Ethereum’s major holders are returning to the market. Amid the past week’s market consolidation, major players have seized the opportunity to accumulate ETH aggressively.

On-chain data reveals an uptick in whale holdings, while ETH-based exchange-traded funds (ETFs) recorded their first weekly net inflow in eight weeks, signaling a significant shift in sentiment.

ETH Whale Accumulation and ETF Inflows Hint at Imminent Price Surge

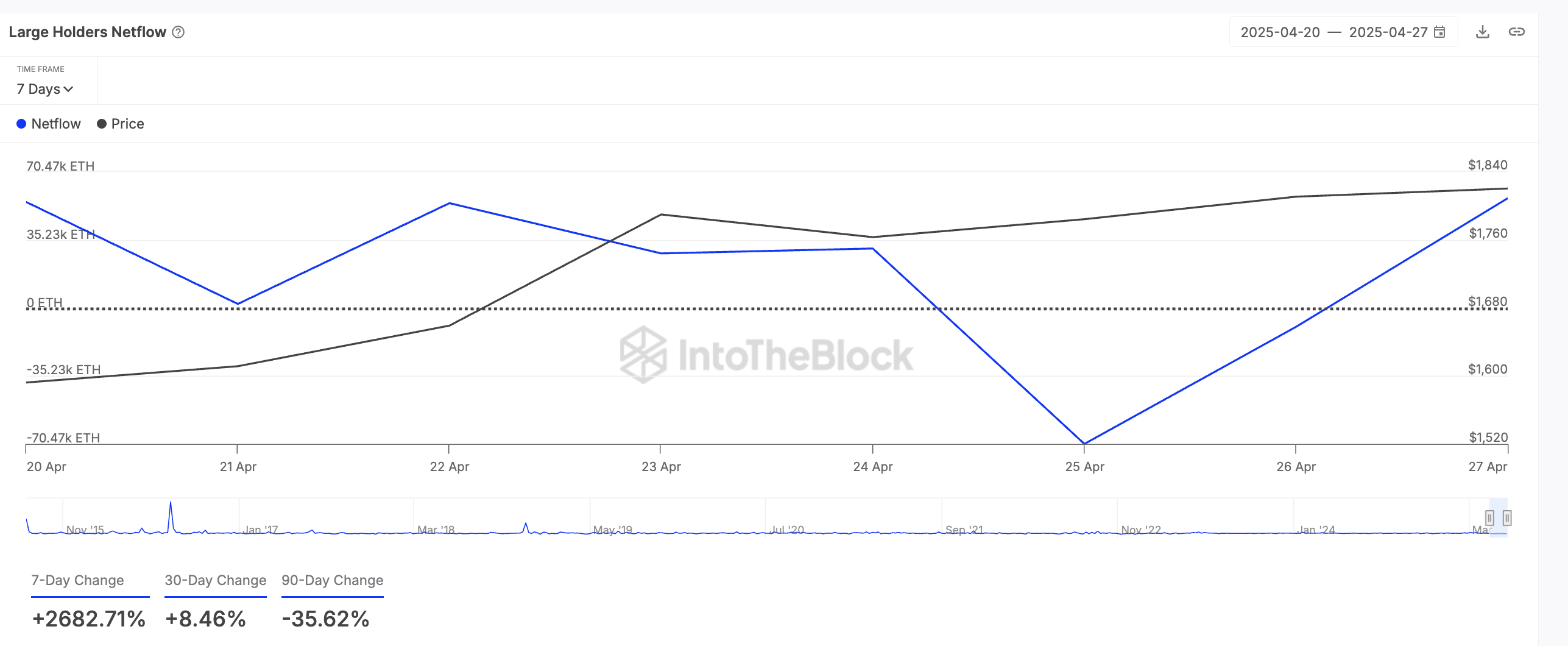

According to on-chain data, leading altcoin ETH has noted a significant spike in its large holders’ netflow over the past week. According to the on-chain data provider, this has rocketed 2682% in the past seven days.

Large holders of an asset refer to whale addresses holding more than 0.1% of its circulating supply. The large holders’ netflow metric tracks the difference between the coins these investors buy and the amount they sell over a specific period.

When an asset’s large holders’ netflow surges, its whale investors are ramping up their coin accumulation. This accumulation trend suggests a belief in ETH’s future upside, as major holders tend to act when they see value at current price levels.

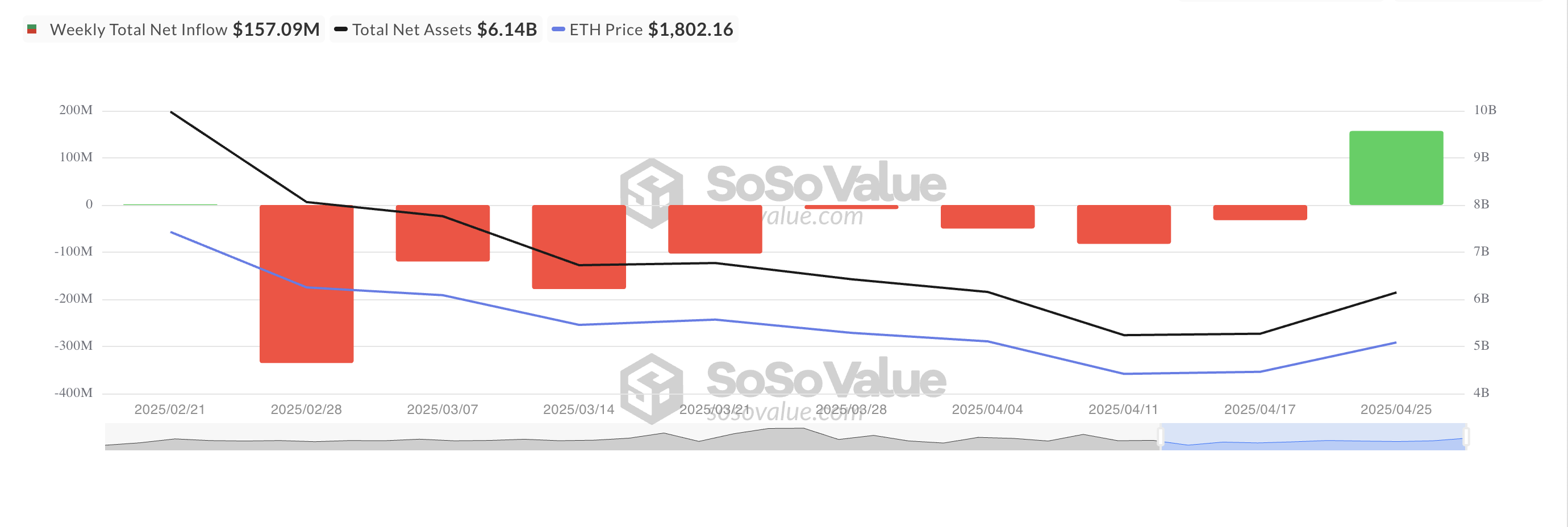

Adding to the bullish narrative, ETH-backed ETFs recorded their first weekly net inflow in eight weeks. According to SosoValue, net inflows into ETH-backed ETFs reached $157.09 million between April 21 and April 25, reversing an eight-week streak of outflows totaling over $700 million.

With major players re-entering the market, ETH could be poised for further upside in the near term.

Ethereum Sees Bullish Momentum

On the technical side, ETH’s positive Balance of Power (BoP) highlights the resurgence in demand for the leading altcoin. This is currently at 0.31.

This indicator measures the buying and selling pressure of an asset. When its value is positive, pressure outweighs selling pressure. This indicates strength in the ETH’s price movement and signals further potential upward momentum. If this happens, ETH could rally back above $2,000 to exchange hands at $2,027.

However, if market sentiment worsens, ETH could shed recent gains and plummet to $1,385.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.