Berachain (BERA) price surged to $15 in the first hours after the mainnet launch but quickly began to decline. The Berachain airdrop was one of the most anticipated distributions of 2025, following a positive year of development throughout 2024.

However, technical indicators now suggest weakening momentum, with RSI dropping from overbought levels and CMF turning negative. With other recent airdrops like HYPE and PENGU struggling post-launch, BERA faces a challenging path to recovery unless market sentiment shifts.

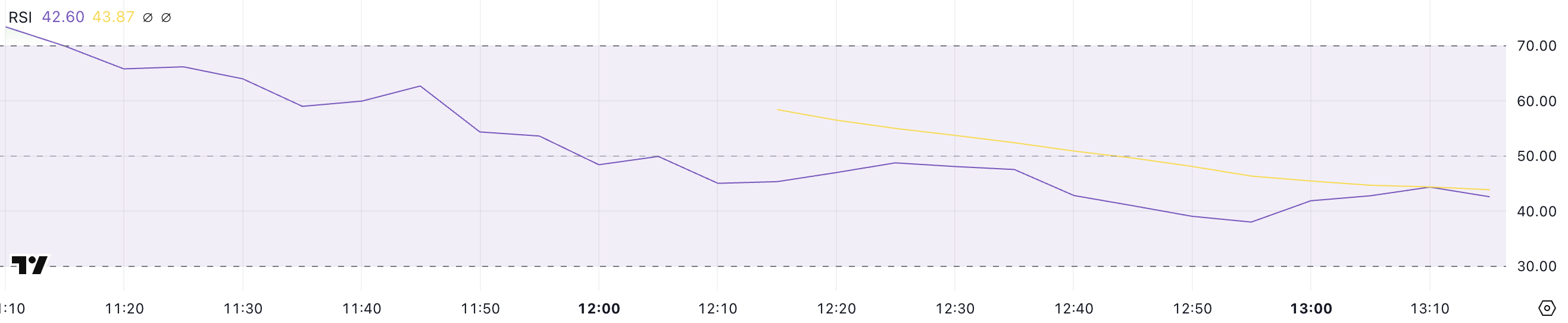

BERA RSI Is Dropping Fast

BERA is the native token of Berachain, one of the most hyped layer-1 blockchains in the last few years. After launching earlier today, it currently has an RSI of 42.6, falling from nearly 70 just a few hours ago.

The Relative Strength Index (RSI) is a momentum indicator that measures the speed and magnitude of price changes to assess whether an asset is overbought or oversold.

Readings above 70 indicate overbought conditions and potential for a pullback, while levels below 30 suggest oversold conditions that could lead to a rebound. With BERA’s RSI now well below 70, the recent selling pressure has weakened its momentum, signaling a shift in trend.

At 42.6, BERA’s RSI suggests that its price is in neutral territory but leaning toward bearish momentum. The drop from overbought levels indicates that the previous uptrend has lost strength, and further downside movement could follow if selling pressure persists.

However, if RSI stabilizes or reverses near this level, it could suggest consolidation before the next move. A continued decline toward 30 would signal increasing weakness, while a bounce from this zone could indicate that buyers are stepping in to support a potential recovery.

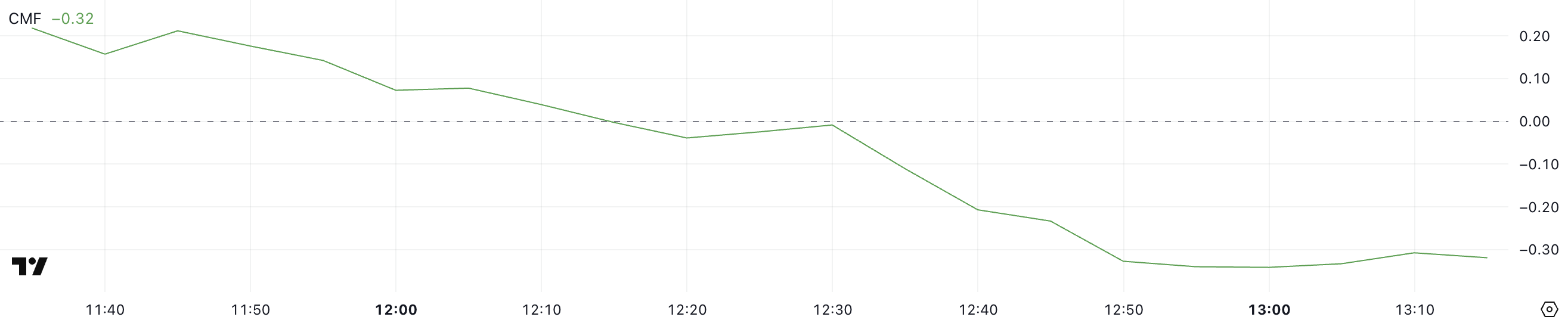

BERA CMF Is Very Negative After Touching 0.2

BERA currently has a Chaikin Money Flow (CMF) of -0.32, after sitting around 0.20 just a few hours ago before starting to drop. CMF is an indicator that measures buying and selling pressure by analyzing volume and price movements over a specific period.

A positive CMF value suggests accumulation, indicating strong buying interest, while a negative value signals distribution and selling pressure. With BERA’s CMF now deep in negative territory, selling pressure has intensified, suggesting a shift in market sentiment.

This drop in CMF comes after Berachain launched its BERA airdrop following a year of building throughout 2024. However, the broader trend for airdrop tokens has been weak, with previous highly-anticipated launches like HYPE and PENGU struggling in terms of returns.

BERA’s CMF at -0.32 suggests that liquidity is flowing out, meaning sellers are dominating the market. If this trend continues, BERA could face further downward pressure unless buyers step in to absorb the selling and stabilize the price.

BERA Price Prediction: Will BERA Recover Soon?

BERA price surged to $15 in the hours following its airdrop but quickly began to decline. With RSI now at 42.6, down from nearly 70, and CMF dropping to -0.32, indicators suggest that buying momentum has faded while selling pressure is increasing.

The falling RSI points to weakening bullish strength, while the negative CMF signals capital outflows, reinforcing the idea that sellers are in control. Given this setup, Berachain may continue to struggle unless demand picks up to counteract the selling.

Recent airdrops like HYPE and PENGU have also performed poorly after their initial buzz, highlighting a broader trend of weak post-airdrop returns. If BERA follows a similar pattern, it could experience further downside as early recipients sell off their tokens.

However, if selling pressure stabilizes and indicators start to reverse, BERA could enter a consolidation phase before finding its next direction. For now, the technical setup remains bearish, and a strong catalyst would be needed to shift sentiment back in its favor.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.