling overbought conditions and a potential price decline. Conversely, values below 30 suggest the asset is oversold and may be due for a rebound.

At 54.11 and climbing, XRP’s RSI indicates that buying pressure is strengthening. It also hints at the likelihood of more gains before the token becomes overbought.

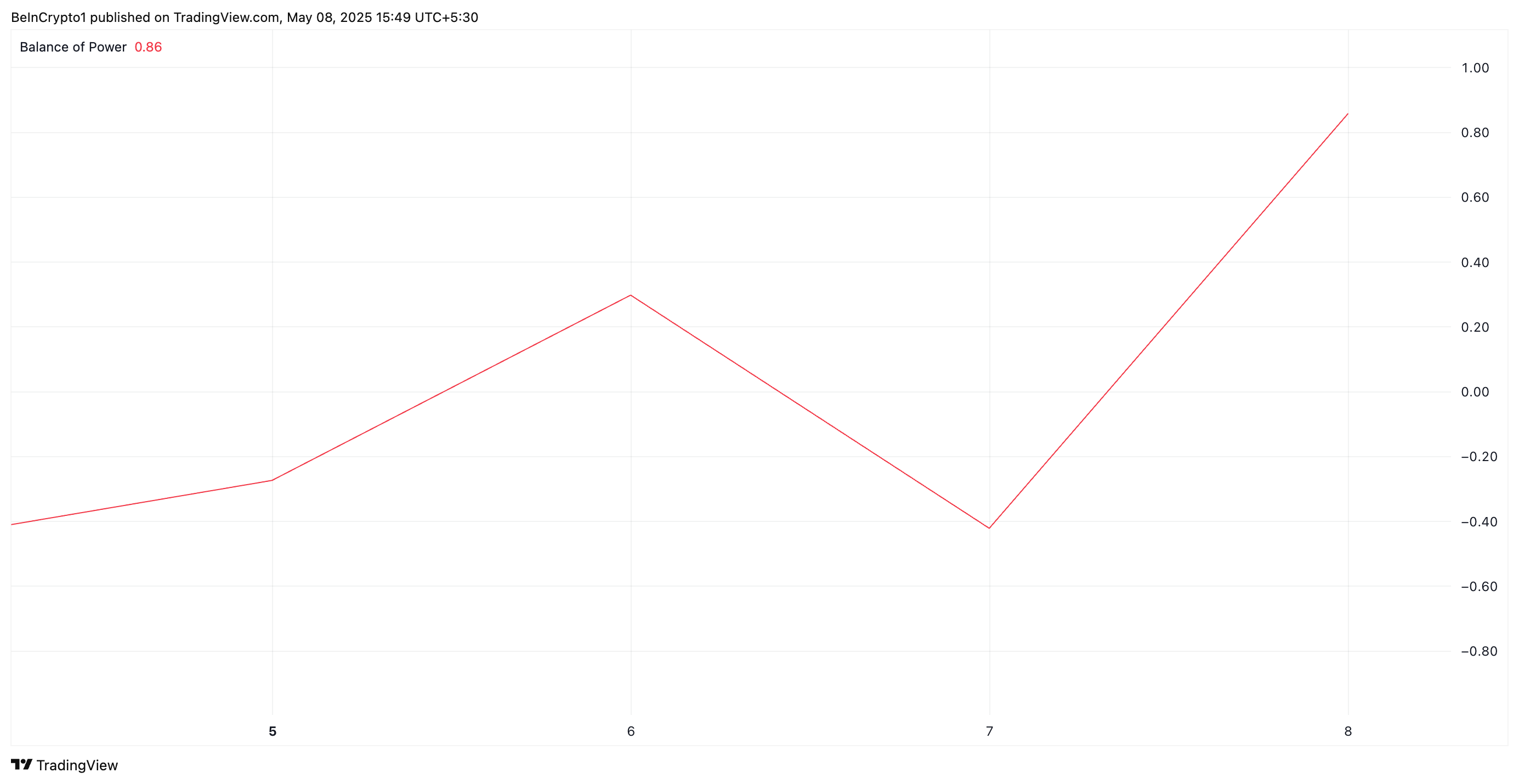

Likewise, XRP’s Balance of Power (BoP) returns a positive value at press time, highlighting the bullish bias toward the altcoin. It currently stands at 0.86.

The BoP indicator measures the strength of buying versus selling pressure in an asset’s market. When it climbs this way, buyers dominate the spot markets. This indicates a potential bullish trend for the XRP token and suggests its upward momentum could continue.

XRP Bulls Eye $2.50 After Breakout

XRP rests solidly above the descending trend line at $2.21. If demand strengthens and the breakout sees more bullish momentum, it could drive the token’s price past the resistance at $2.29.

A successful breach of this price level could drive XRP to $2.50.

XRP Price Analysis. Source: TradingView

However, if buying stalls and XRP’s retest of the breakout line fails, it could fall to $1.99.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.