A week ago, a death cross appeared on Solana’s (SOL) one-day chart, signaling a growing bearish momentum.

While the coin’s price has since consolidated within a range, rising selling pressure suggests a potential breakdown in the near term.

Solana’s Death Cross and Bearish Momentum Fuel Fears

BeInCrypto’s assessment of the SOL/USD one-day chart reveals that a death cross emerged seven days ago. This is a bearish pattern formed when an asset’s short-term moving average (the 50-day) crosses below its long-term moving average ( the 200-day).

It confirms a shift from a bullish trend to a bearish one, indicating weakening momentum and increased downside risk. Since the pattern emerged, SOL’s price has traded within a narrow range. It has since oscillated between resistance formed at $136.92 and a support floor of $121.18.

However, with selling pressure mounting, SOL appears poised for a breakdown below this support level. The widening gap between its 50-day and 200-day SMAs reinforces the likelihood of this happening in the near term.

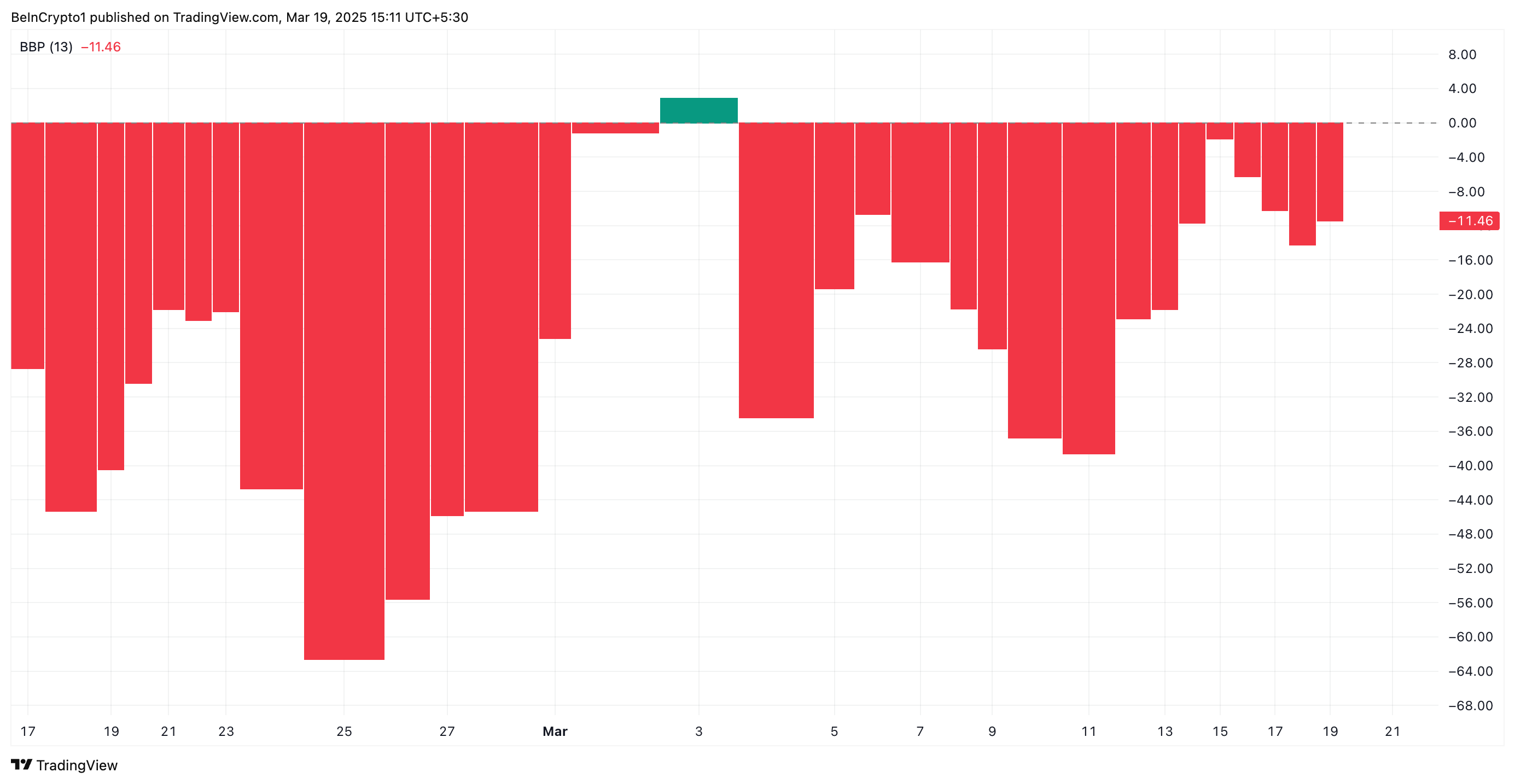

Adding to this bearish outlook, SOL’s negative Elder-Ray Index indicates that sellers are gaining control. This indicator currently stands at -11.46 at press time.

The Elder-Ray Index measures the strength of buyers (bull power) and sellers (bear power) by comparing an asset’s high and low prices to its exponential moving average (EMA). When the index is negative, it indicates that bear power is dominant.

This confirms the increased selling pressure among SOL traders and hints at the likelihood of a break below the support formed at $121.18.

SOL Bears Eye $110 as Selling Pressure Mounts—Will Support Hold?

SOL’s breakdown below the $121.18 support zone would exacerbate the downward pressure on its price. Such a breach would offer another confirmation of the bearish trend in the market and could cause the coin’s price to plummet toward $107.88.

On the other hand, if market sentiment improves and SOL demand spikes, it could break above the resistance at $136.92 and soar to $152.87.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.