Bybit CEO Ben Zhou claims that crypto liquidations since new US tariffs could be between $8 to $10 billion. Specifically, he said that Bybit and other major exchanges limit the liquidation data that gets publicized.

During the 2022 FTX collapse, Zhou stated that real liquidations were 4-6x worse than reported figures. Moving forward, he said Bybit will increase transparency about real-time liquidation data.

Bybit’s Zhou Gets Real About Tariffs

Ben Zhou, CEO of Bybit, the second-largest crypto exchange by trading volume, has made concerning claims. The market was already weakened by DeepSeek, a Chinese AI protocol that damaged US tech sector stocks.

However, since President Trump’s tariffs on Canada and Mexico, the crypto market has been in a freefall. Losses of $2 billion were reported, but Zhou claimed that the tariffs hurt much more:

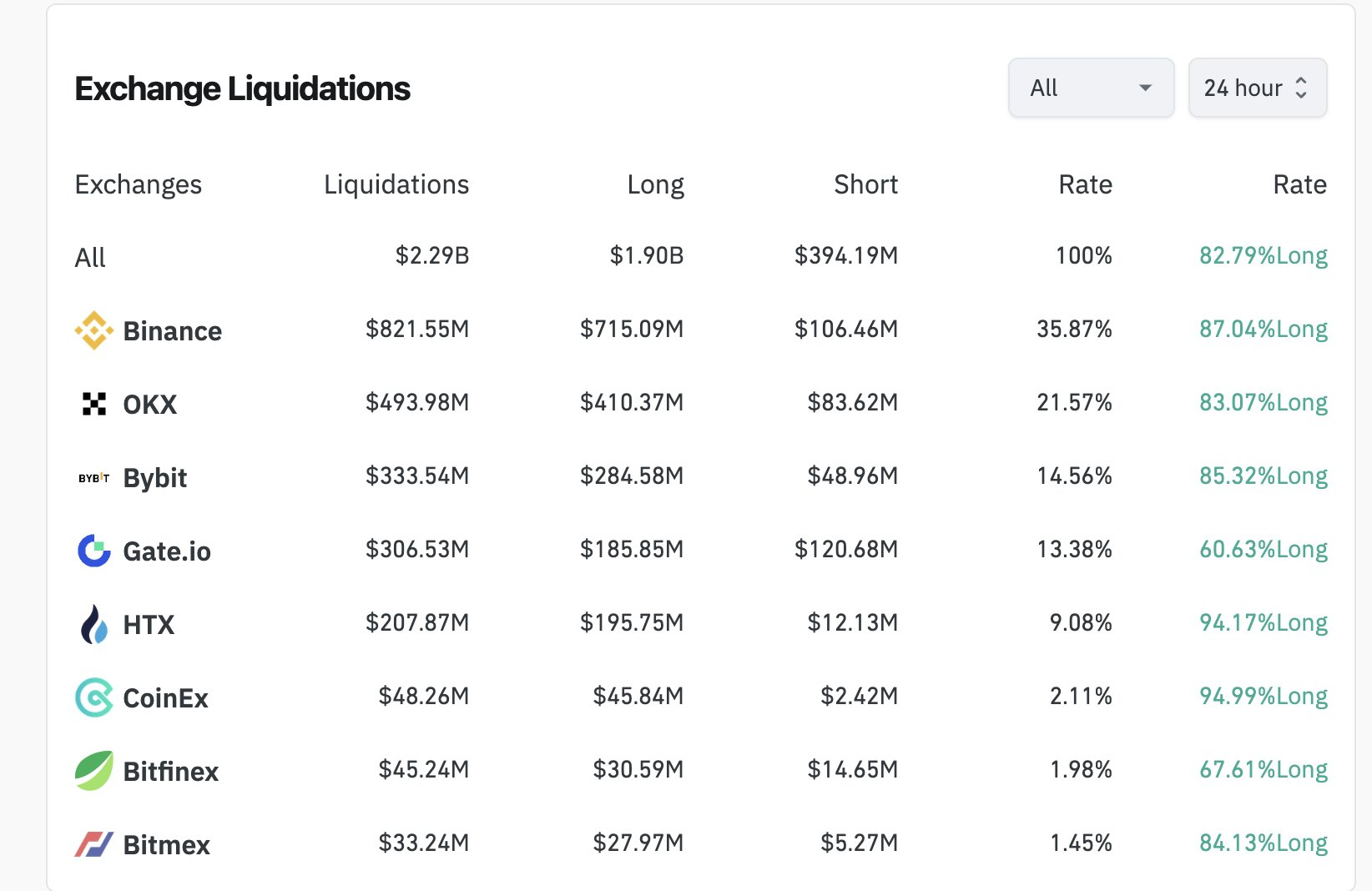

“I am afraid that today real total liquidation is a lot more than $2 billion, by my estimation it should be at least around $8-10 billion. FYI, Bybit 24 hour liquidation alone was $2.1 billion. Bybit 24 hour liquidations recorded on Coinglass was around $333 million, however, this is not all of the liquidations. We have API limitation on how much feeds are pushed out per second,” Zhou said.

Zhou’s opinion on the tariffs is especially relevant because Bybit was heavily entangled with FTX. Zhou was asked how the reported liquidations from the FTX collapse compared to the real number as a baseline.

He stated that real liquidations were “at least” 4-6 times worse. Moving forward, Zhou said Bybit would be more transparent with liquidation data.

Bitcoin’s price dropped below $95,000 in Monday’s rout, but the entire market took hits. BTC sell-offs inspired a similar dumping action in Solana, and Ethereum also hit a YTD low.

If Zhou is correct and the tariffs liquidated up to 5x the reported amounts, this could become a very painful moment for the market.

Earlier in January, Arthur Hayes, former BitMEX CEO, predicted that BTC could drop to $70,000 in the current political climate, triggering a mini-financial crisis.

Ultimately, the crypto industry has experienced many serious bear markets. Nonetheless, it has always managed to bounce back.

Bitcoin is still worth nearly double what it was 6 months ago, and these downswings exist in the context of monumental growth. This price cycle may present a buying opportunity for long-term holders as crypto will eventually recover.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.