Industry experts have proposed various scenarios for Bitcoin’s potential bottom after its price fell below $80,000 on Monday.

These predictions rely on different perspectives, including historical patterns, macroeconomic factors, and technical analysis.

Where Could Bitcoin Find Its Bottom?

Arthur Hayes, co-founder of BitMEX, believes Bitcoin will bottom around $70,000. His argument is based on historical trends, which show Bitcoin typically drops 36% from its all-time high (ATH) during a bull cycle.

“Be patient. BTC likely bottoms around 70,000 USD. 36% correction from 110,000 USD ATH, normal for a bull market,” Hayes predicted.

He outlined a more detailed strategy, advising traders to look for signs such as a stock market crash, a major traditional financial institution going bankrupt, and central banks like the Fed, PBOC, ECB, and BOJ injecting liquidity. When these conditions align, he believes it will be time to allocate capital.

In a personal blog post, Hayes also predicted that Bitcoin could surge at least tenfold from its bottom, fueled by the Fed’s liquidity injections—similar to what happened during the COVID-19 crisis.

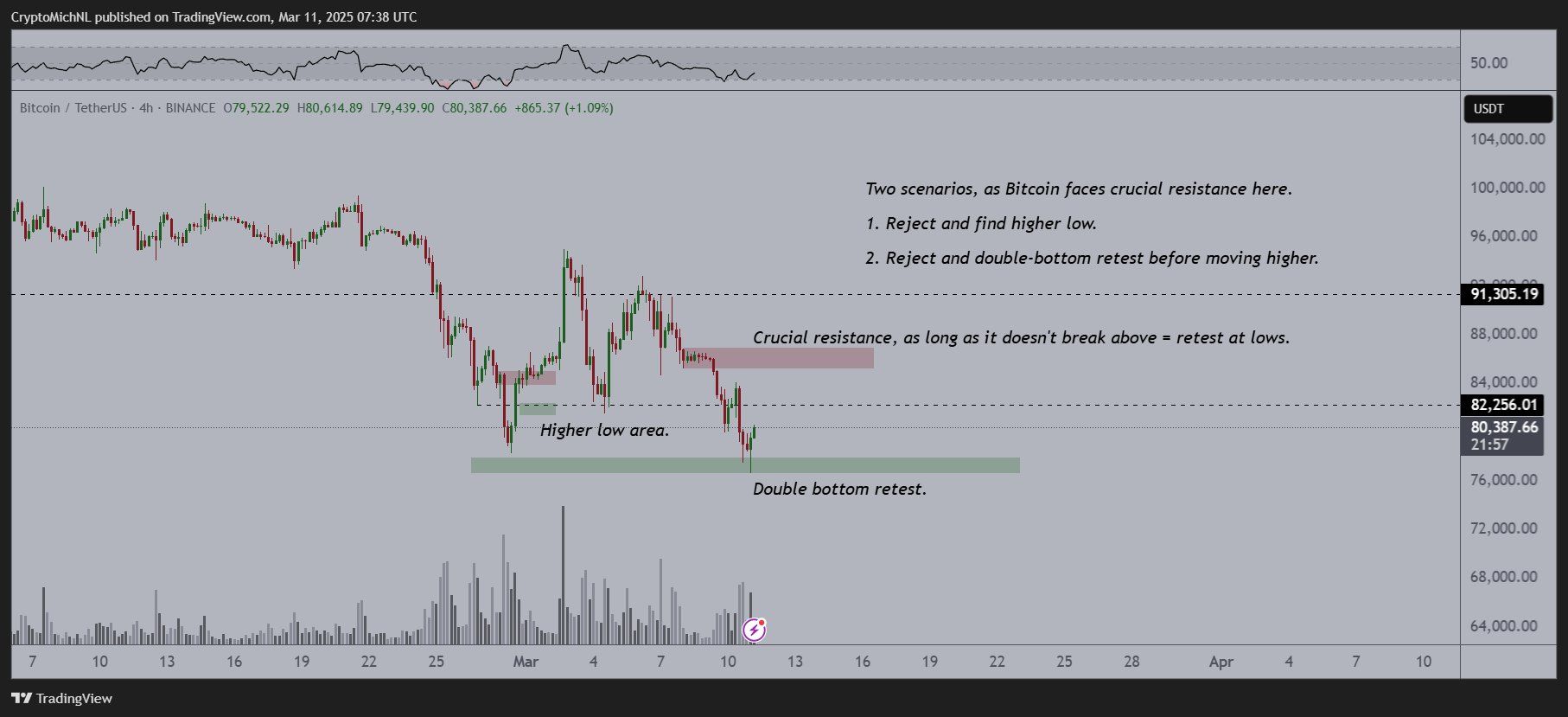

However, Michaël van de Poppe, founder of MNCapital, holds a more optimistic outlook. He believes Bitcoin has already bottomed and is set to recover through a double-bottom pattern.

“Double bottom retest on Bitcoin and, finally, a relatively quick bounce upwards. I’d like to see $82,500 – $83,500 break. If that happens, we’ll see an even stronger move upwards,” Michaël van de Poppe predicted.

Despite his bullish outlook, he did not rule out the possibility of a deeper decline.

As recession concerns in the US rise, some analysts are preparing for a worst-case scenario in which Bitcoin plunges further. Investor Doctor Profit warned that such an event could become a “black swan” in 2025, pushing Bitcoin down to $50,000.

“Bitcoin entry – Recession scenario. Orders are set, preparing to hunt the wicks,” Doctor Profit commented.

Adaora Favour Nwankwo, an ambassador at CoinEx, shares Doctor Profit’s perspective. She also noted that Bitcoin’s price trajectory is closely tied to economic indicators, and the upcoming CPI data could significantly impact its movement.

“Here’s a possible scenario: If a recession occurs, Bitcoin’s maximum potential decline is around $50,000. If no recession happens, the bottom price range is expected to be between $70,000 and $75,000,” she predicted.

At the time of writing, Bitcoin (BTC) was trading at around $81,000, marking a 14% decline from its March high of $95,000.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.