The question of whether the bull run is over is more complex than it seems. While Bitcoin’s price action has deviated from historical post-halving trends, other indicators suggest that the cycle may still have room to run. Stablecoin market capitalization has surged, reflecting strong liquidity and institutional capital waiting on the sidelines.

Meanwhile, despite a sharp correction in decentralized exchange (DEX) volumes, on-chain activity remains significantly higher than in past cycles. This data hints at broader adoption rather than an outright market reversal.

Bitcoin Historical Data Shows This Cycle Is Different

Bitcoin’s performance serves as a benchmark for the broader market, and analyzing its data in comparison with previous cycles can provide valuable insights into the current bull run.

A quick glance at BTC’s historical price movements post-halving suggests that its present trajectory deviates from past trends. Traditionally, after each halving, the price enters a strong rally, yet recent price action appears less predictable.

Looking at historical data, Bitcoin has typically peaked within 12-18 months following a halving, aligning potential price surges for mid-to-late 2025 in this cycle.

However, external factors like increasing institutional involvement, Trump’s pro-crypto stance, and ongoing geopolitical tensions are complicating traditional models. The market has evolved, making direct comparisons with previous cycles less reliable.

While uncertainty is at an all-time high due to macroeconomic shifts, regulatory developments, and the trade war, the cycle itself may still have room to run. With Bitcoin’s growing integration into global finance, its movements are now shaped by far more than just the halving mechanism.

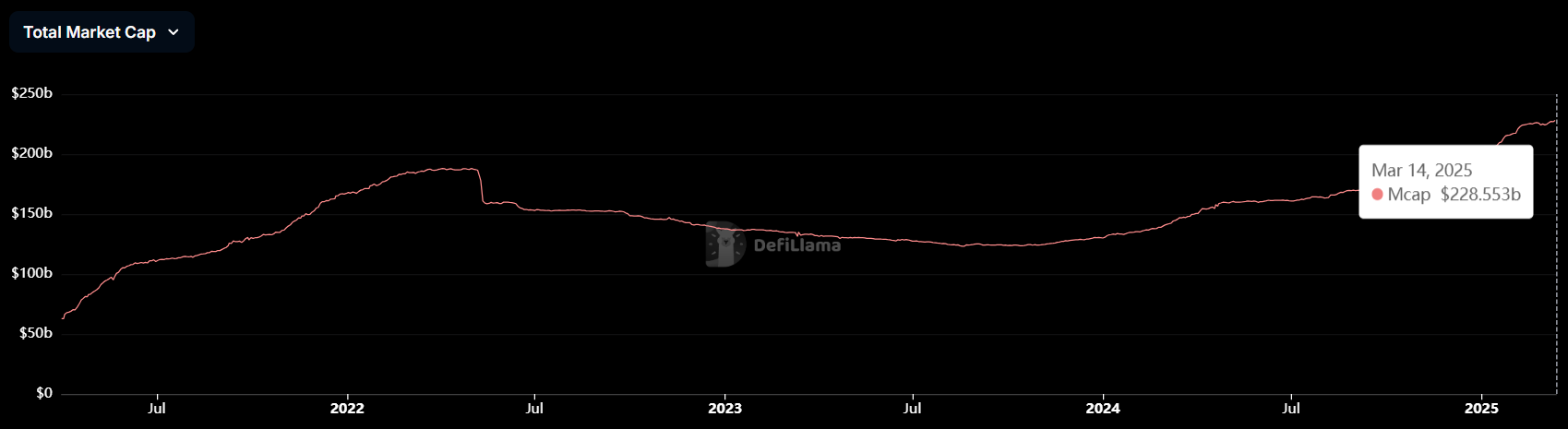

Stablecoins Are On The Rise

Despite the recent market correction, the stablecoin market cap continues to rise, growing from $146 billion in March 2024 to $217 billion today – a 48.6% increase in just one year. This expansion signals a growing demand for on-chain liquidity and a strong influx of capital into the crypto ecosystem.

Historically, rising stablecoin supply has often preceded bullish market movements, as it suggests that more funds are sitting on the sidelines, ready to be deployed into riskier digital assets.

This increasing stablecoin market cap could be a key indicator for the ongoing bull run. It reflects investor confidence and a preference for maintaining crypto exposure without exiting to fiat.

Tracy Jin, COO of crypto exchange MEXC, provided insights into the key drivers behind the stablecoin market surge and the signals it sends to traders:

“The growth of the stablecoin market capitalization to a record indicates a massive capital rotation in the cryptocurrency ecosystem. Investors are moving against volatility as Bitcoin continues to experience downward pressure.

On the one hand, the increased share of stablecoins in the total market size confirms the high level of liquidity and the willingness of large players to invest further. The growing value of the stablecoins is a clear testament to the key role stablecoins play as the cornerstone of liquidity in the cryptocurrency industry and the maturing digital asset market.” – Jin told BeInCrypto.

One major signal of this trend is the recent $2 billion investment in Binance by MGX, an Abu Dhabi sovereign wealth fund – conducted entirely in stablecoins.

The fact that sovereign wealth funds are now using stablecoins for billion-dollar deals suggests that crypto liquidity is deepening, reinforcing the adoption of stablecoins. This suggests that money – and users – are still there, maybe just in a consolidation phase, waiting to deploy capital as more opportunities appear.

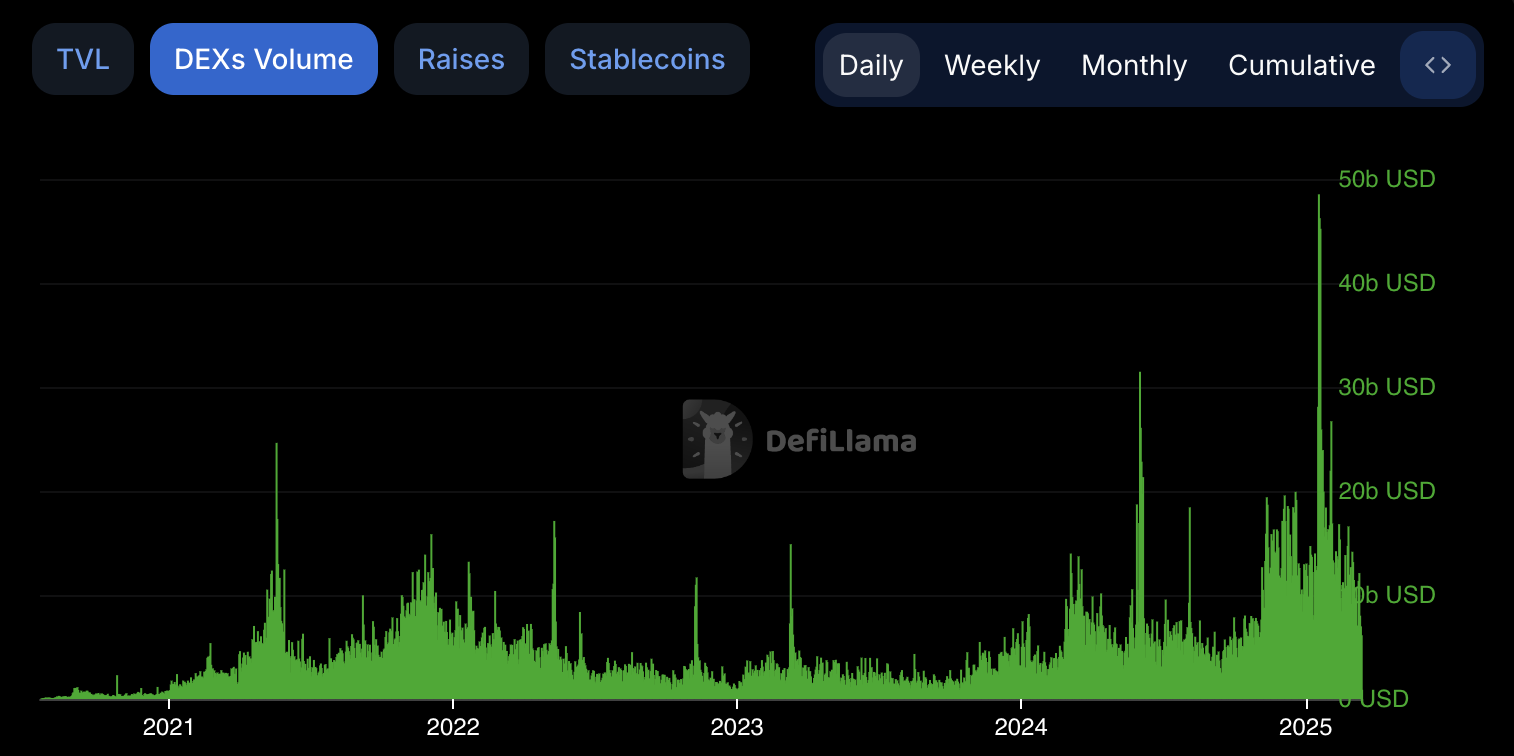

DEX Volume Is Strongly Correcting, But Still Signaling Broader Adoption

Decentralized exchange (DEX) volumes surged starting in September 2024, peaking at an all-time high of $48.5 billion on January 17, 2025. However, the past month has seen a sharp drop, with daily volume now sitting at $6 billion.

While this decline may seem alarming, it’s important to put it into perspective. The current levels still represent 70% to 80% of the average DEX volume recorded during the 2021 and 2022 cycle, highlighting that on-chain activity remains elevated compared to past bull runs.

Despite the heavy pullback, the fact that current correction levels are near previous cycle highs suggests that overall participation and liquidity in DeFi remain strong.

This resilience in DEX volume implies that the bull run may not be over yet. While speculative excess has cooled, significant on-chain activity remains, indicating sustained engagement from both retail and institutional players.

The fact that DEX volume is still comparable to previous peak cycle averages suggests that on-chain liquidity and interest have not evaporated but rather adjusted in response to broader market conditions.

This could mean that the market is currently in a re-accumulation phase rather than signaling the end of the bull run.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.