Solana (SOL) price recently surged to a new all-time high, breaking volume and trading records after the launch of TRUMP’s official coin on the Solana blockchain.

While technical indicators like the EMA lines and Ichimoku Cloud reflect a bullish overall trend, they also hint at potential weakening momentum in the short term. As SOL hovers near critical levels, the question remains whether the hype can propel it toward uncharted territory above $300 or if the price will consolidate and test lower supports.

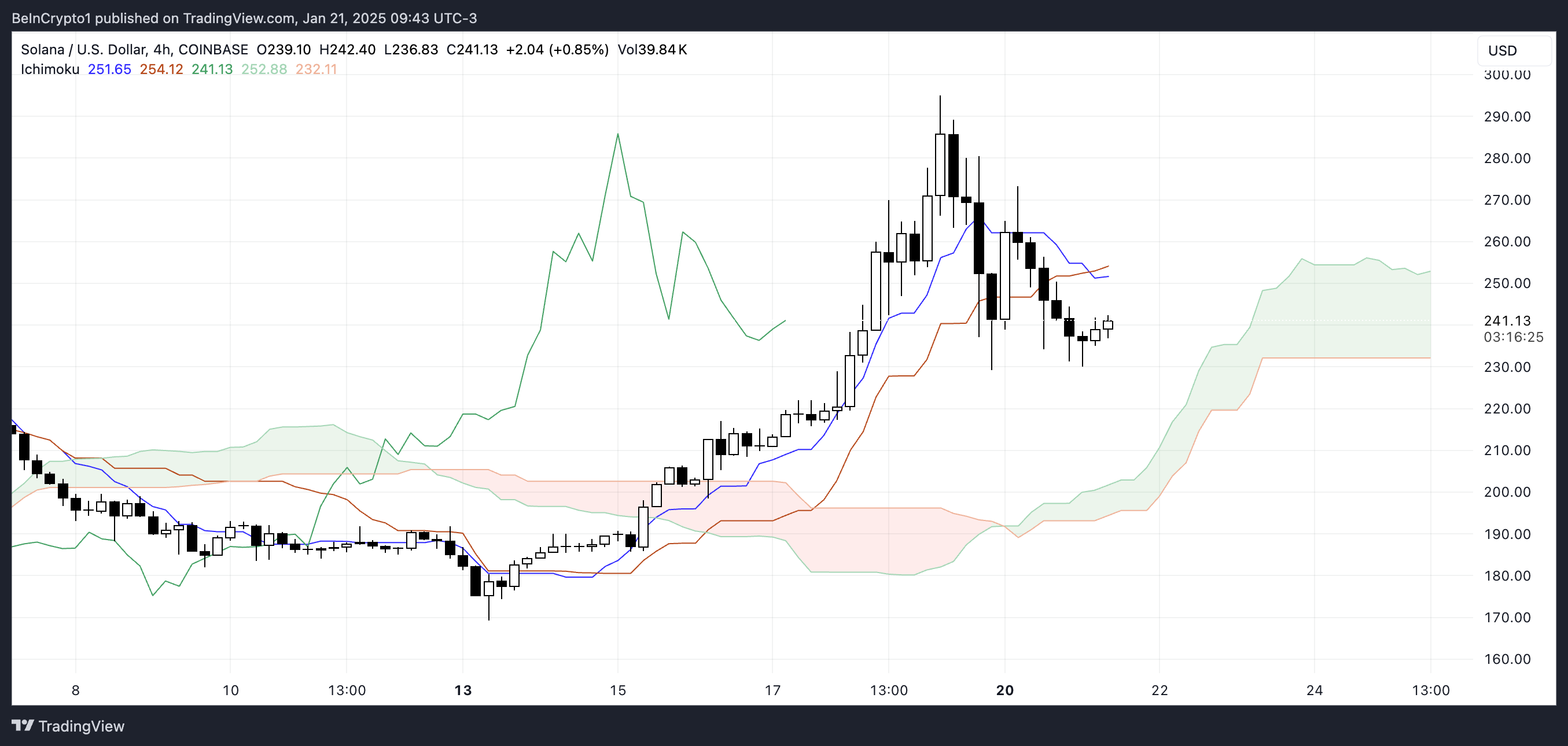

SOL Ichimoku Cloud Indicates Potential Weakening Trend

The Ichimoku Cloud chart for Solana indicates a mixed trend. The price is currently below the blue Conversion Line (Tenkan-sen) and the red Base Line (Kijun-sen), suggesting short-term bearish momentum.

However, the price remains above the green cloud (Senkou Span A and Senkou Span B), signaling that the broader trend is still bullish.

The cloud ahead is widening and remains green, which reflects potential stability in the longer term. The narrowing gap between the Conversion Line and Base Line suggests weakening bullish momentum in the short term.

If SOL price aligns back above these lines, it could indicate renewed strength, while a break below the cloud would suggest a shift toward a bearish trend.

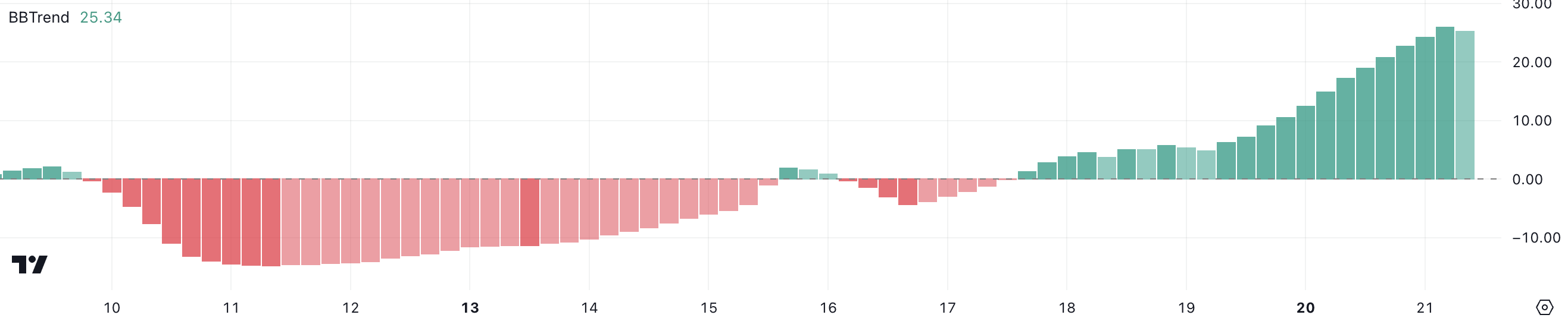

Solana BBTrend Is Breaking Records

Solana BBTrend is currently at 25.34, slightly down from its recent peak of 25.99, the highest level since December 2023. BBTrend, or Bollinger Band Trend, measures price strength relative to the upper and lower Bollinger Bands, providing insights into volatility and trend direction. A positive BBTrend value indicates bullish momentum, while negative values suggest bearish momentum.

SOL BBTrend remained positive for four days and is holding at 25.34, indicating sustained bullish momentum, even as the metric shows a slight decline from its peak.

This suggests that while SOL’s recent upward trend remains intact, the pace of its bullish momentum may be slowing, potentially leading to consolidation in the short term.

SOL Price Prediction: Can Solana Reach $300 In January?

The EMA lines for SOL maintain a bullish setup, with short-term averages positioned above long-term ones, signaling continued upward momentum. However, the narrowing gap between these lines indicates a weakening strength in the trend, suggesting a potential reversal.

Should bearish pressure increase, Solana price could face a retest of its $223 support level. A break below this critical level could trigger further declines, with $211 as the next key support and $191 representing a psychological barrier as SOL price dips below $200.

Conversely, SOL recently achieved a new all-time high, fueled by renewed excitement following the launch of TRUMP’s official coin on the Solana blockchain. If the momentum from this event sustains and the hype intensifies, SOL could challenge resistance levels above $280 and $294.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.