Tesla saw a boost in its financial performance in the fourth quarter of 2024, thanks in part to its Bitcoin holdings.

The company reported a $600 million gain due to a change in accounting rules. The move allowed Tesla to value its Bitcoin at market prices.

Tesla Makes $600 Million on Bitcoin

This shift in accounting standards stems from a new rule by the Financial Accounting Standards Board (FASB). The rule mandates that starting in 2025, companies holding digital assets must mark those assets to market each quarter.

The new FASB rule gives companies the option to implement this change earlier, which Tesla appears to have done. Before this rule, companies were required to report their digital assets based on the lowest valuation of those assets during their time of ownership.

Now, after adjusting values to current market prices, Tesla saw a marked increase in the valuation of its Bitcoin holdings. Moreover, as per its earnings release, Tesla did not sell any Bitcoin in Q4.

In Q4 2024, Tesla’s Bitcoin holdings were valued at $1.076 billion, up from just $184 million in previous quarters after the rule change. The dramatic increase reflects the changing market value of Bitcoin, which has seen fluctuations over time.

This increase in Bitcoin’s market value contributed to a $600 million gain, boosting Tesla’s financial performance. The company’s total GAAP income for Q4 reached $2.3 billion, meaning that Bitcoin gain played a key role in the results.

“It’s important to point out that the net income in Q4 was impacted by a $600 million mark-to-market benefit from Bitcoin due to the adoption of a new accounting standard for digital assets,” CFO Vaibhav Taneja reportedly noted on the earnings call.

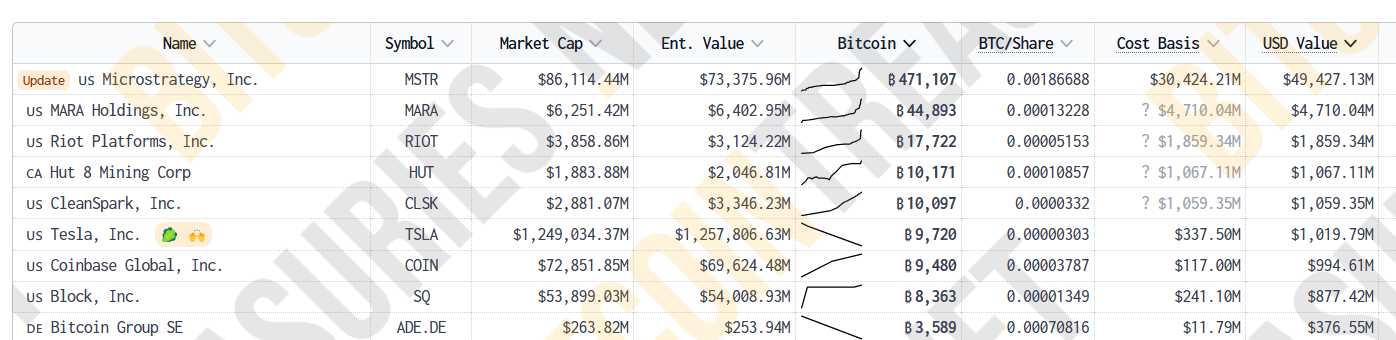

According to Bitcoin Treasuries, Tesla holds 9,720 BTC, making it the sixth-largest publicly traded company holding Bitcoin.

Tesla entered the Bitcoin market in 2021 with the purchase of 43,200 BTC. Following this initial purchase, Tesla sold part of its Bitcoin holdings over the years.

The change in Tesla’s Bitcoin valuation has also raised questions about the effect the new accounting rules will have on Microstrategy earnings.

“What on earth is going to happen when MicroStrategy announce their earnings next week. They have 471,107 Bitcoin and most likely will also take advantage of the new FASB accounting rule,” a X user posted.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.