Bitcoin’s recent surge above the $95,000 mark has reignited bullish sentiment across the crypto market, lifting several altcoins.

The rally in BTC has reignited investor confidence, and with the first week of May underway, three altcoins stand out as potential strong performers: Ethereum (ETH), Virtuals Protocol (VIRTUAL), and Solayer (LAYER).

Ethereum (ETH)

Ethereum is gearing up for its long-awaited Pectra upgrade, scheduled to go live on the mainnet on May 7. This network overhaul is expected to significantly improve Ethereum’s scalability, validator mechanics, and smart contract architecture.

Despite its bullish potential, the upgrade comes with risks that may affect ETH’s price. Major exchanges are expected to pause ETH deposits and withdrawals during deployment, which could trigger short-term volatility or temporary sell pressure.

Also, any technical challenges during the deployment could introduce market uncertainty and worsen market sentiment.

ETH trades at $1,808 at press time, noting a steady buildup in bullish momentum. This is reflected by its Chaikin Money Flow (CMF), which currently sits at 0.13 and is in an uptrend. A positive CMF reading like this indicates a surge in buying pressure. If this trend persists, ETH could rally to $2,072.

On the other hand, a dip in the coin’s demand could send its price to $1,744.

Virtuals Protocol (VIRTUAL)

VIRTUAL has soared by 37% over the past week, making it the top-performing asset in the market over the last seven days. It currently trades within an ascending parallel channel, confirming the surge in buying pressure.

This bullish pattern is formed when an asset’s price moves between two upward-sloping, parallel trendlines, one acting as support and the other as resistance. This pattern indicates a sustained upward trend with consistent price swings between the parallel lines.

If VIRTUAL remains within the channel, it could rally above the $2 mark to trade at $2.15.

However, if demand wanes, and VIRTUAL breaks below the support line of the ascending parallel channel, its price could fall to $0.96.

Solayer (LAYER)

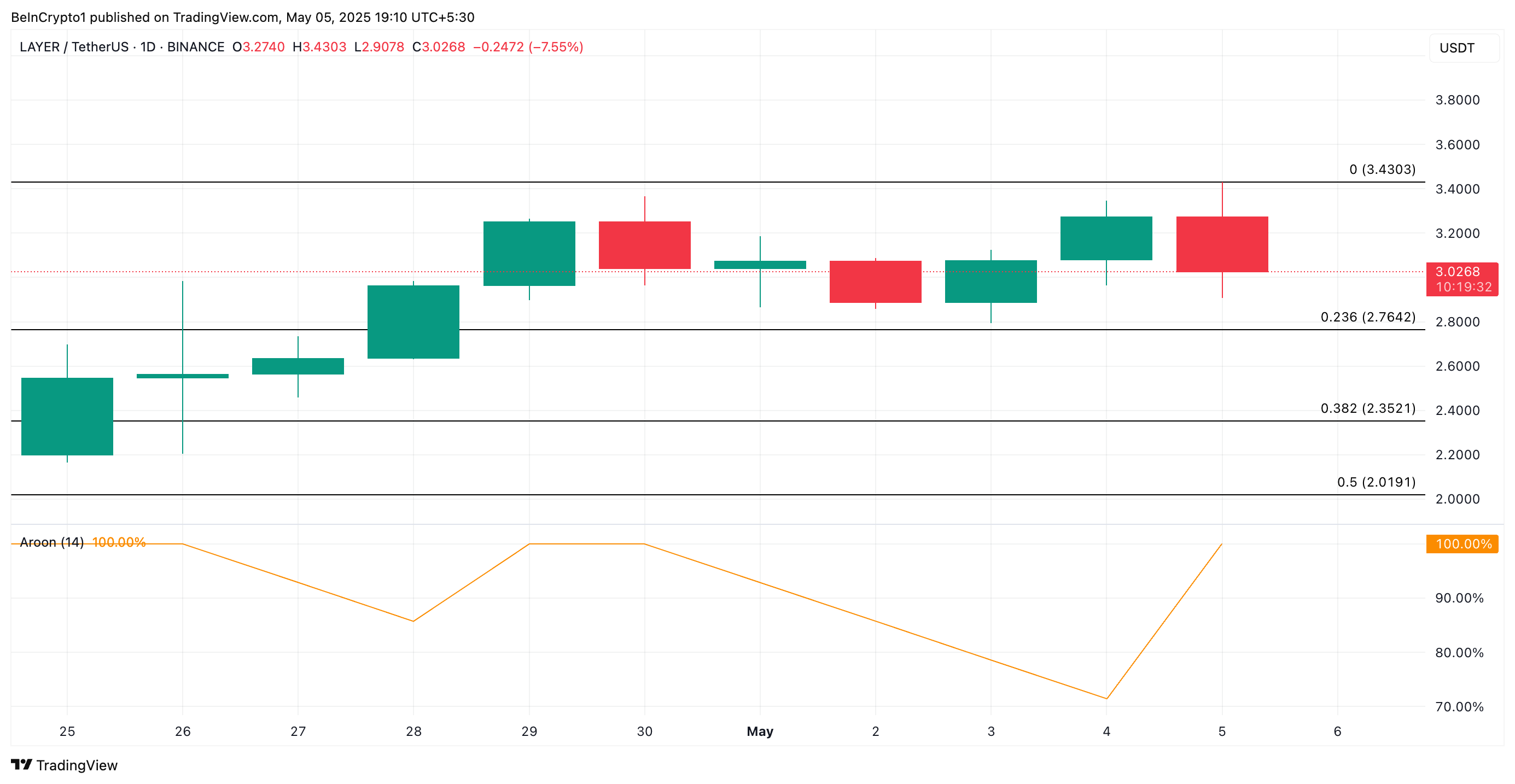

LAYER has gained 14% over the past week to trade at $3.02 at press time. An assessment of the LAYER/USD one-day chart shows the token’s Aroon Up Line at 100%. This indicates that its current uptrend is strong, backed by significant demand for the altcoin.

An asset’s Aroon Indicator measures the strength and direction of a trend by tracking the time since the highest and lowest prices over a given period. It comprises two lines: Aroon Up, which measures bullish momentum, and Aroon Down, which tracks bearish pressure.

As with LAYER, when the Aroon Up line is at 100, the asset has recently hit a new high. This is true of the token, which traded at an all-time high of $3.43 early Monday.

This trend suggests that buying pressure is high, and the price may continue rising. If this happens, LAYER could revisit its all-time high and rally past it.

LAYER Price Analysis. Source: TradingView

Conversely, if selloffs commence, the token’s price could fall to $2.46.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.