Last week’s broader market downturn sent many altcoins tumbling, and Movement’s native token MOVE was no exception. On Tuesday, the token plunged to an all-time low (ATL) as selling pressure intensified.

However, market participants saw this decline as a buying opportunity, leading to a surge in demand and pushing its value up. Over the past 24 hours, MOVE has rebounded sharply, climbing 25%, making it the market’s top gainer for the day.

MOVE Outshines Crypto Majors with 25% Surge

MOVE is up 25% in the past 24 hours, making it the market’s top performer. The token has outpaced leading assets like Bitcoin and Ethereum, which have risen by just 6% each over the same period.

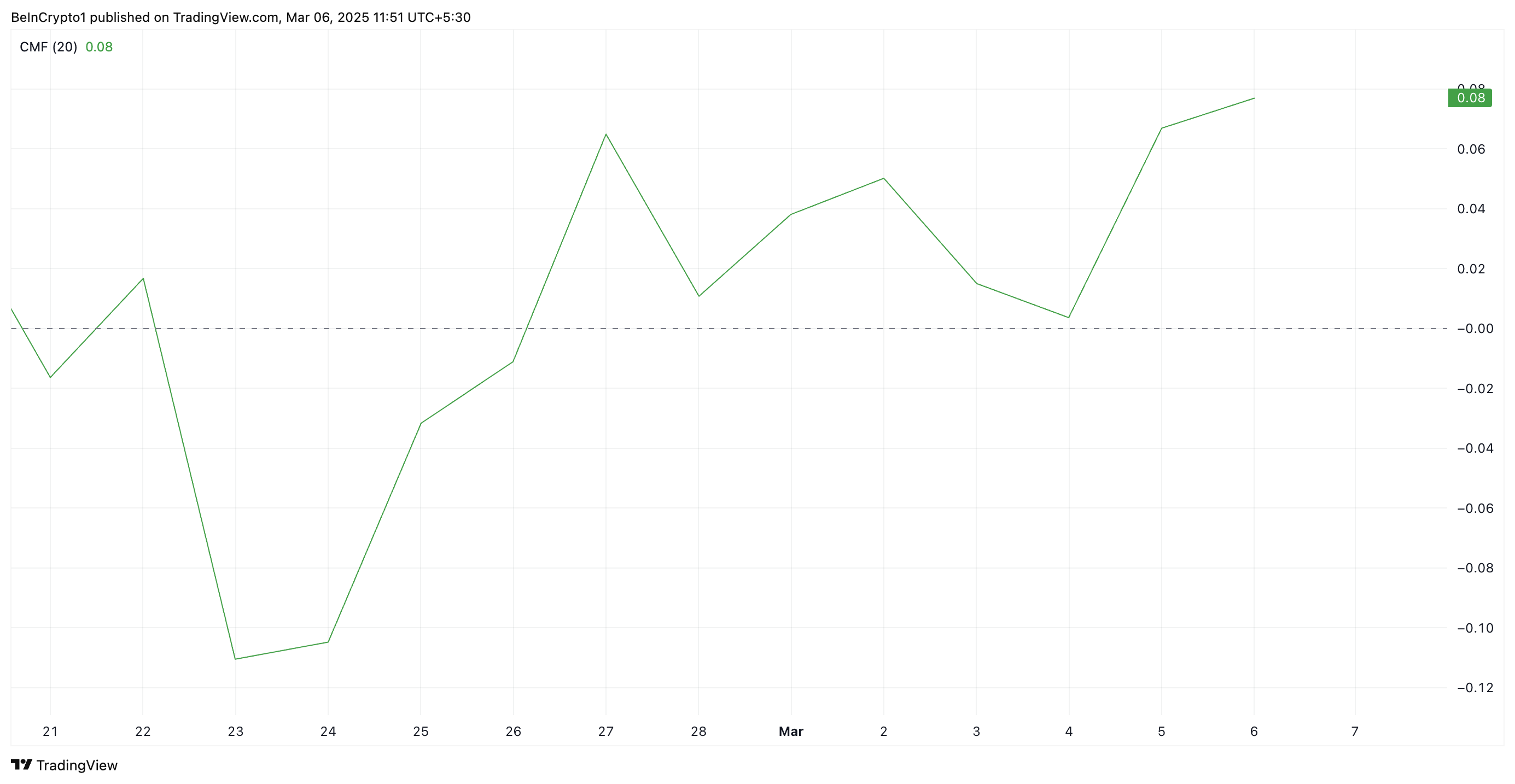

Readings from the MOVE/USD one-day chart hint at the likelihood of an extended rally as new demand strengthens. For example, its rising Chaikin Money Flow (CMF) confirms the growing demand for the altcoin. At press time, the momentum indicator, which measures money flows into and out of an asset, is above zero and in an upward trend at 0.09.

A positive CMF reading like this indicates strong buying pressure among MOVE traders. This signals sustained demand and the potential for continued upward momentum in its price action.

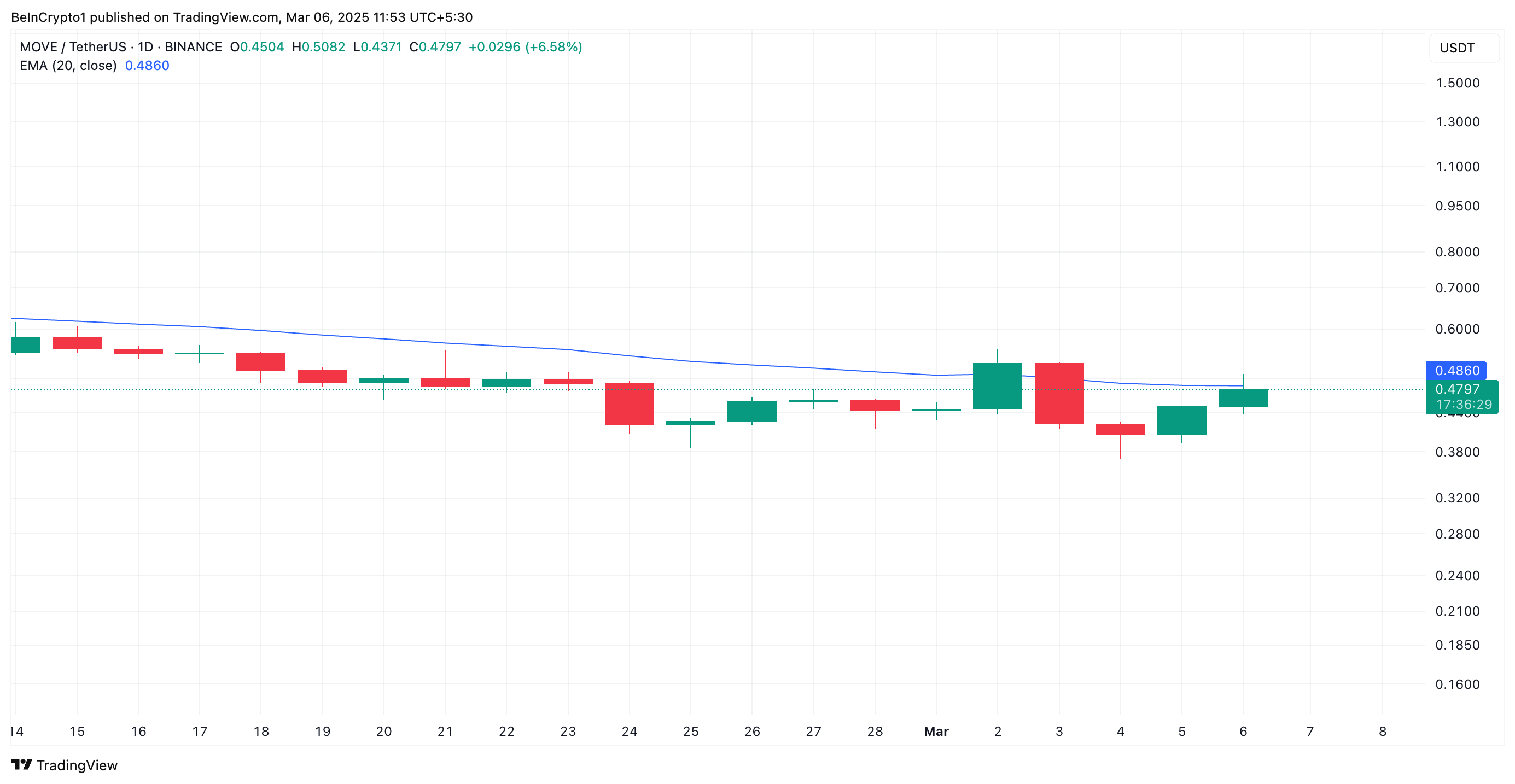

Additionally, MOVE has broken above its 20-day exponential moving average (EMA), highlighting the accumulation trend among market participants.

The 20-day EMA measures an asset’s average price over the past 20 trading days. It is a short-term trend indicator that emphasizes recent price movements, making it responsive to market shifts.

When an asset breaks above this key moving average, it signals growing bullish momentum. It suggests a potential trend reversal or continuation of an uptrend.

MOVE Climbs Higher—But Can It Sustain the Rally?

MOVE’s break above the 20-day EMA confirms the uptrend, indicating that buyers are gaining control and price momentum is shifting in their favor. This move could attract more traders looking to ride the bullish wave, potentially increasing buying pressure in the spot markets.

If sustained, it can signal the beginning of a stronger rally, and MOVE’s price could rally toward $0.61. A successful breach of this resistance could propel the token toward $0.72.

On the other hand, if profit-taking commences, this bullish outlook would be invalidated. In that scenario, MOVE’s price could fall back to its all-time low.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.