Crypto US stocks are drawing attention today, with Coinbase (COIN), Galaxy Digital (GLXY), and Core Scientific (CORZ) showing distinct catalysts and price movements.

Coinbase is preparing for its S&P 500 debut while managing the fallout from a recent data breach. Galaxy started trading on NASDAQ today after a four-year regulatory battle with the SEC. Meanwhile, Core Scientific stands out as the top performer in the group, gaining 53% in the past month and maintaining strong analyst support.

Coinbase (COIN)

Coinbase (COIN) has experienced notable price action following its landmark inclusion in the S&P 500, set to take effect on May 19. The crypto exchange will replace Discover Financial Services due to Capital One’s acquisition of the latter, making Coinbase the first crypto-native company to join the index.

This historic listing triggered bullish momentum, though recent price movements have been volatile.

After climbing in anticipation of the listing, COIN dropped 7.20% yesterday following news of a cybersecurity breach but rebounded 2.6% in pre-market trading.

The breach, which affected under 1% of users, stemmed from rogue overseas contractors leaking personal data—including names and partially masked Social Security numbers.

Despite the attackers demanding a $20 million ransom, Coinbase refused and instead offered the same amount as a bounty for leads on the perpetrators. Technically, COIN continues to face resistance near $265, with bullish EMA lines still in place.

However, if the correction deepens, key support levels at $223.6, $211.58, and $193 could come into play. With the S&P 500 inclusion drawing near, a renewed uptrend could emerge, potentially pushing COIN back toward retesting the $264 zone.

However, rising competition from spot Bitcoin ETFs is putting pressure on Strategy’s long-standing premium. Short seller Jim Chanos recently initiated a long-Bitcoin/short-MSTR trade, calling Strategy’s valuation “irrational” and fueled by retail hype.

Analysts argue that the availability of low-fee, direct BTC exposure through ETFs like BlackRock’s IBIT challenges the need for corporate wrappers like MSTR.

With a 32.79% one-year upside forecast and a price target of $527, investor sentiment remains cautiously optimistic, but if Bitcoin faces a sharp correction, Strategy’s debt-heavy model could quickly become a liability.

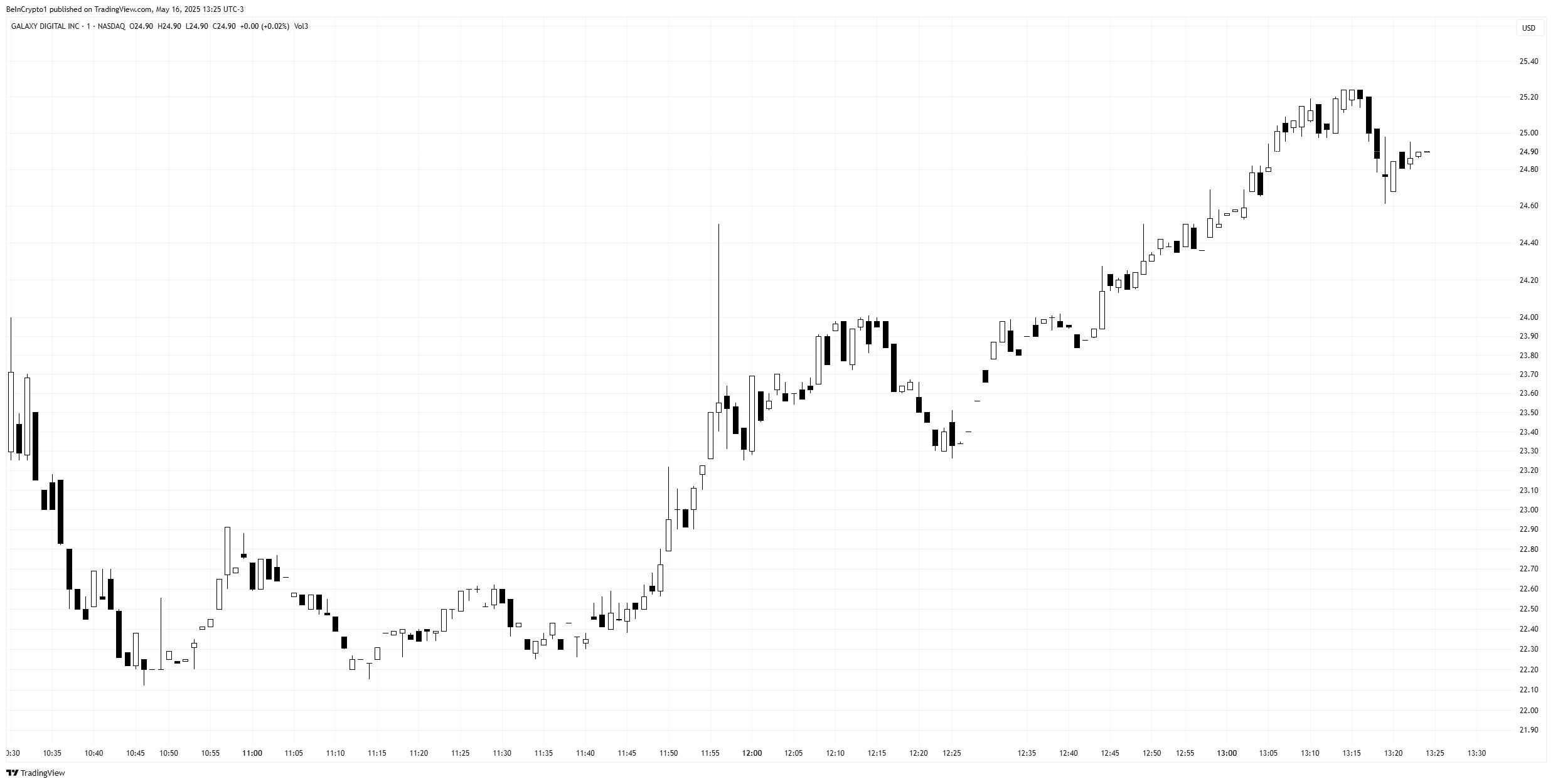

Galaxy Digital (GLXY)

Galaxy Digital, a crypto firm founded by Mike Novogratz, started trading on the Nasdaq under the ticker GLXY at $23.50 per share.

GLXY is now focused on two high-growth areas: crypto and AI. Novogratz believes this will drive the company’s value in the future.

The listing comes after a four-year regulatory battle with the US Securities and Exchange Commission, which Novogratz described as a “grueling” and costly process.

Core Scientific (CORZ)

Core Scientific (CORZ) was the only major crypto US stocks to close in the green yesterday, gaining 1.84% and adding another 1% in the pre-market.

The stock has been one of the top performers in recent weeks, rising 53% over the past month and 11% in just the last five days. This strong momentum is backed by bullish sentiment from analysts—16 experts surveyed by TradingView project an average 12-month upside of nearly 74%, with a price target of $18.28.

Of 17 analysts, 15 rate CORZ as a “Strong Buy,” further reinforcing investor confidence.

Technically, CORZ appears poised for further gains, with its EMA lines suggesting the formation of a potential golden cross. If the current momentum continues, the stock could test resistance levels around $13 in the near term.

However, should the uptrend stall, key support levels to watch lie at $10.34 and $9.45. As bullish sentiment and analyst confidence converge, CORZ is emerging as a standout among crypto-related equities.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.