Hedera (HBAR) has struggled to gain momentum in recent weeks, reflecting a lack of direction amid a highly uncertain cryptocurrency market. This indecision has left investors cautious, making it difficult for them to take a definitive stance on the altcoin’s potential.

The price of HBAR has remained range-bound, further amplifying the ambiguity surrounding its short-term prospects.

HBAR Investors Are Not Sure

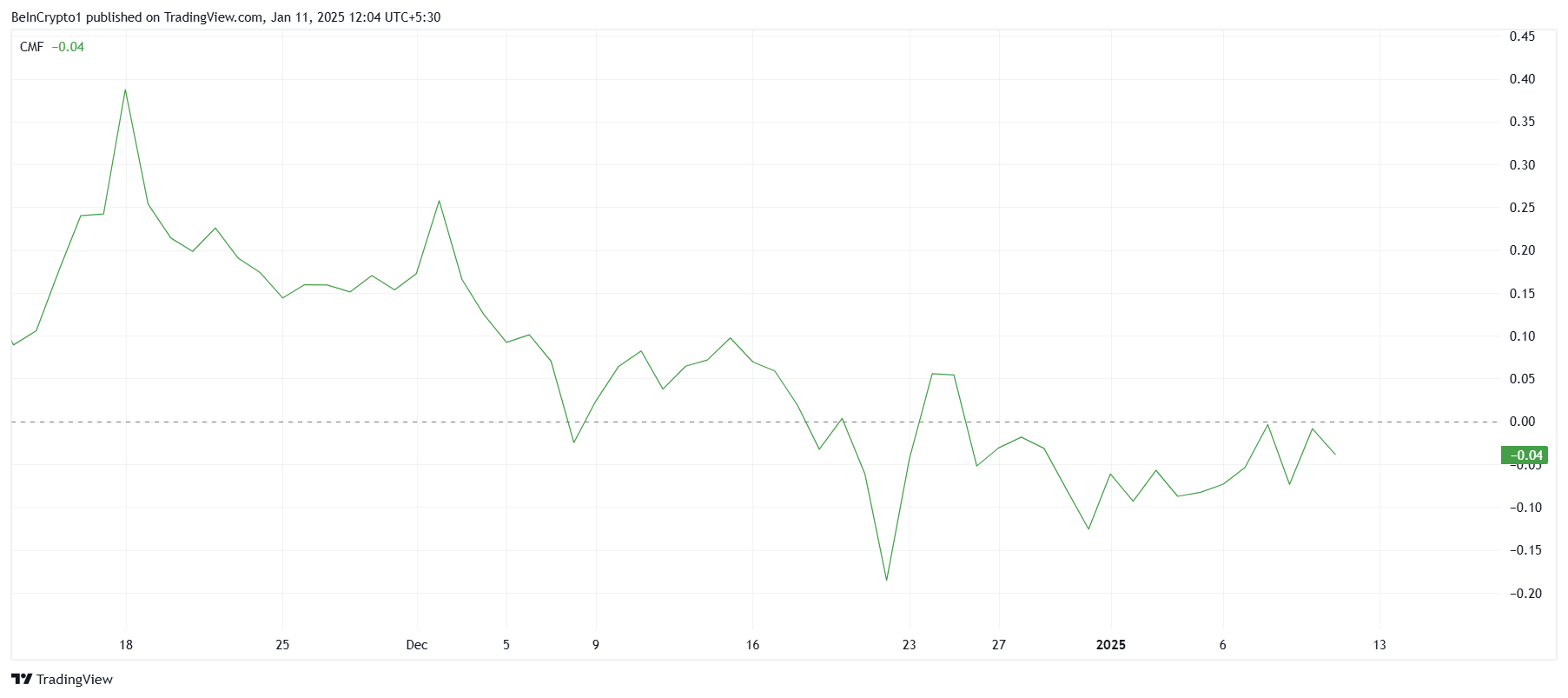

Hedera’s market sentiment, as indicated by the Chaikin Money Flow (CMF), remains subdued. Over the past two weeks, the CMF has persistently lingered below the zero line, signaling that capital outflows continue to exceed inflows. This trend highlights an ongoing hesitation among investors, who appear unwilling to inject significant liquidity into the asset amid its lackluster performance.

The sustained bearish CMF reading highlights a broader concern about the altcoin’s inability to generate bullish momentum. This hesitance among market participants has kept HBAR trapped in a consolidation phase, preventing any decisive movement that could restore investor confidence in the near term.

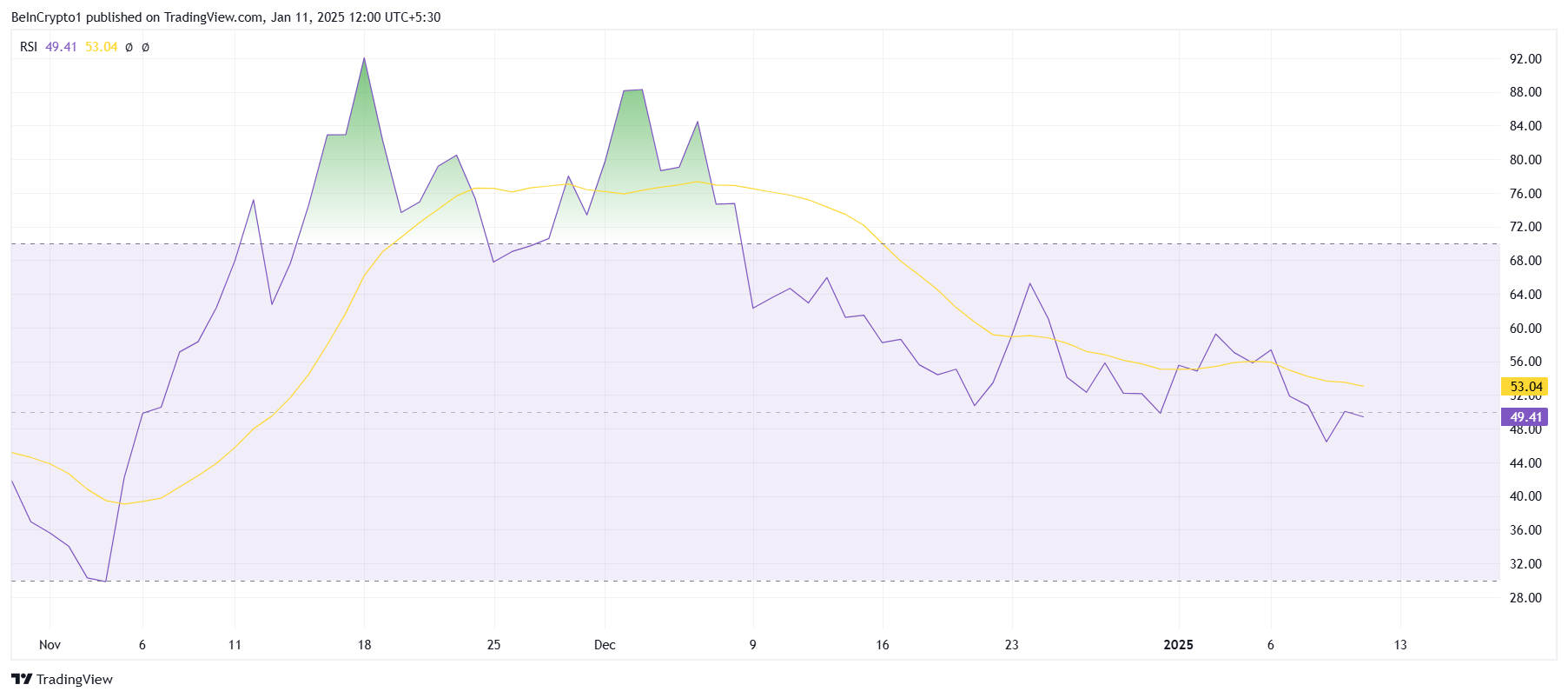

HBAR’s broader momentum reflects an intensifying bearish trend. The Relative Strength Index (RSI), a key technical indicator, has been steadily declining over the past month. This downward slope suggests that selling pressure is mounting, further weakening the altcoin’s position.

The RSI’s movement below the neutral line of 50.0 is particularly concerning, as it confirms the dominance of bearish sentiment. Unless this trend reverses, Hedera could face additional challenges, potentially exacerbating the uncertainty that currently overshadows its price action.

HBAR Price Prediction: Breaking Out of Consolidation

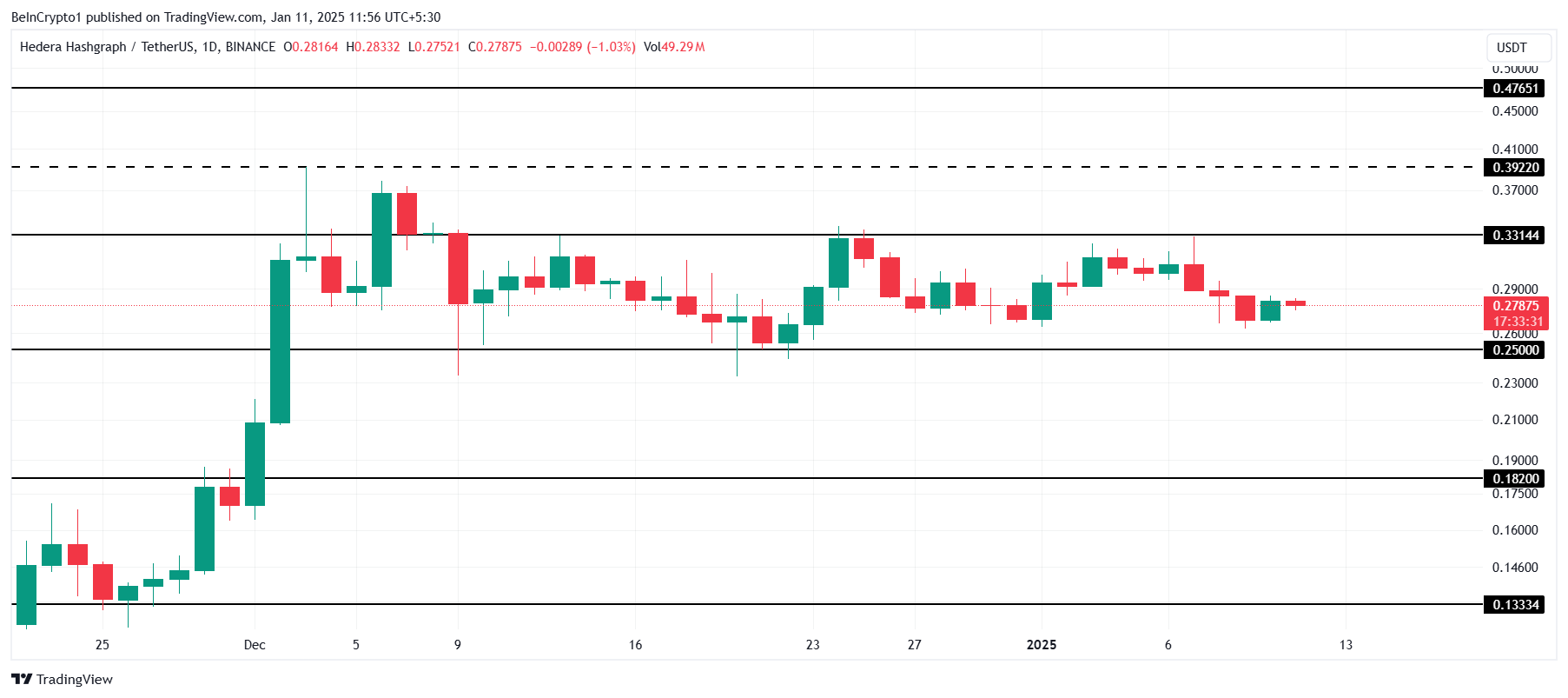

Hedera’s price has been consolidating between $0.33 and $0.25 for the past month, with little indication of breaking out. This prolonged stagnation has contributed to growing investor uncertainty. The lack of volatility makes it difficult to predict the altcoin’s next move.

If current indicators persist, HBAR risks losing its $0.25 support level. A breach of this critical threshold could push the price down to $0.18. This would further validate the bearish momentum seen in recent weeks.

However, a shift in market sentiment could offer a more optimistic scenario. Should broader crypto market trends turn bullish, HBAR may break above its $0.33 resistance level. In such a case, the altcoin could aim for $0.39, marking a 40% rally. This would push HBAR to the 2024 high and effectively invalidate the bearish outlook.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.