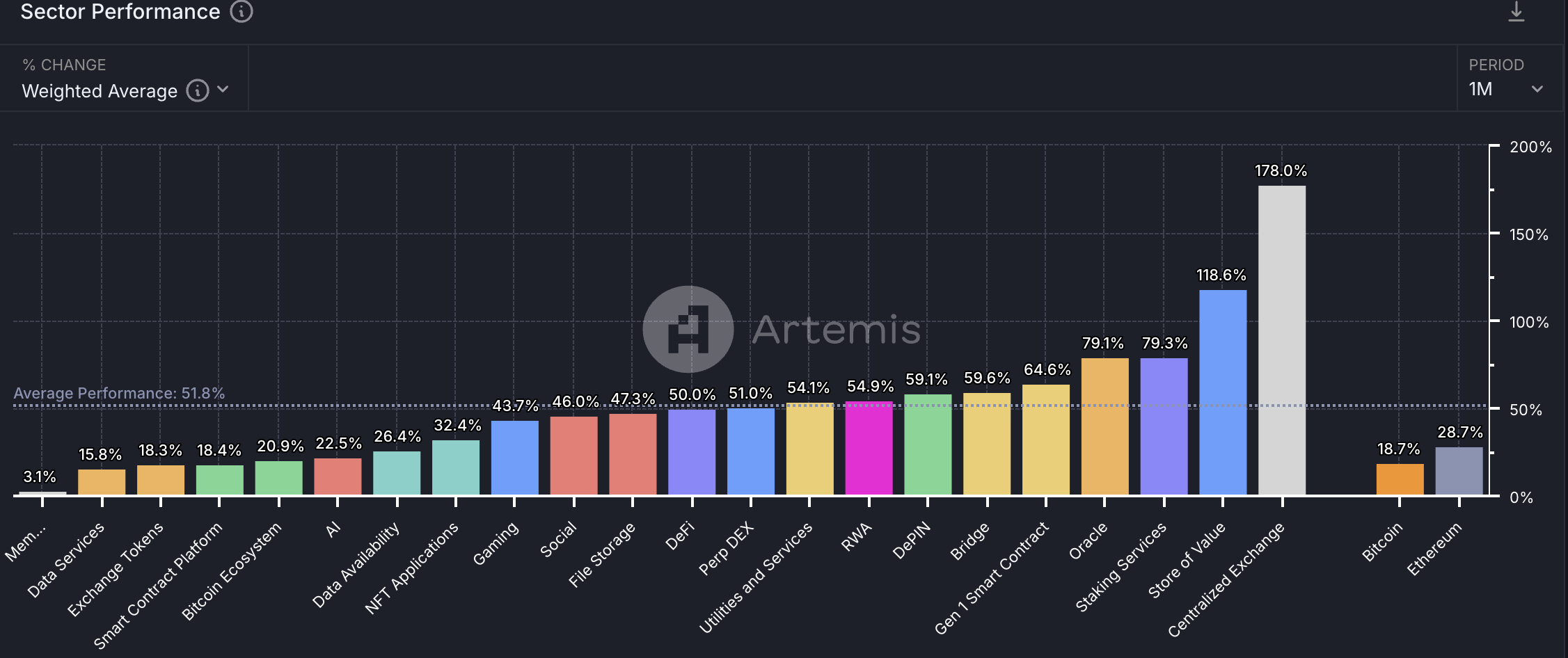

Data from across the industry shows a new market trend – the meme coin craze on the decline. Although the leading meme coins have maintained a consistent performance level, several bearish trends have appeared in the last month.

Certain assets are still delivering high-profile successes, but the meme coin space is quietly declining across the board.

Is a Meme Coin Winter Coming?

Around a month ago, the meme coin space was looking quite different: these assets were in an intense bull market, outperforming the top altcoins. DWF Labs even launched a $20 million fund to boost meme coin creators.

However, new data is revealing growing cracks, as the space’s trade volumes have dipped from the ~$30 billion range to under $14 billion.

CoinMarketCap data also shows that the leading meme coins have mostly kept a flat performance this month. Nonetheless, meme coins are famous for wild jumps and declines, and they have a tendency to steal the spotlight from one another.

For example, earlier this month, FARTCOIN achieved a 200% price hike, while older assets like DOGE fell sharply at that time. In a similar vein, POPCAT was a top-level performer in November, but it quickly began lagging behind the market. In other words, these big successes can distract from other losses. The whole market, however, is quietly underperforming.

It is difficult to create a comprehensive narrative that accurately explains these trends. Perhaps high-profile rug pull scams like Hawk Tuah have contributed to lowered market interest.

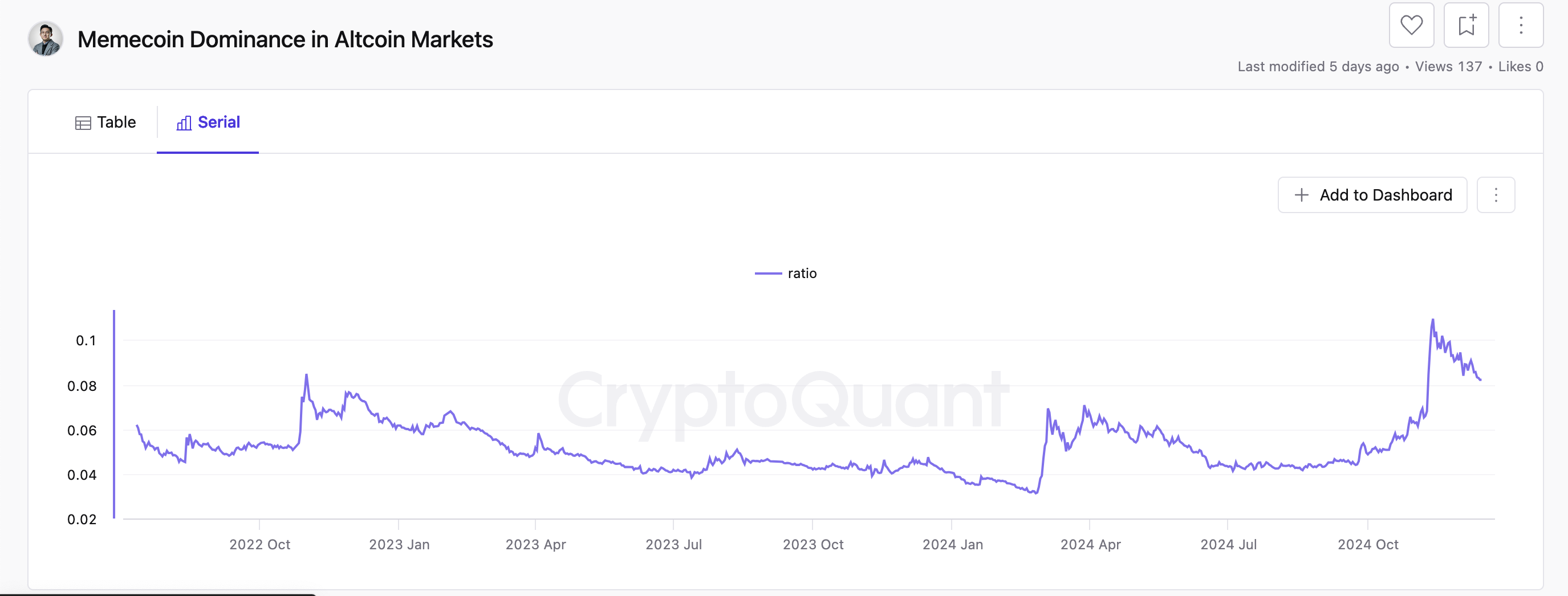

More data clearly reveals that most meme coin traders lose money, at least on certain platforms. For whatever reason, their market dominance against altcoins is dramatically falling.

Although these trends are definitely worrying, it’s premature to claim that a meme coin bear market is imminent. For example, November trading data suggested that an altcoin season was also imminent, but the actual rally failed to materialize.

Perhaps these trends will also amount to a temporary mirage. Still, traders should be aware of these bearish signals.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.