The US Supreme Court has rejected an appeal by Nvidia Corp., allowing a shareholder lawsuit regarding the firm’s crypto revenue to proceed.

The lawsuit accuses the company of misleading investors about its dependence on cryptocurrency mining revenues ahead of a significant market downturn.

Nvidia Crypto Lawsuit Might Go to Trial in 2025

The court’s decision follows a November hearing where justices questioned whether the case raised legal issues substantial enough to merit Supreme Court intervention.

In the lawsuit, shareholders claim that during 2017 and 2018, Nvidia’s CEO, Jensen Huang, concealed the extent to which record-breaking revenue growth relied on sales of its GeForce GPUs for crypto mining rather than gaming.

However, Nvidia argued that the crypto lawsuit lacked sufficient detail to advance to the evidence-gathering phase of the legal process.

According to Bloomberg, the shareholders’ legal representative called the decision a “major win for corporate accountability.” The lawsuit will now continue in a federal district court in Oakland, California.

When the crypto market crashed in 2018, Nvidia faced significant challenges. In November of that year, the company disclosed that it had missed revenue projections. This caused Nvidia’s stock to plummet by over 28% in two days. Huang attributed the shortfall to a “crypto hangover.”

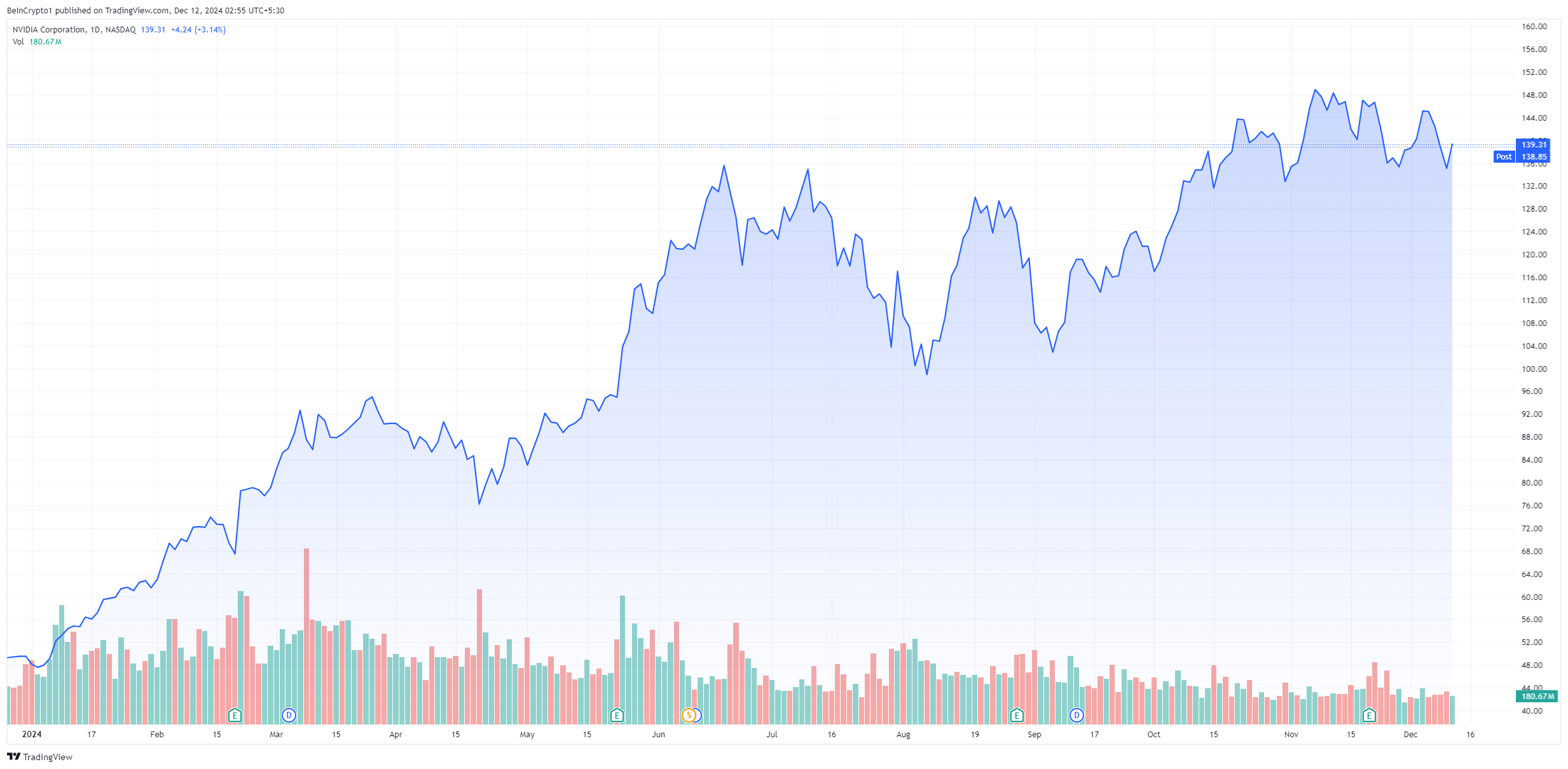

Despite these legal challenges, Nvidia’s stock has surged nearly 190% year-to-date. This was driven by strong demand for its GPUs in Bitcoin mining. The company’s 4000-series GPUs have outperformed AMD in profitability rankings and gained significant market share.

In its latest financial report, Nvidia announced a 95% year-over-year revenue increase in Q3, reaching $35.1 billion. Its Data Center segment posted a 111% growth, and Q4 revenue is projected to hit $37.5 billion.

Earlier this year, Nvidia surpassed a $3 trillion market capitalization. This surge saw the company outpace Apple and set a new benchmark for the tech industry.

Also, Nvidia is focusing on diversifying its business beyond gaming and crypto mining. In July, the company revealed plans to provide infrastructure for next-generation humanoid robotics.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.