KCS, the native token of cryptocurrency exchange KuCoin, is holding strong amidst a market-wide downturn. The altcoin has defied the broader market downturn with a 1% price increase in the past 24 hours.

This modest uptick may signal the beginning of a larger bullish trend, as technical indicators show strengthening upward momentum. This analysis holds the details.

Buying Pressure Intensifies for KCS

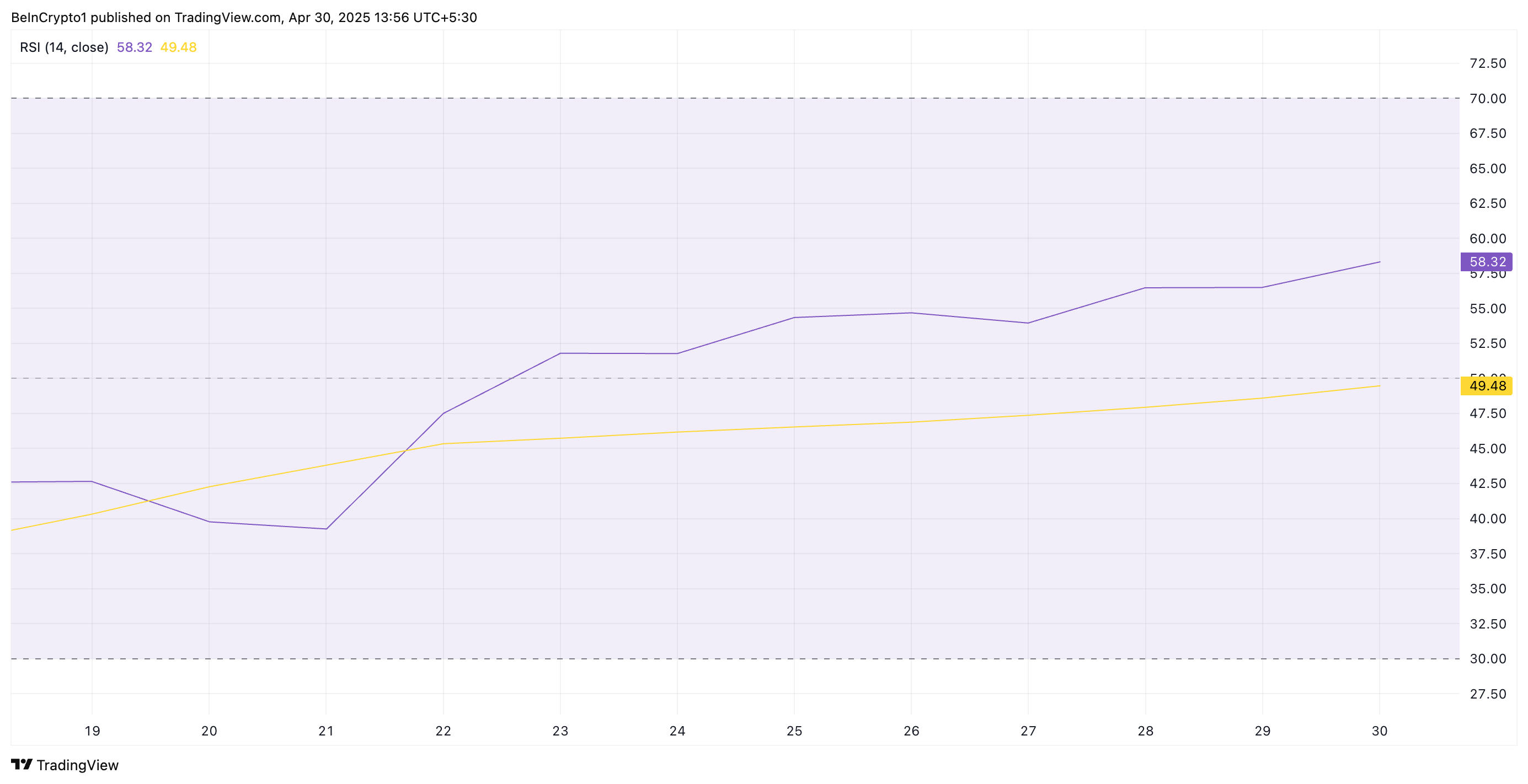

Readings from KCS’ daily chart suggest that bullish pressure is building. Notably, its Relative Strength Index (RSI) is currently at 58.32 and is on an upward trend, confirming the strengthening demand for the altcoin.

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100, with values above 70 suggesting that the asset is overbought and due for a price decline. Converesly, values under 30 indicate that the asset is oversold and may witness a rebound.

At 58.32 and climbing, KCS RSI signals that bullish momentum is gaining traction and buying pressure is intensifying.

Moreover, the token’s Moving Average Convergence Divergence (MACD) confirms this positive trend. As of this writing, KCS’ MACD line (blue) rests above its signal line (orange).

An asset’s MACD indicator identifies trends and momentum in its price movement. It helps traders spot potential buy or sell signals through crossovers between the MACD and signal lines.

As in KCS’ case, when the MACD line is above the signal line, it indicates bullish momentum in the market. Also, traders often view this setup as a buy signal; hence, they might be prompted to buy more KCS tokens, further driving up its short-term value.

KCS Tests Critical Level as Bulls Aim for 58-Day High

KCS currently trades at $10.71, resting just below the resistance formed at $10.90. If the demand for the altcoin grows and it successfully flips this price barrier into a support floor, it could propel KCS to $11.77, a high last reached on March 3.

However, if KCS holders resume profit-taking, it could lose its recent gains and fall to $10.027.

If the bulls fail to defend this support level, KCS could extend its decline, break below $10 to trade at $8.94.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.