Bitcoin May Not Beat Gold & Forex as Safe Haven Asset

On 3 January 2020, a United States drone strike killed Iran’s most prominent military commander, which increased the tensions between the U.S. and Iran and could trigger a broader Middle East conflict. Investors worried the conflict between the two nations might escalate into a prolonged and damaging war, so some of them increased the allocation of gold and Forex, while others rush to cryptocurrencies, bitcoin, in particular, driving their prices to surge high. Gold and traditional currencies such as the US Dollar, Japanese Yen, Euro, Pound or Chinese Renminbi are all universally accepted as safe-haven assets, but what about bitcoin? Is BTC a safe-haven asset under the growing geopolitical and economic turmoil?

Is BTC a Safe Haven Asset?

Amid all the turmoil and confusion, though bitcoin managed to reach $9,011, the highest price of the year so far, it is still a high-risk bet and cannot be a safe haven even in times of turmoils for the following reasons:

- Bitcoin market volume is too small to support the concept of safe-haven assets. In traditional investing, a safe haven asset is one where the price typically rises when traders fear of increasing risks or loss; shift money from a riskier asset into a safer one to retain the value of an investment. In fact, compared to the traditional financial market, bitcoin’s market cap of less than $200 billion US dollar is too small to perform the function of safe-haven assets. Moreover, due to the lack of regulations, manipulations, and scams also exist in the bitcoin market. That’s also one of the reasons why SEC rejected or postponed Bitcoin ETF.

- Bitcoin cannot be used in a chaotic environment for lacking internet access. In the turbulence area, it may cut off the connection of bitcoin traders and global cryptocurrency exchange for lack of Internet access or limited connectivity. For instance, in Iran, Revolutionary Guard crackdowns on nationwide protests against political corruption and rising gas price, the Iranian government shut down global internet access for nearly five days. And bitcoin wallet apps and exchange apps are blocked despite regaining Internet connectivity. In this case, bitcoin cannot be considered as an alternative of currencies as well as a safe haven asset.

Invest in Safe Haven Asset in Bex500 Exchange

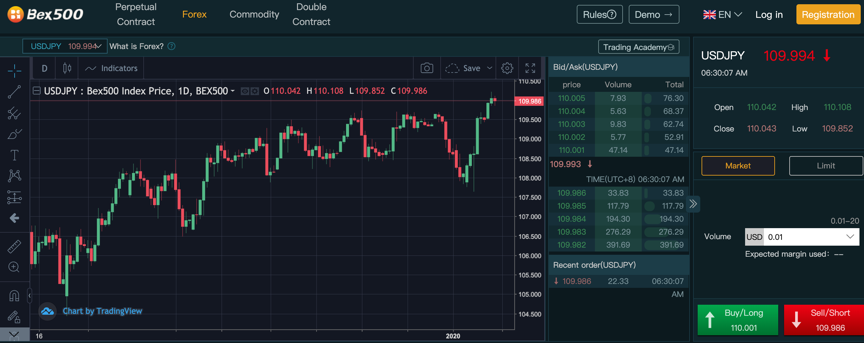

Bex500 is a bitcoin-based derivatives exchange available to traders from 130+ countries around the world. In the Bex500 exchange, investors can trade 40+ products including crypto perpetual contract, Forex, commodity and exclusive double contract with up to 200x leverage, with BTC or USD. Traders can amplify the profits by shorting or longing with high leverage added even in small price fluctuations.

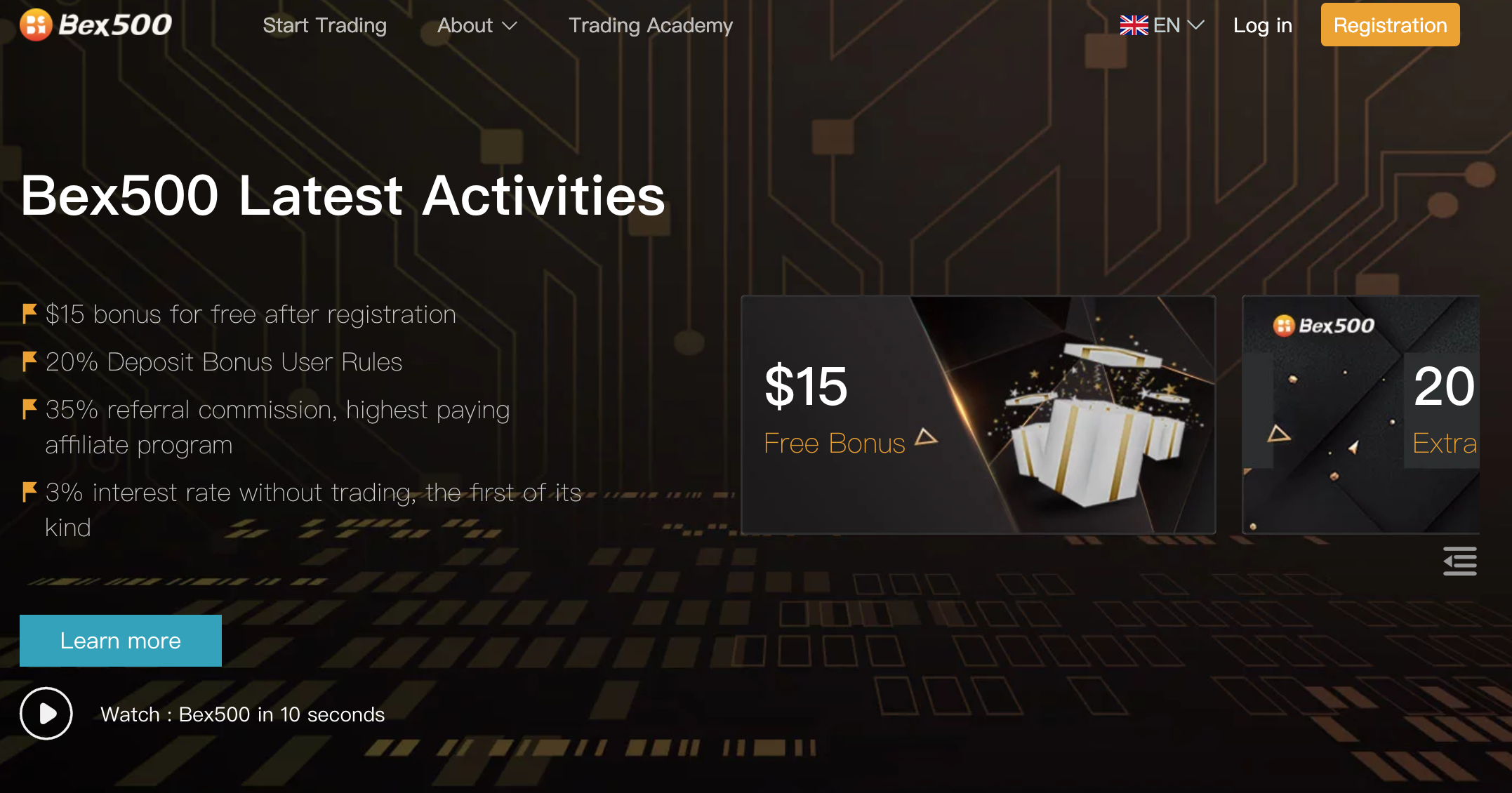

Join Bex500 now to get $15 worth free BTC or USD, and you can use it to make profits in crypto, forex or commodity trading. Deposit BTC or USD in your Bex500 account, you will also get an extra 20% bonus.

Invest in Safe Haven Asset in Bex500 Exchange

Bex500 is a bitcoin-based derivatives exchange available to traders from 130+ countries around the world. In the Bex500 exchange, investors can trade 40+ products including crypto perpetual contract, Forex, commodity and exclusive double contract with up to 200x leverage, with BTC or USD. Traders can amplify the profits by shorting or longing with high leverage added even in small price fluctuations.

Join Bex500 now to get $15 worth free BTC or USD, and you can use it to make profits in crypto, forex or commodity trading. Deposit BTC or USD in your Bex500 account, you will also get an extra 20% bonus.

More about Bex500

Website: www.bex500.com

Telegram: https://t.me/bex500official

Facebook: Bex500official

FB Group: Bex500

Twitter: @Bex5002

Instagram: bex500official

YouTube: Bex500 Official

Email: [email protected]

WhatsApp: +85254494690

More about Bex500

Website: www.bex500.com

Telegram: https://t.me/bex500official

Facebook: Bex500official

FB Group: Bex500

Twitter: @Bex5002

Instagram: bex500official

YouTube: Bex500 Official

Email: [email protected]

WhatsApp: +85254494690

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Ashton Wolfe

From planting Bitcoin ATM's around North America to developing solutions for top-tier fintech businesses in all of the different regions around the world. Always on the hunt to find the next wave in the fintech & blockchain spaces to provide value & results across the board. Currently focusing on different developing payment businesses in Asia, digital banking and tackling different approaches in advising businesses suited to their best interest. Being the Managing Partner at...

From planting Bitcoin ATM's around North America to developing solutions for top-tier fintech businesses in all of the different regions around the world. Always on the hunt to find the next wave in the fintech & blockchain spaces to provide value & results across the board. Currently focusing on different developing payment businesses in Asia, digital banking and tackling different approaches in advising businesses suited to their best interest. Being the Managing Partner at...

READ FULL BIO

Sponsored

Sponsored