Bitcoin’s price has remained below the $100,000 mark since the start of February. Currently trading at $96,920, the leading cryptocurrency has noted a 7% drop in value over the past week.

However, recent macroeconomic developments suggest that this trend may soon reverse.

Fed’s RRP Drop Could Push Bitcoin Prices to New Heights

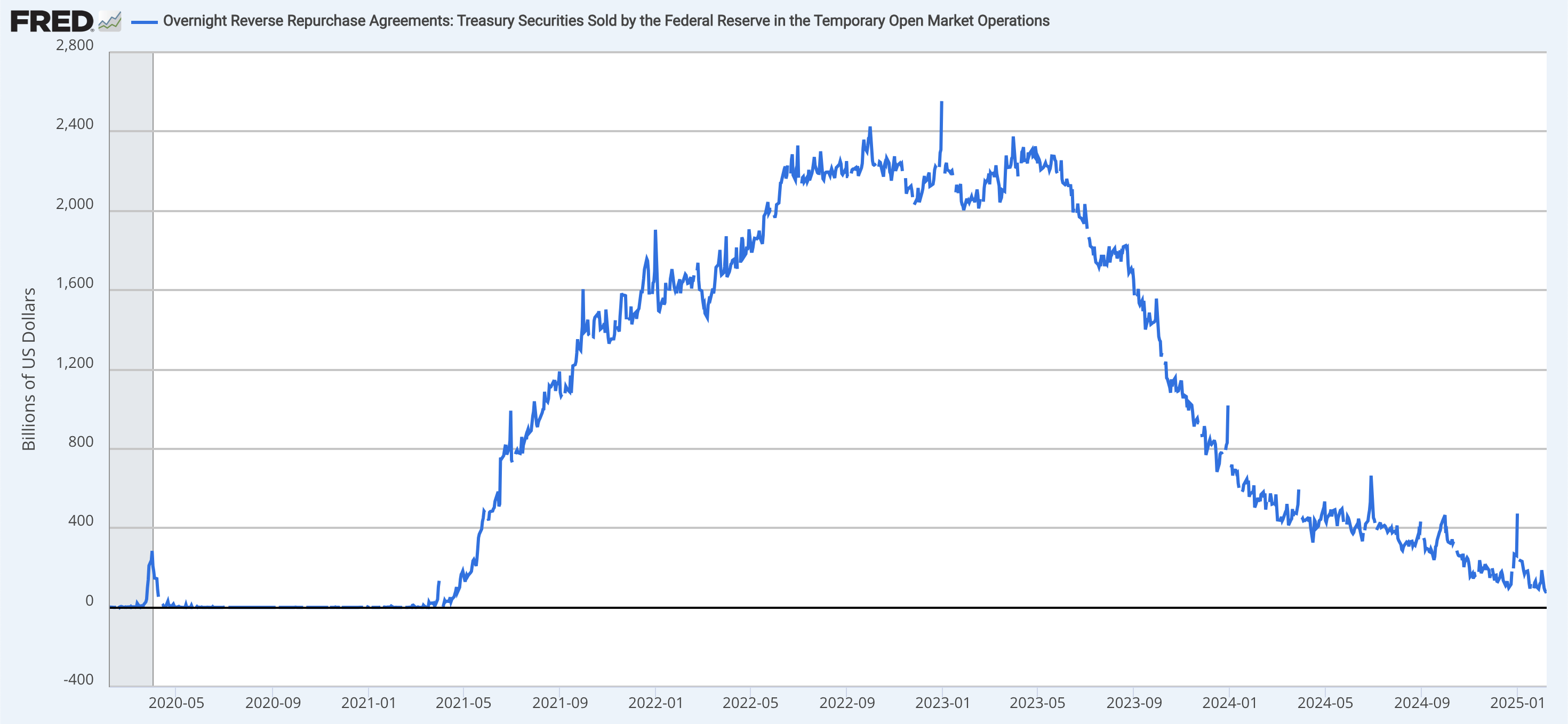

The Federal Reserve’s Reverse Repurchase Agreement (RRP) or Reverse Repo facility has hit its lowest level in 1,387 days, signaling a potential shift in liquidity flow direction.

The US Federal Reserve uses the RRP to manage short-term liquidity in the financial system. It allows financial institutions—such as money market funds and banks—to deposit excess cash with the Fed overnight.

In return, the Fed provides these institutions with Treasury securities. This helps the regulator control short-term interest rates and manage the money circulating in the financial system. The Fed devised this method to absorb excess liquidity when there is too much cash in the market.

When the RRP balance drops like this, traditional financial service providers are moving away from using the Fed’s facility for excess liquidity storage. It means they might be putting their money into other riskier assets like cryptocurrencies.

This could drive prices higher as demand for crypto-assets increases due to the availability of more cash in the system. With more liquidity flowing into the market, Bitcoin stands to benefit as institutional investors and traders seek alternative stores of value.

Bitcoin Traders Remain Resolute

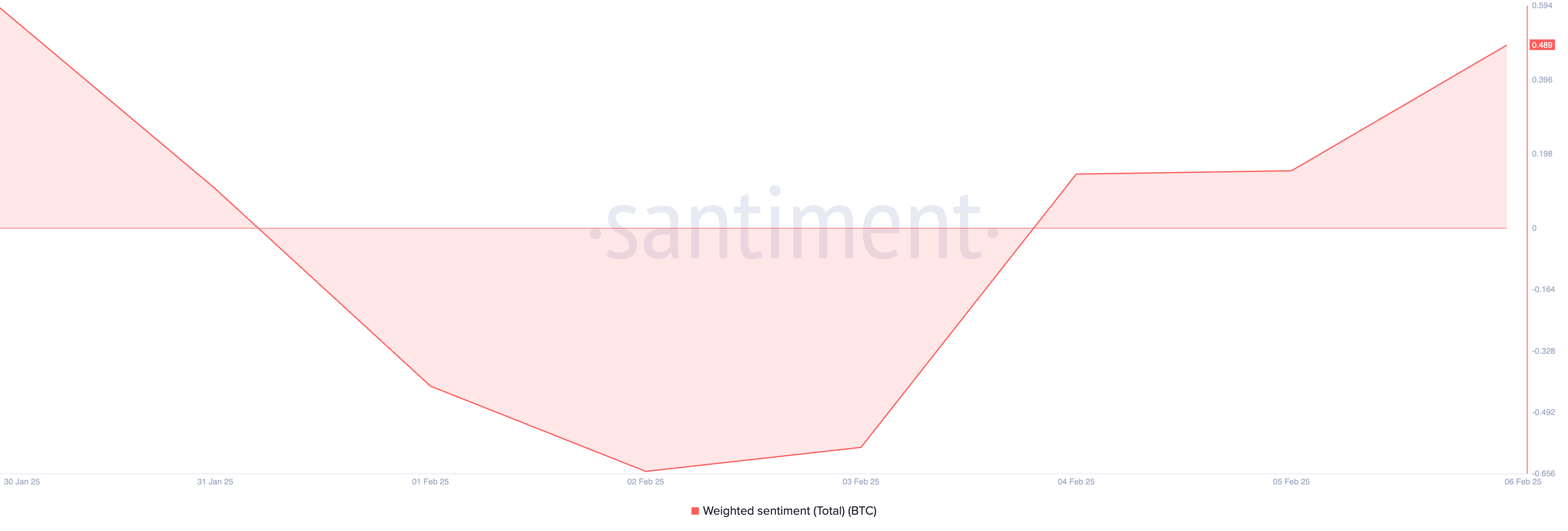

Bitcoin traders have remained resolute in their bullish bias toward the coin despite its recent headwinds. For example, the BTC’s weighted sentiment is positive at press time, signaling that the market remains optimistic about a near-term price rebound.

An asset’s weighted sentiment measures its overall positive or negative bias, considering both the volume of social media mentions and the sentiment expressed in those mentions. When it is positive, it is a bullish signal, as investors are increasingly optimistic about the asset’s near-term outlook.

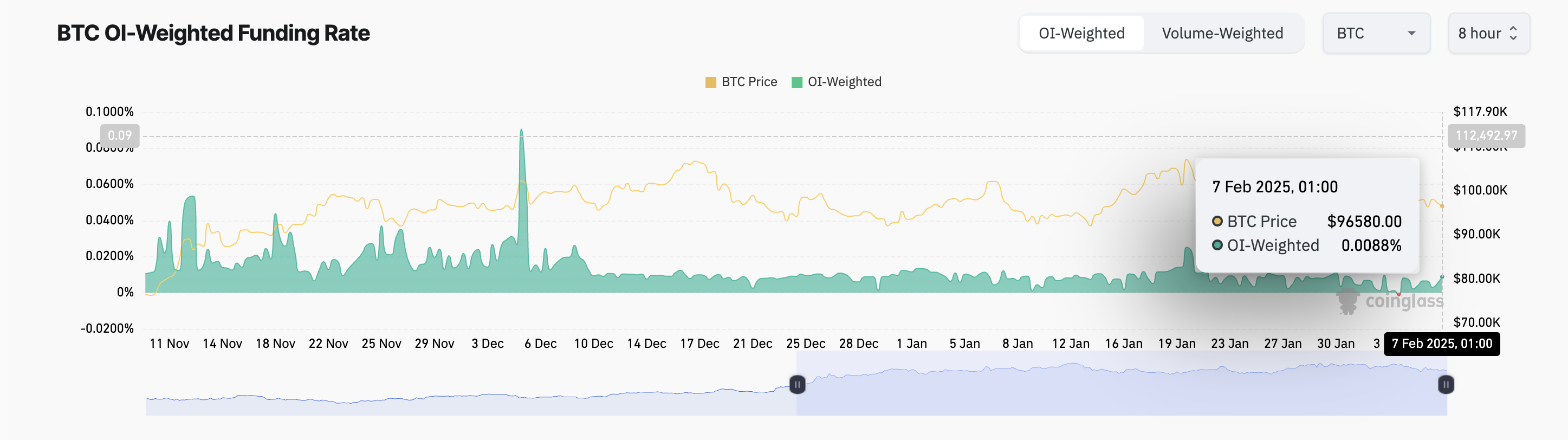

Further, BTC’s funding rate across its derivative markets is also positive, supporting this bullish outlook. At press time, this stands at 0.0088%.

The funding rate is a periodic payment made between traders in futures markets, specifically for perpetual contracts, to ensure the contract’s price aligns with the underlying asset’s price. When it is positive, traders in long (buying) positions pay those in short (selling) positions. This indicates more demand for long positions and suggests a bullish market sentiment.

BTC Price Prediction: A Break Above $100K Could Trigger Next Bull Run

A potential surge in liquidity inflow into the crypto market would mean more capital for traders and investors to increase their BTC holdings.

If the coin sees a resurgence in demand due to this, its price could break above the crucial $100,000 resistance and attempt to revisit its all-time high of $109,356.

On the other hand, if buying activity weakens further, Bitcoin’s price could extend its decline and fall to $92,325.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.