The price of TRUMP has been on a steady decline, experiencing a brief pause last week. Despite this, the cryptocurrency has struggled to regain its footing.

Even though US President Donald Trump’s decisions have affected market sentiment, they have not provided the necessary momentum for the meme coin’s recovery.

TRUMP Investors Are Pulling Back

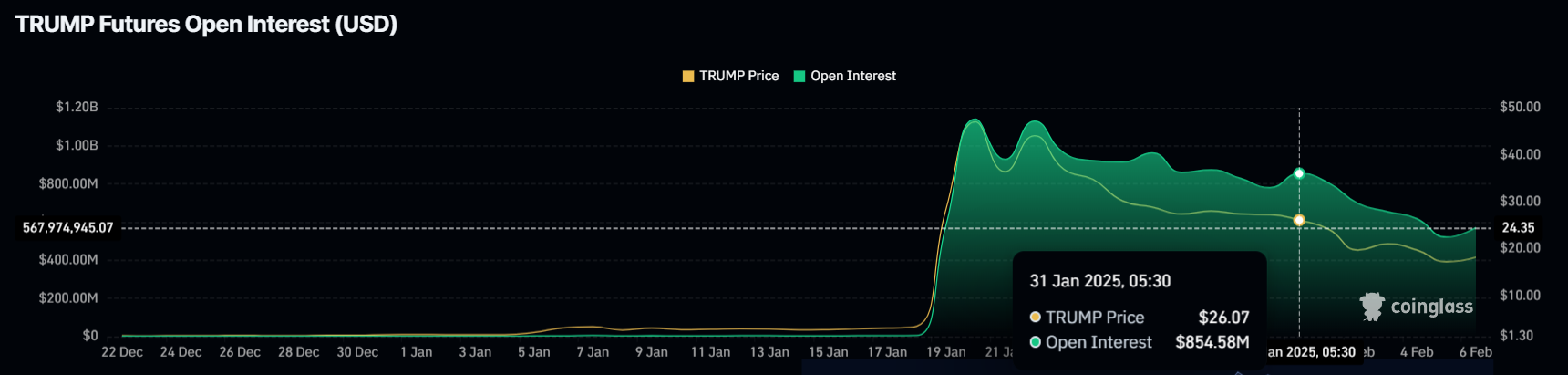

Open Interest in TRUMP has dropped by 33%, falling from $854 million to $567 million. This $287 million reduction signals waning confidence among traders. The significant withdrawal of capital indicates that many are exiting their positions, reducing liquidity and amplifying bearish pressure.

The declining Open Interest suggests that traders are growing impatient with TRUMP’s price action. Many investors are choosing to pull their money out rather than bet on a potential recovery.

This trend strengthens the bearish sentiment, making it harder for the asset to regain lost ground.

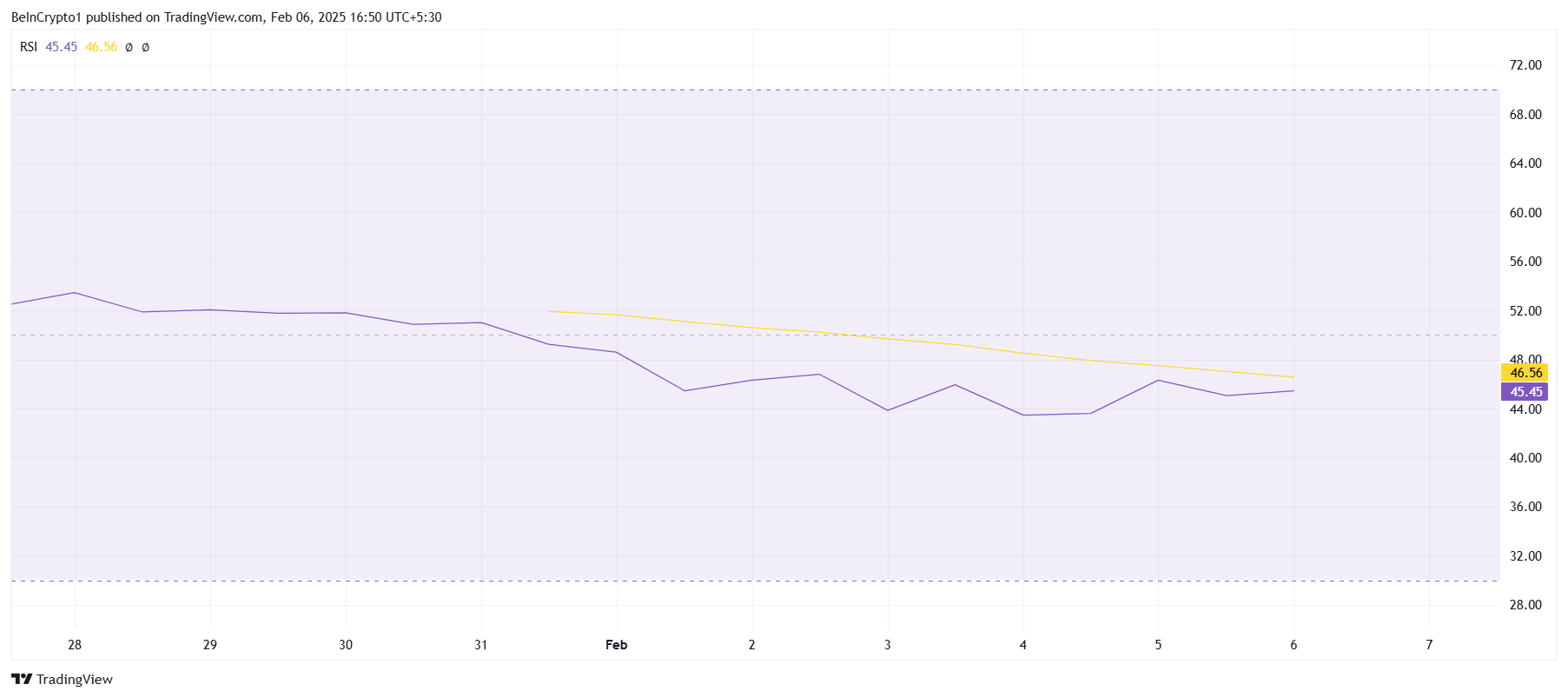

Technical indicators further reinforce the bearish outlook. The Relative Strength Index (RSI) is currently below the neutral 50.0 mark. This signals increasing bearish momentum, with sellers exerting more control over the price direction.

As long as the RSI remains under the neutral level, TRUMP could continue its downtrend. Without a surge in buying pressure, recovery may be difficult, and the cryptocurrency could face extended consolidation or further losses.

TRUMP Price Prediction: Reclaiming Support

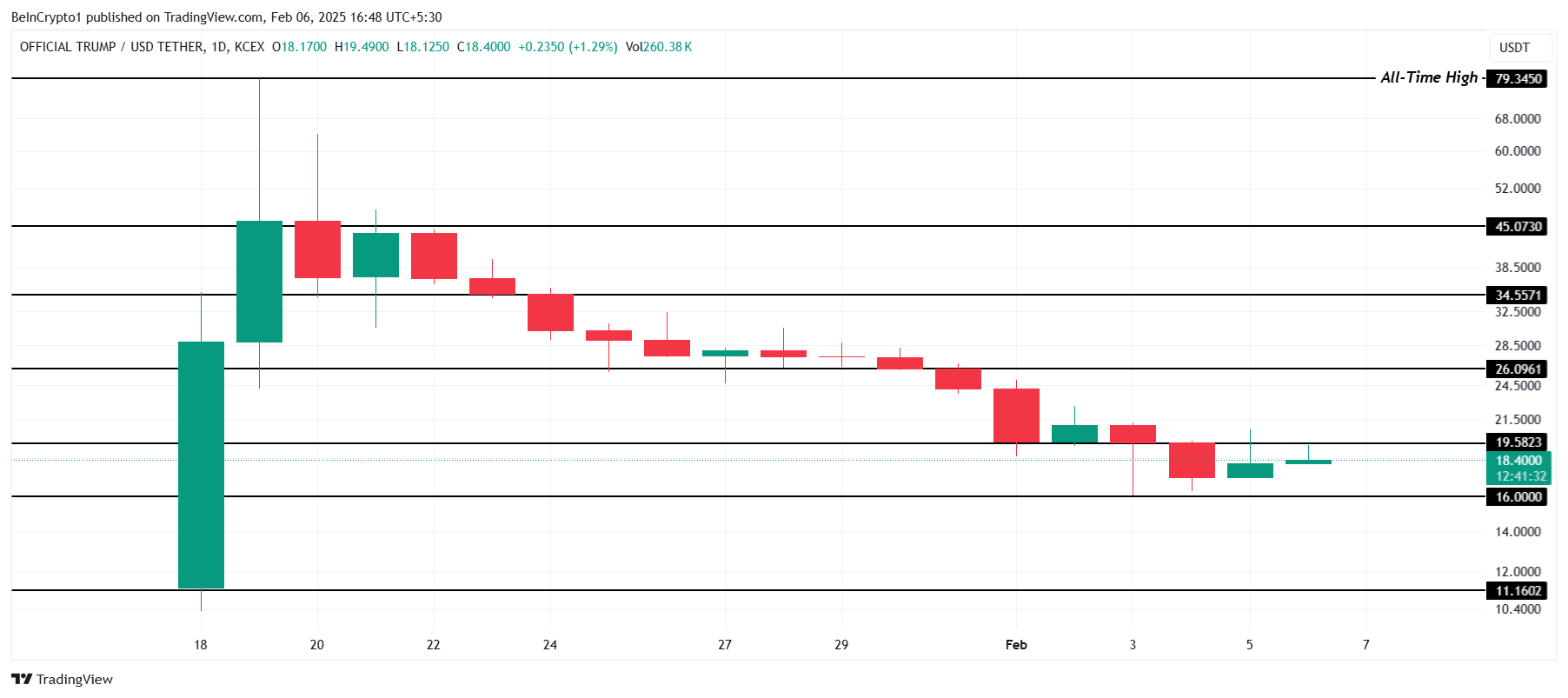

TRUMP is currently trading at $18.40, struggling below the critical resistance of $19.58. However, it remains above its key support level of $16.00. The altcoin’s immediate goal is to reclaim $20.00 as a stable support level.

Given the prevailing bearish signals, a swift recovery remains uncertain. As long as TRUMP holds above $16.00, it may consolidate within the $16.00 to $19.58 range. Breaking past $19.58 will be crucial for any potential uptrend.

Flipping $19.58 into support would pave the way for a rally toward $20.00 and beyond. If this resistance level is breached, TRUMP could target $26.09, effectively invalidating the bearish thesis and reigniting bullish momentum.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.