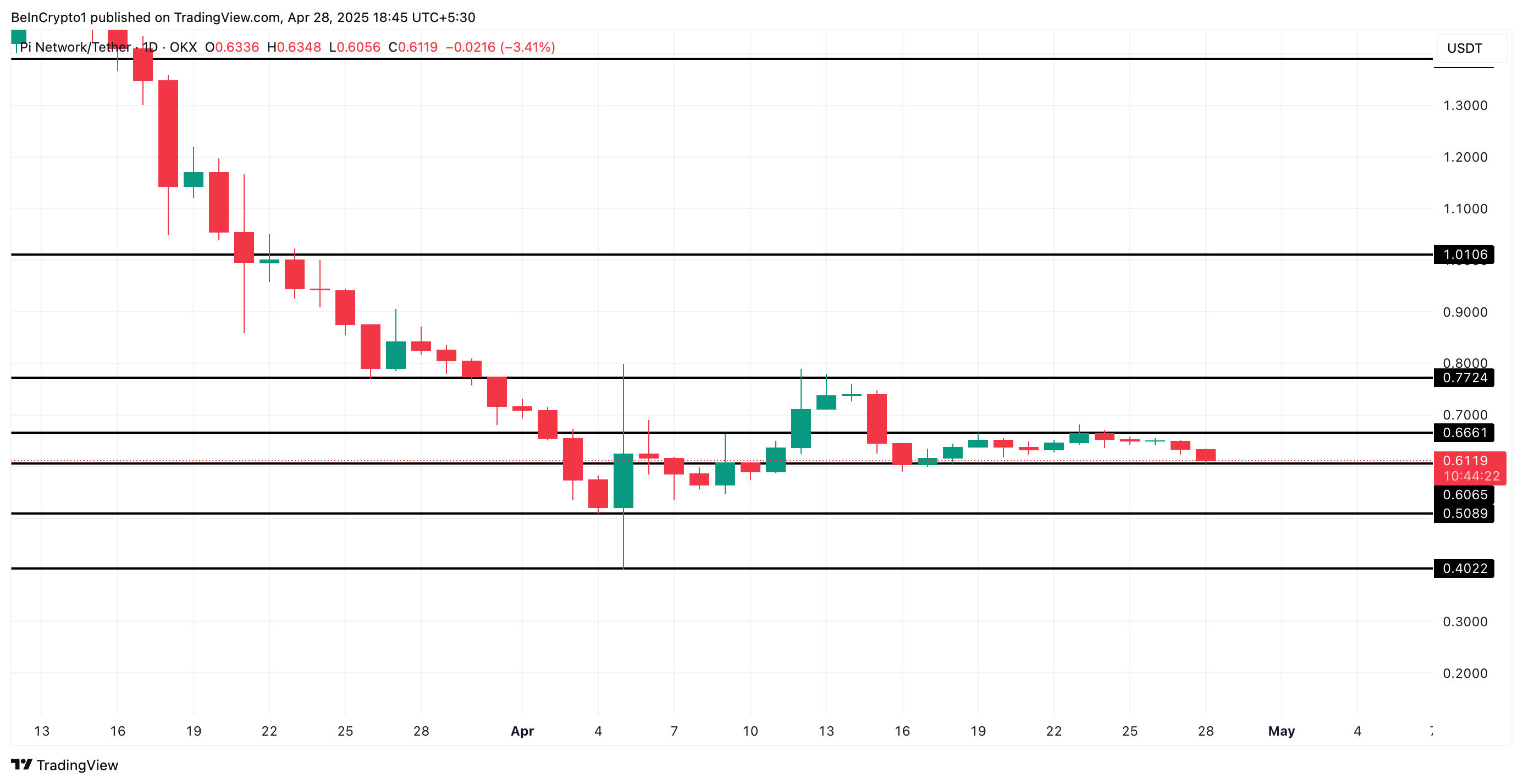

Pi Network’s PI token seems to have entered a consolidation phase, as the price action has leveled off. Since April 16, the token has faced resistance at $0.66 while finding support at $0.60, creating a narrow trading range.

This signals a period of indecision in the market, with neither PI buyers nor sellers taking full control.

PI’s Price Action in Limbo

Readings from PI’s Aroon indicator confirm the recent stagnation in its price. As of this writing, the token’s Aroon Up Line (yellow) is at 0%, while its Aroon Down Line (blue) is in decline at 14.29%.

The Aroon indicator identifies market trends and determines whether a trend is strong or weak.

A 0% reading on the Aroon Up Line suggests that PI has not reached a new high recently, signaling a lack of upward momentum. Meanwhile, the Aroon Down Line’s decline to 14.29% indicates that the token has not been experiencing significant downward pressure either.

This trend suggests a balanced market, where neither bulls nor bears are taking the lead. The setup confirms that PI is in a consolidation phase, with a breakout in either direction dependent on shifts in market sentiment.

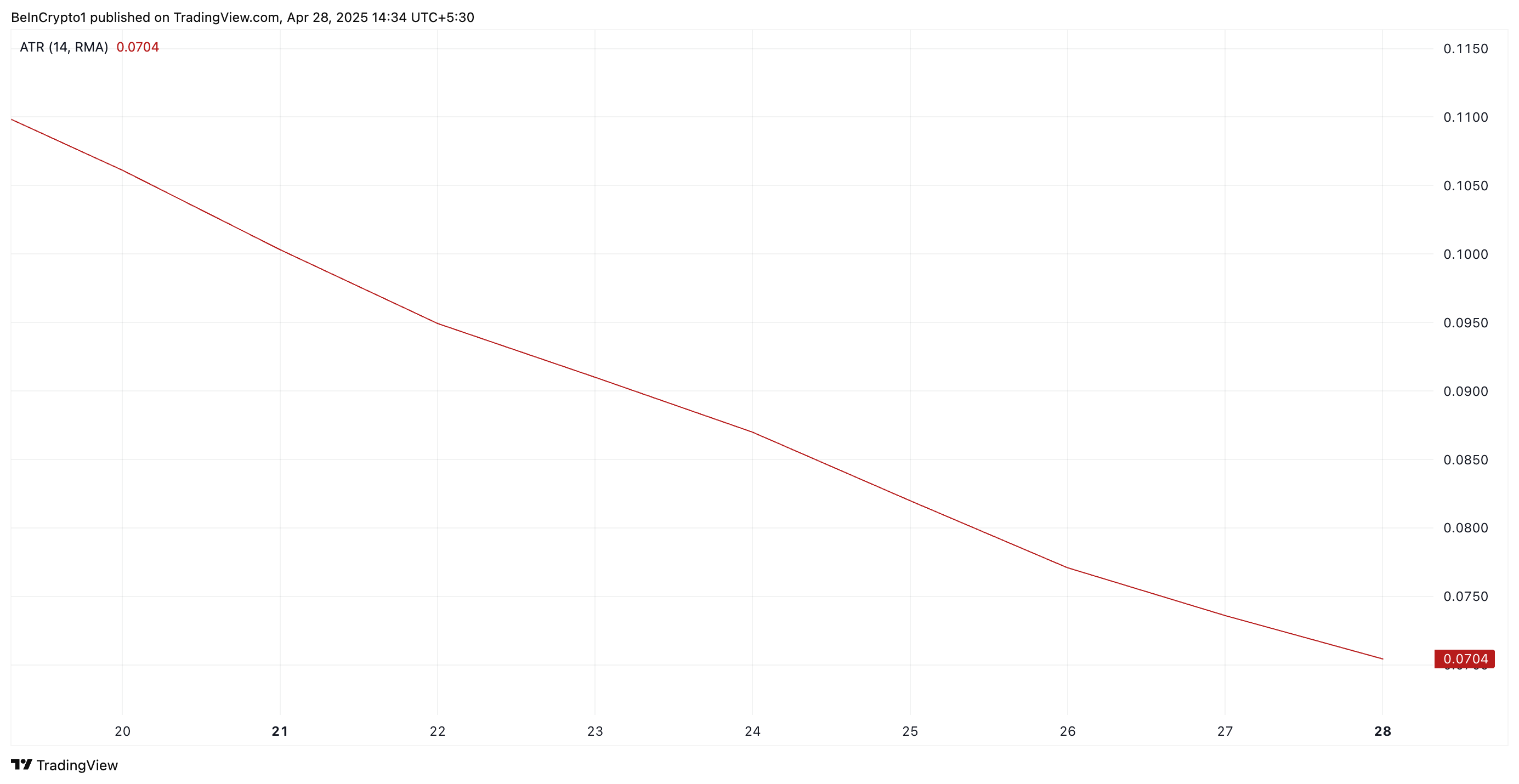

Further, the steady decline in PI’s Average True Range (ATR) since early March confirms the decrease in its market volatility and the shift towards consolidation. At press time, this indicator stands at 0.07.

The ATR indicator measures market volatility by calculating the average range between the high and low prices over a set period. When it falls like this, it indicates a decrease in market volatility, suggesting that price movements are becoming less erratic.

This often signals a period of consolidation or indecision in the market, as traders await a potential breakout or shift in direction. For PI, this is evident as both buyers and sellers hesitate, waiting for a catalyst to drive their next moves.

Will Bullish Momentum Drive PI to $1 or Will Bears Retake Control?

A breakout—whether to the upside or downside—could signal the start of a new trend, making PI a token to watch in the coming days. If bullish pressure soars and demand for the altcoin spikes, its price could witness a rally and attempt to break above the resistance at $0.66.

A successful breach of this level could propel PI’s price to $1.

Conversely, if the bears regain full control and selloffs resume, PI could break below the support at $0.60 and fall to $0.50.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.