XRP has experienced a significant price pullback recently, largely driven by the broader bearish market trend affecting major cryptocurrencies.

Despite this, whales have been accumulating large amounts of XRP, which may signal the potential for a price reversal. Historical trends suggest that a rally could be on the horizon.

XRP Whales See A Bullish Future

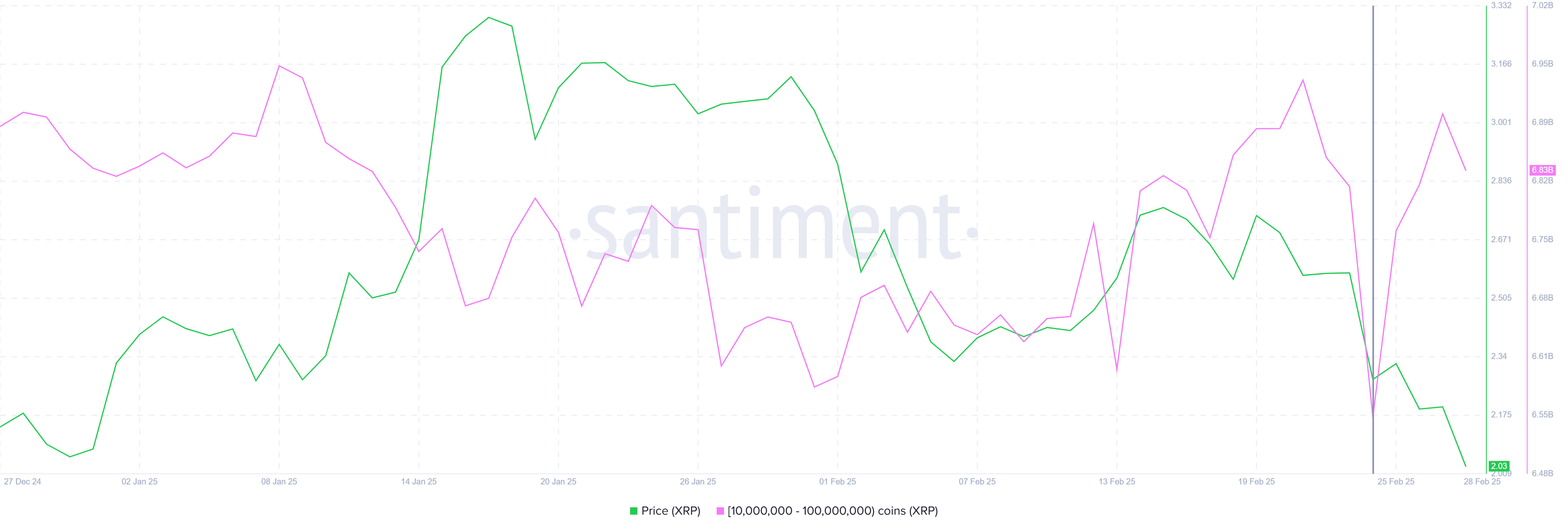

Whale addresses holding between 10 million and 100 million XRP have added over 300 million XRP, totaling $609 million in the last few days. The accumulation occurred after these whales previously sold off their holdings when prices were higher, locking in profits.

Now, with the market in a slump, they are buying back in, signaling a high level of confidence in XRP’s future price movements.

The actions of these whales suggest a belief in an eventual price recovery. Their purchasing behavior is typically a strong indicator of market sentiment, particularly when they accumulate during dips.

The relative strength index (RSI) for XRP is currently in the oversold zone, a critical technical signal. This is the first time in seven months that the RSI has dropped to such low levels. Historically, such drops have been a reversal trigger for XRP, with the last similar occurrence leading to a 47% rally.

The current RSI value suggests that XRP may be oversold and due for a correction, which could result in a price rebound. Given that this level has often preceded significant price surges in the past, the likelihood of a similar outcome increases. If the trend continues, XRP could reach up to $2.98.

XRP Price Has A New Target

XRP is trading at $2.03, down 24% over the past week. The Ripple token is currently holding above the $1.94 support level. XRP is attempting to breach the resistance at $2.33 with the aim of flipping this level into support. If successful, the move would mark the beginning of a potential rally.

With the technical indicators suggesting a bullish reversal, XRP could target $2.33. Further movement above this level would bring it closer to $2.70. Surpassing this resistance would drive the price toward $2.95, which aligns with the targets suggested by the RSI data and recent whale activity.

However, if XRP fails to breach $2.33 and remains in consolidation below this level, the price could stagnate between $1.94 and $2.33. This would invalidate the bullish outlook and delay any potential recovery.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.