The resurgence in broader market activity over the past 24 hours has triggered an uptick in bullish bias towards Hedera (HBAR), with traders increasingly betting on further price gains.

HBAR’s long/short ratio has climbed to its highest level in the past month, signaling a shift in trader positioning.

Bullish Bets Push HBAR Toward Breakout Territory

HBAR’s long/short ratio currently stands at 1.09, its highest level in the past 30 days. This indicates a sharp rise in the demand for long positions among HBAR’s derivatives traders on Wednesday.

An asset’s long/short ratio measures the proportion of its long positions (bets on price increases) to short positions (bets on price declines) in the market. A ratio below one means there are more short positions than long ones.

Conversely, as in HBAR’s case, a long/short ratio reading above one indicates that traders are predominantly bullish on the altcoin, and are opening bets in favor of an extended price rally.

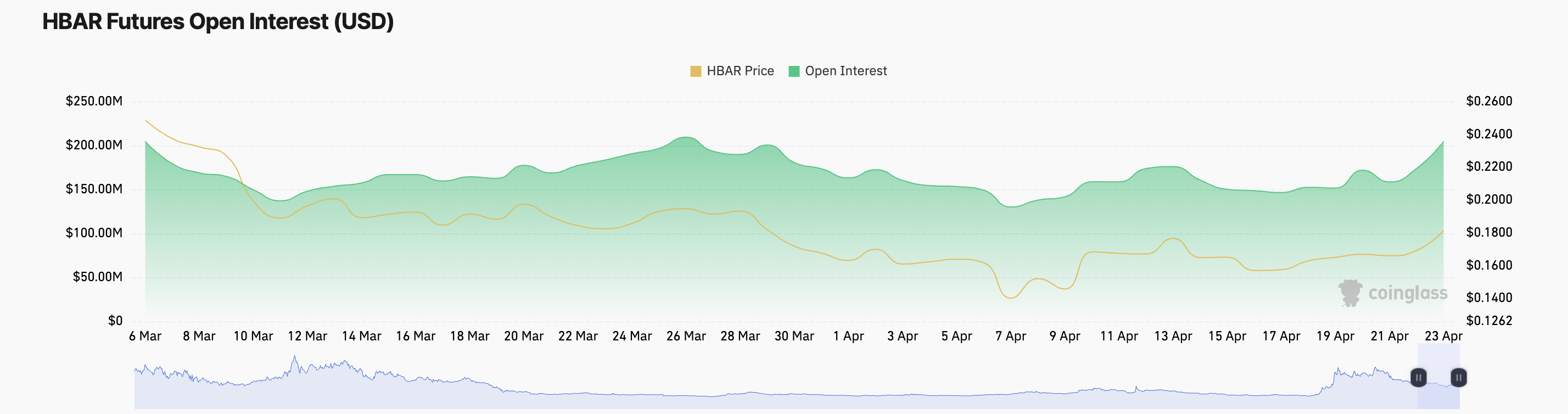

Moreover, HBAR’s rising futures open interest confirms the renewed demand for the altcoin. At press time, this is at $205 million, climbing 18% over the past day. HBAR’s value is up almost 10% within the same period.

Open interest refers to the total number of outstanding futures contracts that have not been settled. When open interest rises alongside price like this, it indicates that new money is entering the market to support the uptrend. This trend signals strong conviction behind the HBAR’s upward movement.

Can HBAR Break Out? Traders Watch $0.199 as Next Key Level

As of this writing, HBAR trades at $0.187, resting above the resistance formed at $0.190. If demand strengthens and HBAR bulls flip this price level into a support floor, the token could extend its uptrend and climb to $0.199.

On the other hand, if HBAR bears regain market control, this bullish projection will be invalidated. In this scenario, the token could lose its recent gains and fall to $0.153.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.