Uniswap, a leading decentralized exchange (DEX), has faced significant challenges in recent weeks. Despite its attempts to recover recent losses, the price has remained stalled below $10.

Several factors are contributing to this struggle, including the broader market conditions and the tepid response to its V4 upgrade. These concerns are raising doubts about Uniswap’s ability to break free from its current stagnation.

Uniswap Fails to Attract Users to V4

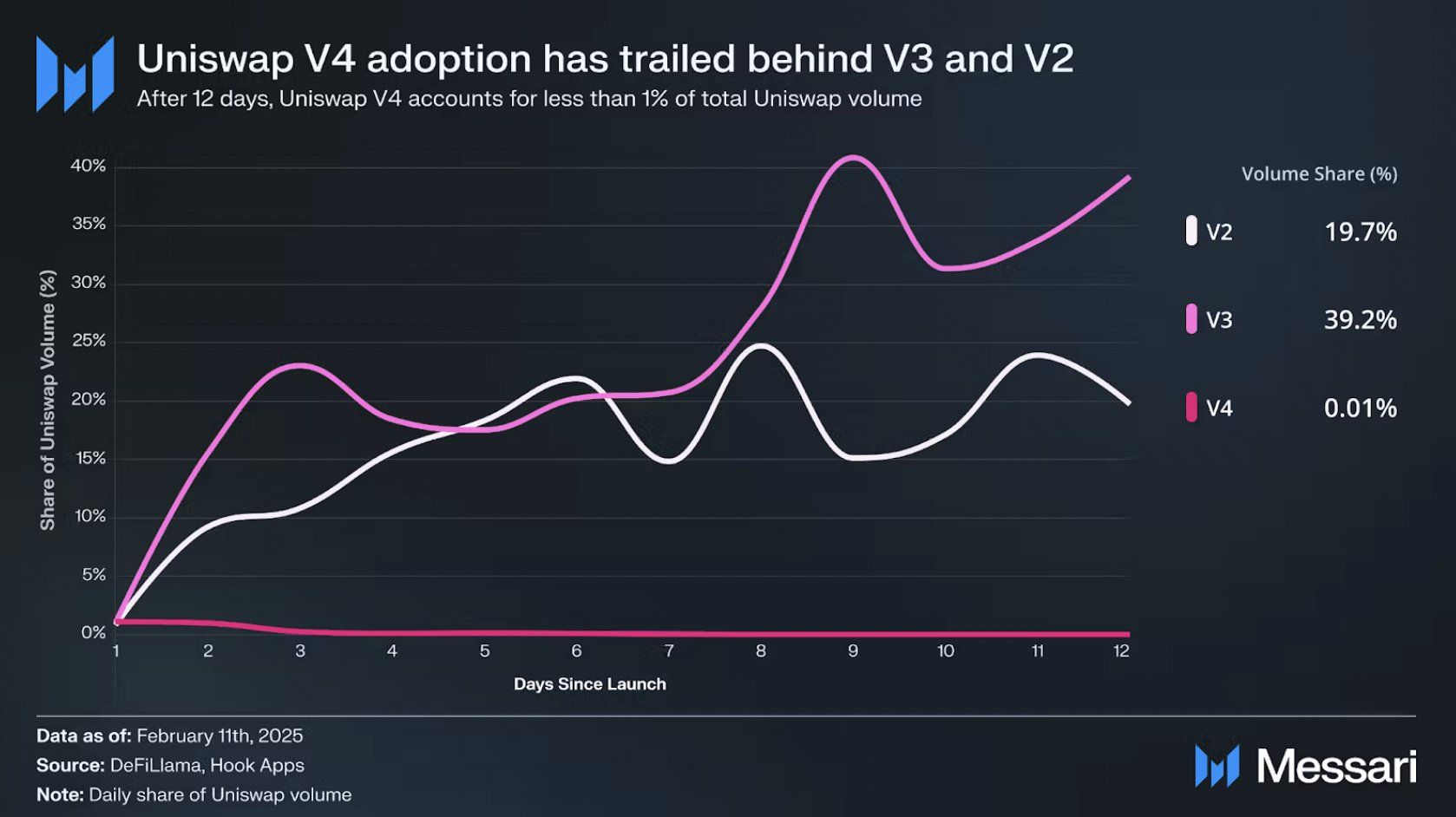

The launch of Uniswap’s V4 DEX, which was highly anticipated by the community, has failed to generate the expected level of interest. The adoption rate for V4 has been far slower than prior versions, with V4 currently occupying only 0.01% of Uniswap’s entire volume share. In stark contrast, V3 and V2 gained traction quickly, capturing 40% and 20% of the market share, respectively, within just 12 days of their launches.

The lack of enthusiasm surrounding V4’s adoption has led to growing skepticism about the use case for this upgrade. Users have been reluctant to shift from the more established V3, and the overall lack of excitement might be putting downward pressure on the token price.

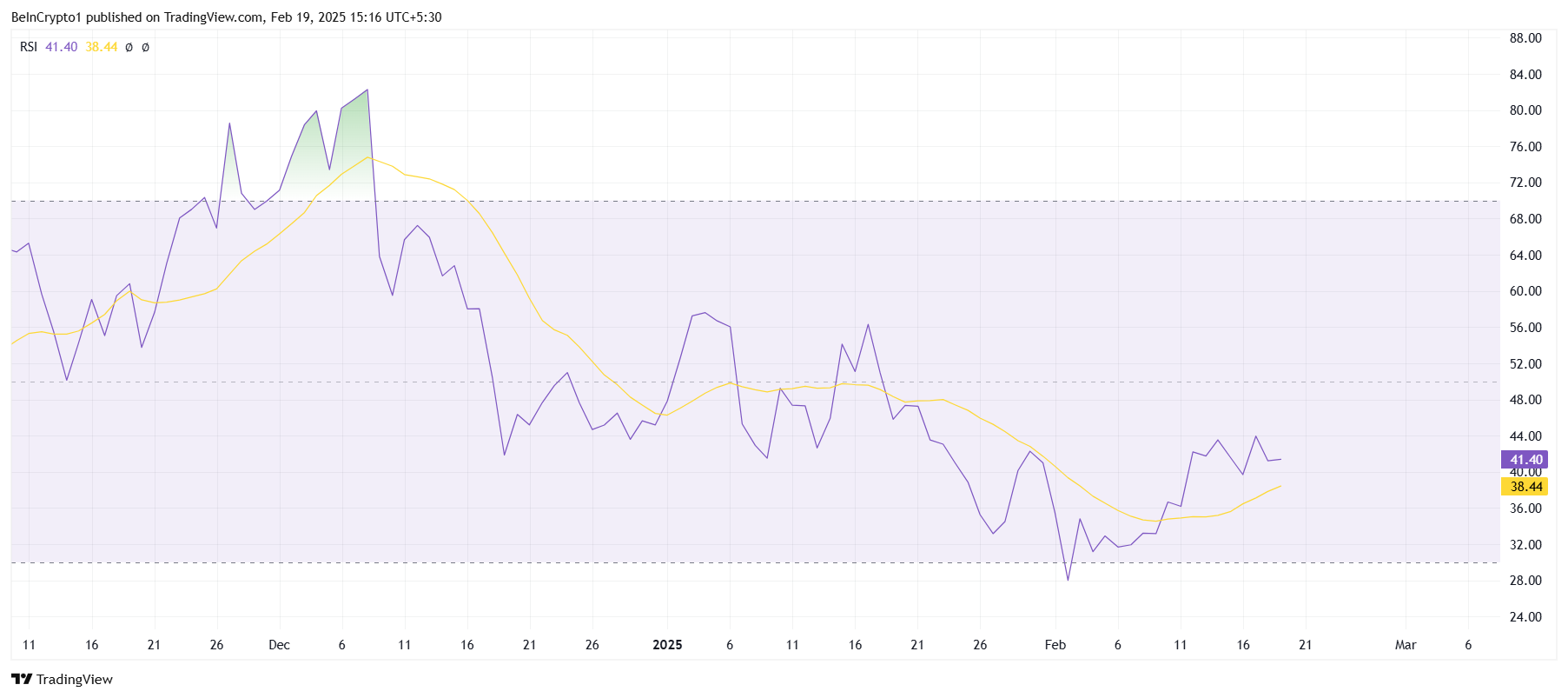

From a technical perspective, Uniswap’s price action remains subdued, as reflected by the Relative Strength Index (RSI), which is hovering below the neutral mark. While there has been a slight uptick in the RSI, indicating some bullish momentum, it remains below the 50.0 threshold.

This suggests that the bullish momentum is weak, and the altcoin may face additional challenges before it can make a meaningful recovery. Until the RSI rises above 50.0 and gains sufficient strength, Uniswap will likely struggle to generate a sustained rally.

The broader market cues have also failed to support Uniswap’s recovery, leaving the altcoin trapped below the $10 level. The slow pace of V4 adoption only exacerbates the situation, making it difficult for Uniswap to regain the momentum it needs.

UNI is Attempting A Breakout

Uniswap’s price, currently at $9.65, has struggled to breach the $10.06 resistance level since the beginning of the month. The ongoing lack of bullish market cues, combined with the slow uptake of V4, suggests that the price will likely remain range-bound for the time being.

If these bearish trends continue, UNI could consolidate within the range of $10.06 and $8.76. This would delay any potential recovery and also leave the altcoin exposed to further losses. If the price slips below $8.76, it could fall further to $8.23, deepening investor losses.

However, if Uniswap manages to accelerate V4 adoption, it could break through the $10.06 barrier and flip it into support. This would allow UNI to move higher, targeting $11.96 and possibly invalidating the current bearish outlook. The key to this recovery lies in the successful uptake of the V4 upgrade, which could reignite investor confidence in the token’s future potential.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.