Bitcoin (BTC) is showing signs of a potential turnaround despite recent volatility, as key on-chain indicators and institutional flows point to improving sentiment. The Mayer Multiple remains below 1, hinting at undervaluation.

Meanwhile, institutional confidence appears to be returning, with BlackRock’s recent 2,660 BTC purchase marking the largest inflow into its Bitcoin ETF in six weeks. As the market stabilizes and adapts to macroeconomic pressures, Bitcoin’s path to new highs is beginning to take shape.

BTC Mayer Multiple Is Still Below 1

Bitcoin’s Mayer Multiple is currently sitting at 0.98, slightly above its recent low of 0.94 recorded on March 10.

This reading suggests that Bitcoin is still undervalued relative to its historical norms, as it continues to trade below its 200-day moving average.

The indicator has been hovering below the 1.0 mark for much of the recent consolidation period, raising questions about when BTC might regain enough momentum to push toward new highs.

The Mayer Multiple measures the ratio of Bitcoin’s current price to its 200-day moving average, providing insights into whether the asset is overextended or undervalued.

Historically, values below 0.8 tend to signal that Bitcoin is heavily discounted and could be in a long-term accumulation zone, while levels above 2.4 often indicate overheated, euphoric conditions.

With the current reading at 0.98, Bitcoin is approaching a neutral-to-bullish threshold.

The last time the Mayer Multiple dipped to 0.84, Bitcoin quickly rallied from $54,000 to $65,000 in just two weeks. It later stabilized between 1.2 and 1.4 before ultimately surging past $100,000 for the first time.

While history doesn’t always repeat, this current setup could be an early sign that Bitcoin is building the foundation for its next major leg higher.

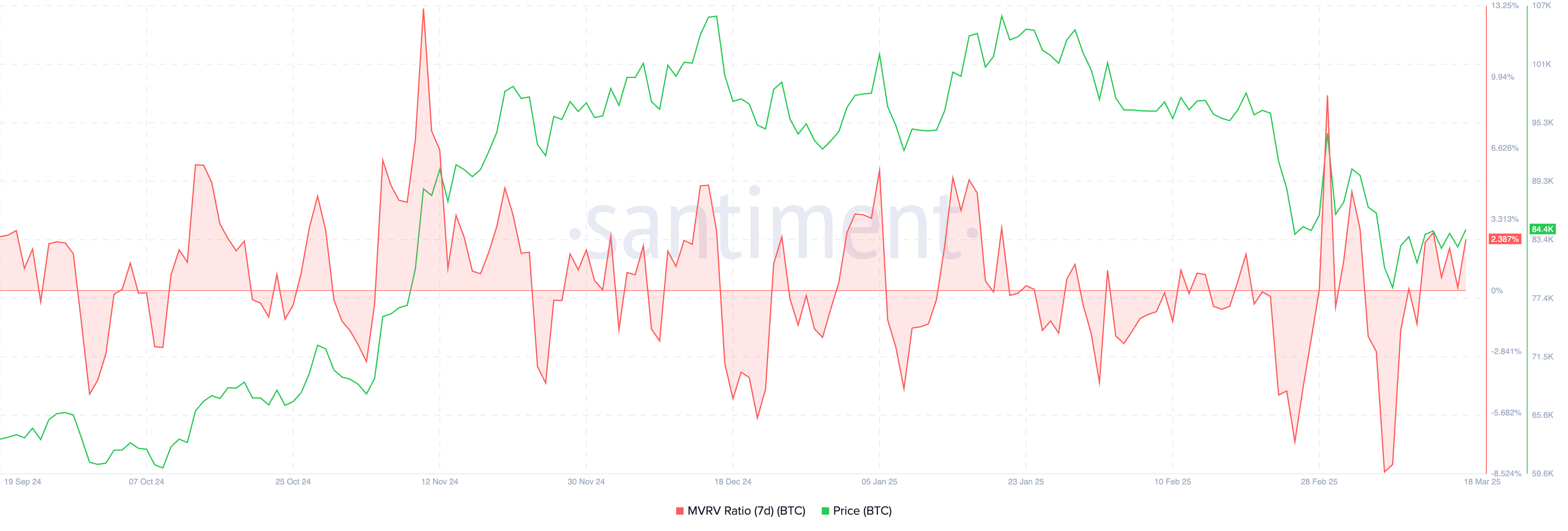

Bitcoin MVRV Brings An Important Threshold

Bitcoin’s 7-day MVRV (Market Value to Realized Value) ratio has climbed to 2.38%, recovering from a recent low of -8.44% on March 8.

This rebound signals that short-term holders are beginning to see modest profits, but historical patterns suggest that stronger price momentum usually follows once the 7D MVRV crosses above the 5% mark.

At its current level, BTC still appears to be in a transition phase. Sentiment is shifting, but it hasn’t fully flipped into a bullish breakout scenario.

The 7D MVRV measures the ratio between Bitcoin’s market value and the average price paid by short-term holders (typically those who acquired BTC in the last 7 days). When the ratio is negative, it indicates these holders are underwater, while positive readings imply they are sitting on profits.

Historically, BTC tends to gain upward momentum when the 7D MVRV moves beyond +5%, as it suggests confidence among short-term participants is returning. Given that BTC is still below this threshold, it may need further accumulation or consolidation before it can convincingly push toward creating new highs.

If the ratio continues to climb and surpass 5%, that could trigger renewed bullish activity and a potential breakout toward fresh all-time highs.

Will Bitcoin (BTC) Create New Highs Soon?

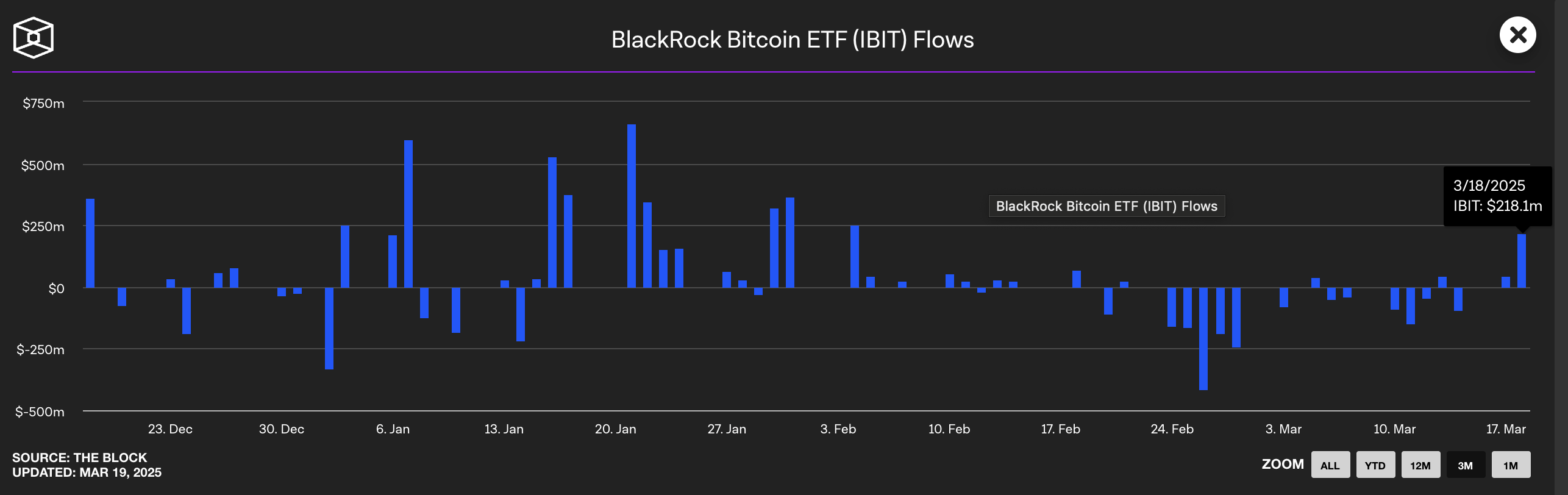

Despite Bitcoin’s 11.4% decline over the past 30 days, institutional bullish sentiment appears to be back, with BlackRock signaling renewed confidence in BTC.

The world’s largest asset manager recently added 2,660 Bitcoin to its iShares Bitcoin Trust (IBIT), marking the biggest inflow into the fund in the past six weeks.

This significant buy comes after a period of uncertainty in IBIT flows since early February, suggesting that institutions are once again positioning for potential upside as market conditions evolve.

BlackRock’s latest buy could signal a broader shift in sentiment as big players overlook short-term volatility and refocus on Bitcoin’s long-term value.

Institutional interest is picking up again while the market slowly adapts to macro pressures like Trump’s proposed tariffs.

Despite the lingering uncertainty, Bitcoin price setup for new highs is growing stronger as confidence returns. If macro conditions stabilize, Bitcoin could be ready for another push higher soon.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.