BNB is attempting to breach the $741 resistance level, which stands as a critical barrier to reaching its all-time high (ATH) of $793.

Despite the altcoin’s persistent effort, broader market cues are keeping bullish momentum in check, leaving BNB stuck in a narrow range.

BNB Investors Are Optimistic

The Relative Strength Index (RSI) has been hovering near the neutral line for the past month, signaling indecision in the market. While BNB has displayed bouts of bullish momentum, it has not been strong enough to drive a significant price uptick. This stagnation reflects weak sentiment influenced by broader market conditions.

The lack of strong bullish momentum has left traders uncertain about BNB’s short-term trajectory. The stagnant RSI highlights that buying pressure is not overwhelming, even as BNB trades close to key resistance levels. Without stronger market-wide optimism, BNB is likely to face continued challenges in breaking through its current price barriers.

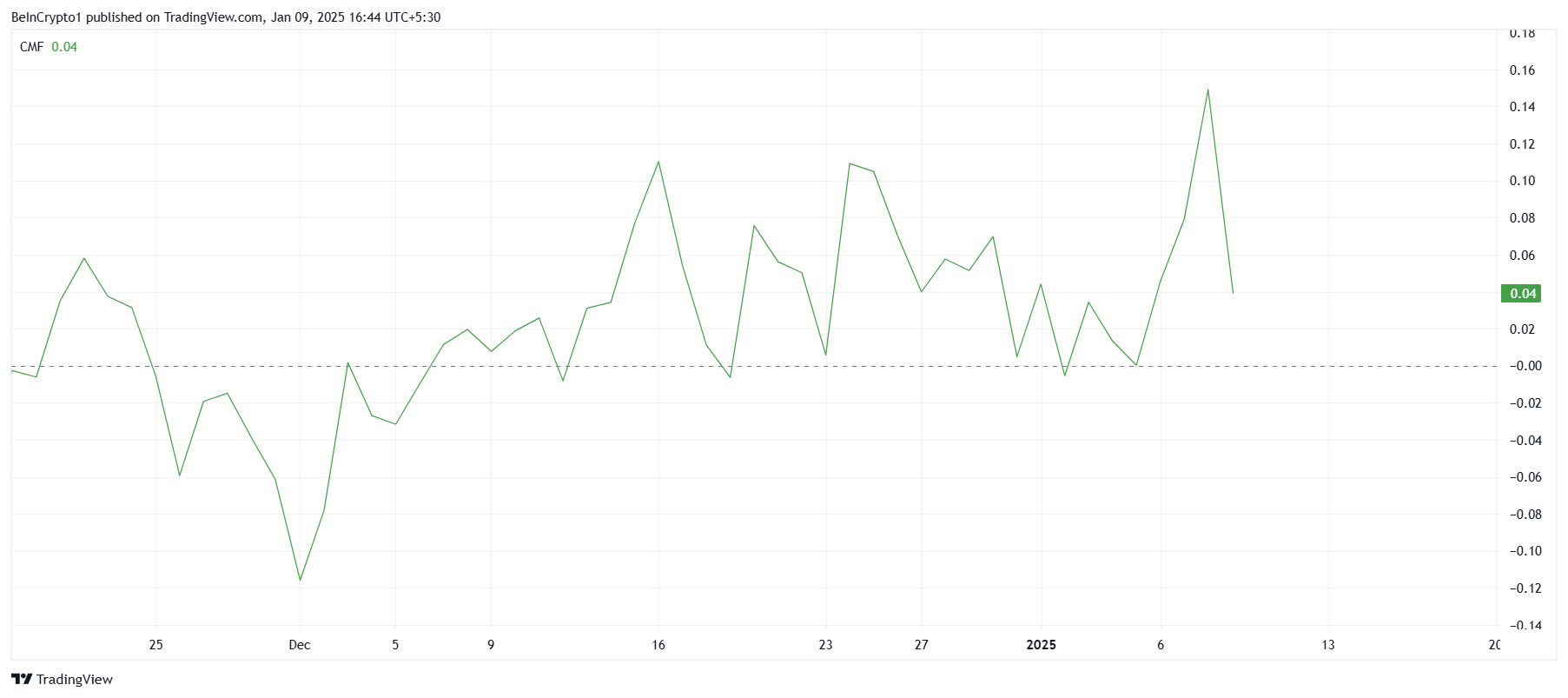

The Chaikin Money Flow (CMF) indicator is showing an uptick, signifying an increase in capital inflows into BNB. This suggests that investors remain optimistic about the asset’s potential breakout and are confident enough to continue pouring money into the cryptocurrency. Strong inflows could act as a catalyst for upward movement.

Investor sentiment remains positive, with market participants positioning themselves for a potential rally. This confidence is evident in the sustained inflows, even as BNB struggles to breach $741. However, the broader market’s influence and mixed signals could delay the anticipated breakout, keeping BNB in a state of consolidation.

BNB Price Prediction: Breaking Out

BNB is currently trading at $700, approximately 14% away from reaching its ATH. To achieve this milestone, the altcoin must break past the $741 resistance level, which has proven to be a significant obstacle over the past month. A successful breach could reignite bullish momentum and push BNB toward its ATH.

However, with mixed signals from technical indicators and broader market sentiment, BNB may remain stuck under $741. The altcoin is likely to consolidate above the $686 support level until stronger cues emerge. This consolidation phase could extend further if market conditions remain stagnant.

Should BNB lose the critical support of $686, it risks dropping to $647, as it has in the past. Any further decline would invalidate the bullish thesis entirely, potentially pushing the altcoin down to $619 and leaving investors wary of additional losses.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.