Coinbase, the largest US-based crypto exchange, is actively working on returning to the Indian market after halting operations in 2022 due to regulatory hurdles.

The exchange engages with Indian authorities, including the Financial Intelligence Unit (FIU), to secure approvals and comply with local regulations.

Coinbase Mulls Reentry in Indian Market

Coinbase entered India with much fanfare in April 2022, launching support for the country’s widely used United Payments Interface (UPI). However, just three days later, the National Payments Corporation of India (NPCI) refused to acknowledge Coinbase’s operations, suspending services.

India’s stringent tax policies have also been a longstanding concern for crypto market participants. The government imposes a 30% tax on crypto income and a 1% transaction levy, discouraging retail investors and reducing liquidity.

Many foreign exchanges, including Binance and Kraken, have faced scrutiny from India’s regulatory bodies, which ruled that they were operating illegally. However, some firms, including Binance, have since complied with FIU requirements and resumed operations.

Coinbase is now taking a similar approach, actively engaging with Indian regulators to ensure compliance. However, the timeline for its relaunch remains uncertain, depending on how long it takes to obtain an FIU license and other necessary approvals. Analysts anticipate significant liquidity if an approval comes.

“Huge liquidity could flow in from this,” analyst Kyle Chassé observed.

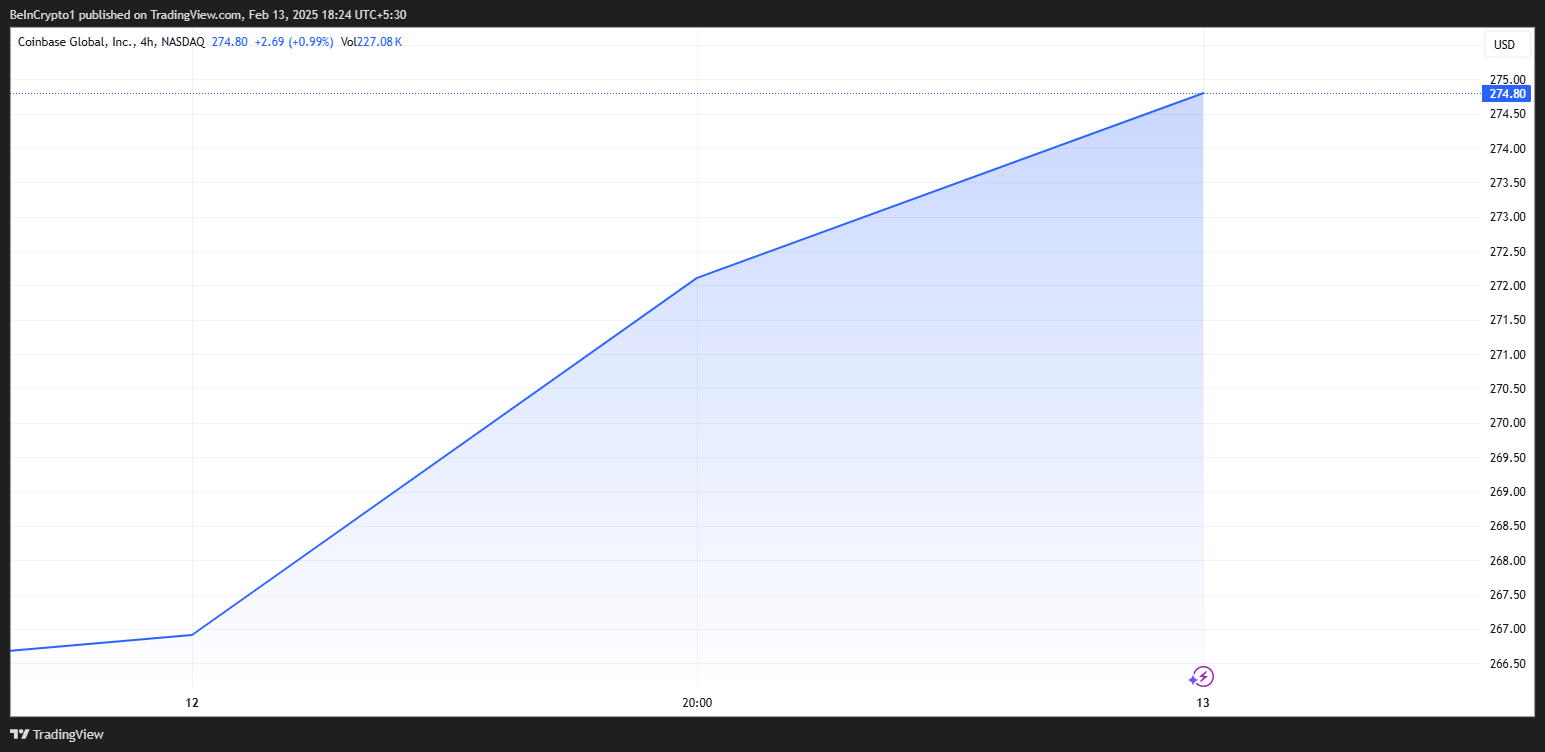

Coinbase stock, COIN, soared on this news and was trading for $274.80 as of this writing.

Of note, however, is that this is not Coinbase’s first attempt at adapting to India’s regulatory environment. In late 2023, the exchange adjusted its services around the G20 Summit in the country, likely in response to changing regulations.

This time, Coinbase appears to take a more calculated approach by ensuring regulatory compliance before relaunching services.

“…last time they got rekt by regulators. If they haven’t leveled up, it’s just another liquidity trap,” a user on X (Twitter) remarked.

India’s Crypto Market and Coinbase’s Potential Impact

Coinbase’s interest in India aligns with its broader international expansion plans. Its chief legal officer, Paul Grewal, was recently appointed to the US-India Business Council (USIBC) Global Board of Directors. This move highlights the company’s strategic push to strengthen ties between the US and India in fintech and digital assets.

“I’m honored to join the USIBC Board to help strengthen the bridge between India and the US in shaping the future of finance,” the USIBC stated, citing Grewal.

Despite regulatory challenges, India remains a significant blockchain and cryptocurrency innovation hub. The country has seen a surge in Web3 adoption, with developers and startups actively contributing to the space.

However, the local crypto trading market has struggled due to regulatory uncertainties and high tax burdens. Coinbase’s return could shake up India’s crypto market, particularly after the collapse of WazirX, which lost half of its reserves in a major security breach.

The Indian market is now dominated by CoinSwitch and CoinDCX, which are Coinbase-backed. A successful reentry by Coinbase could provide competition and offer Indian traders a stronger platform.

“This move could impact the crypto market and reshape competition among local exchanges,” a user on X added.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.