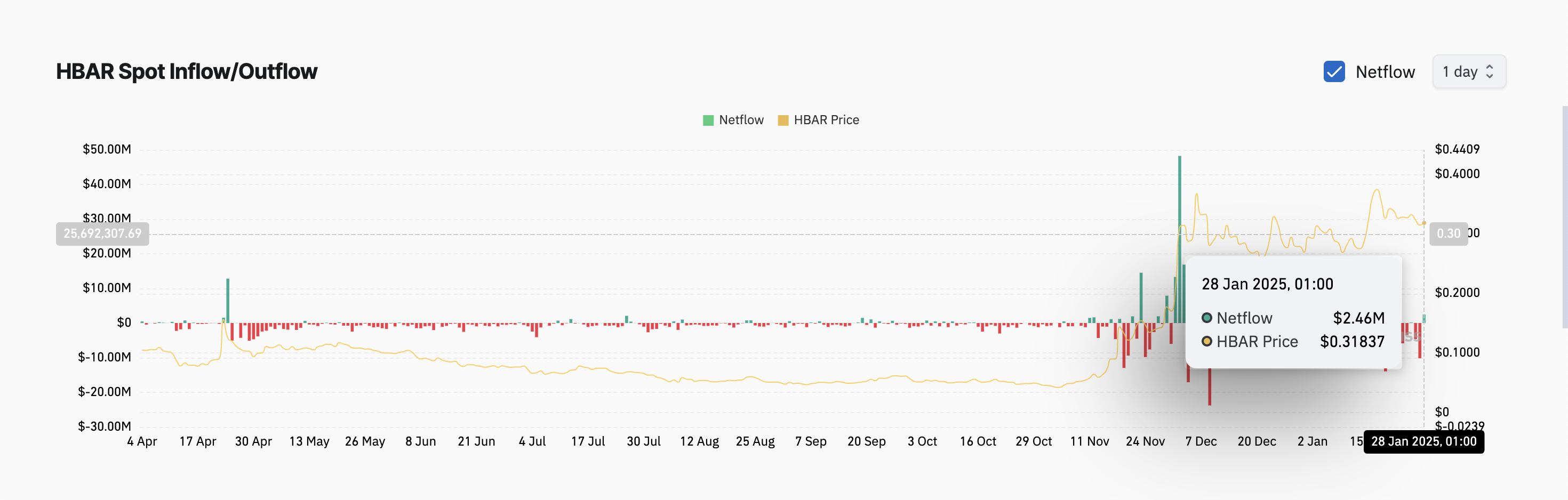

Hedera’s HBAR has recorded its first significant spot inflows in the past ten days, with $2.46 million entering its markets on Tuesday. This has driven the altcoin’s price up by 2% over the past 24 hours, riding the wave of a broader market recovery.

However, while the inflow signals renewed interest in the asset, data suggests this price uptick may be short-lived. Technical indicators suggest HBAR’s bullish momentum remains weak, hinting at a potential price correction.

Hedera Bears Remain in Full Control

So far today, HBAR has recorded spot inflows totaling $2.46 million, marking its first notable inflows in over ten days. Spot inflows indicate fresh capital entering the market through direct asset purchases, signaling renewed investor interest and potential short-term price momentum.

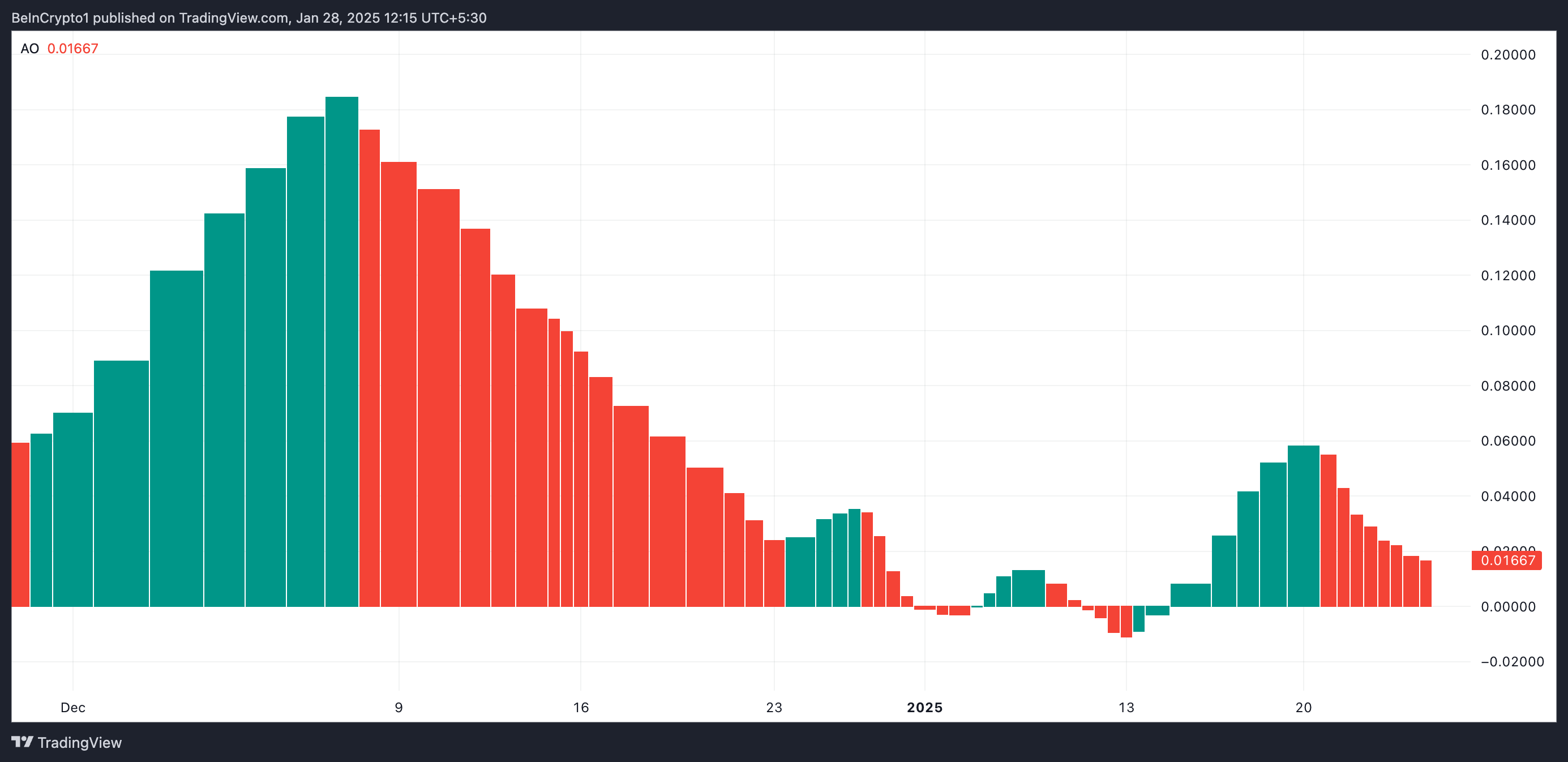

However, despite the fresh inflow and price increase, bearish sentiment weighs heavily on HBAR. Its Awesome Oscillator (AO), which measures its market momentum, continues to present only red histogram bars.

When an asset’s AO bars turn red, bullish pressure weakens, and bearish momentum increases. This hints at the possibility of an HBAR price reversal in the near term.

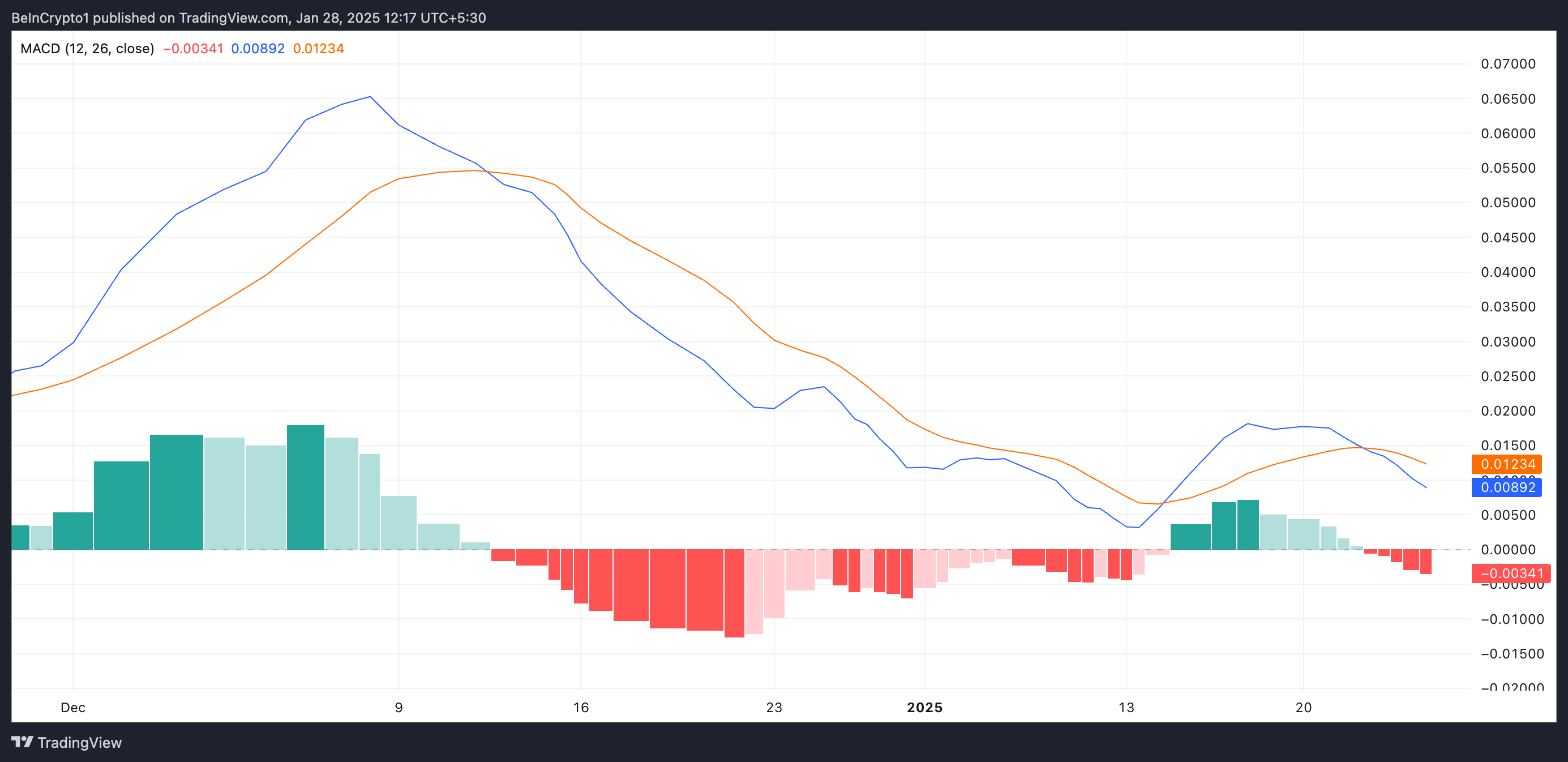

Moreover, readings from its Moving Average Convergence Divergence (MACD) indicator support this bearish outlook. At press time, the token’s MACD line (blue) rests below its signal line (orange).

This momentum indicator helps traders identify trends, momentum shifts, and potential buy or sell signals based on the crossing of the MACD line, signal line, and changes in the histogram. When set up this way, it indicates bearish momentum. This means that selloffs exceed buying activity among market participants, putting significant downward pressure on its price.

HBAR Price Prediction: Will Bulls Push It to $0.40?

If bearish pressure strengthens, HBAR could shed its recent gains and drop toward $0.26. If the bulls fail to defend this support level, HBAR’s price could plummet further to $0.24.

On the other hand, if the bulls regain market control and the uptick is sustained, HBAR’s price could break above $0.33 and climb toward $0.40.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.