Ripple’s XRP has maintained a steady uptrend over the past week. It currently trades at a two-month high of $0.64, having recorded a 19% uptick over the past week.

BeInCrypto’s assessment of XRP’s setup indicates that it is now eyeing a potential return to its year-to-date high of $0.74. How soon will this materialize?

Ripple Holders Bet on a Rally

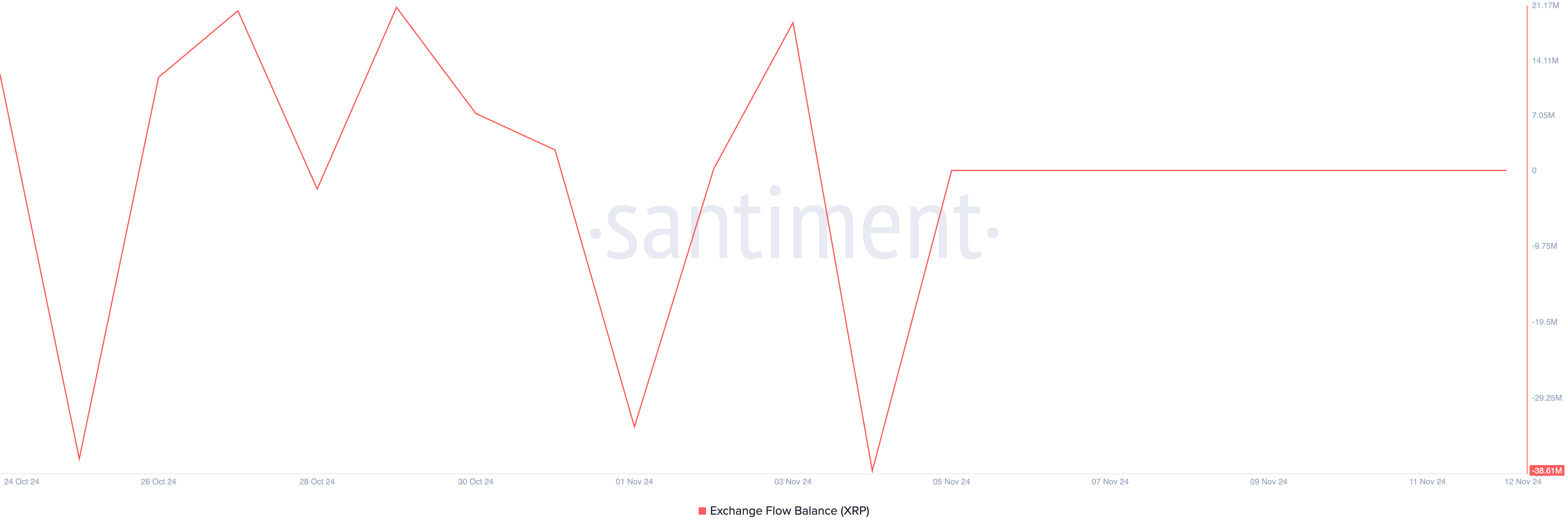

The decline in XRP’s selling pressure, as evidenced by its negative exchange flow volume, hints at its continued uptrend. A negative exchange flow volume for an asset indicates that more of the asset is being moved off exchanges into wallets. According to Santiment’s data, 39 million XRP tokens have been taken off exchanges as of Tuesday.

This is a bullish signal because when more of an asset is being removed from exchanges, less supply is available for immediate sale. This can reduce selling pressure and drive the price higher.

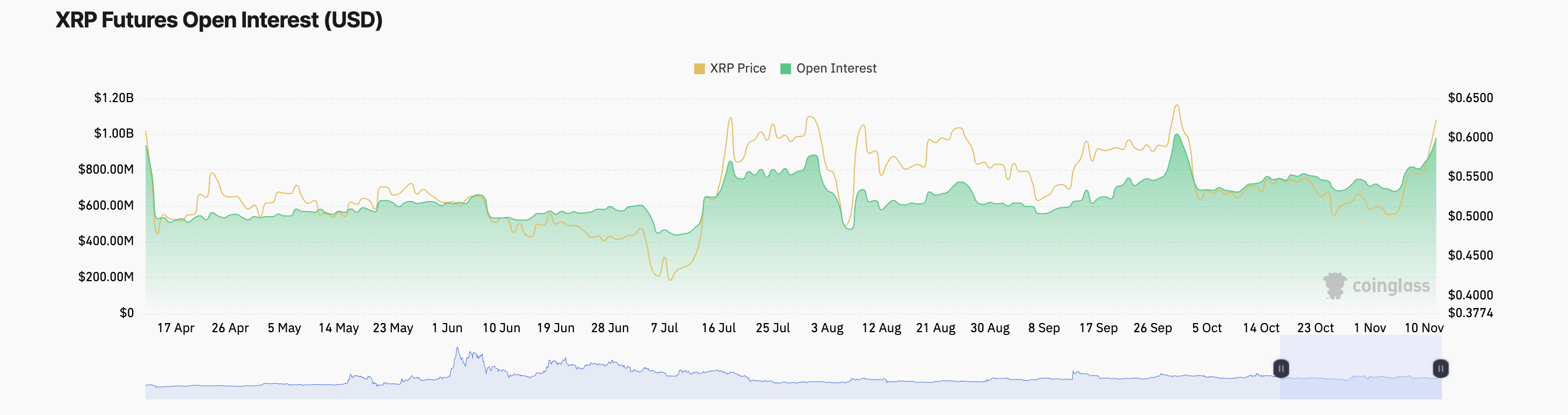

A surge in its open interest has also accompanied XRP’s price uptick. As of this writing, this stands at $989 million, surging by 13% over the past 24 hours.

Open interest measures the total count of open or unsettled contracts (futures or options) in the market. When both open interest and an asset’s price increase together, it indicates fresh liquidity entering the market. This signals a bullish outlook and highlights the potential for a continued rally.

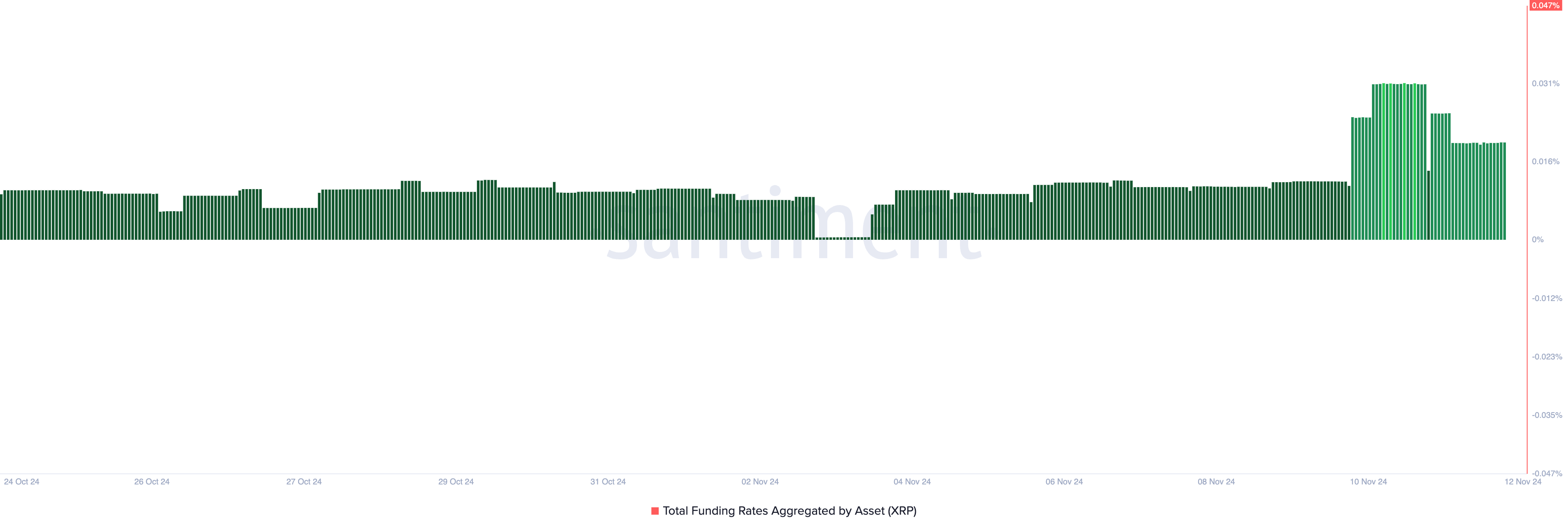

Moreover, XRP’s funding rate has remained positive, indicating that its holders are betting on a further price rally. Per Santiment’s data, this currently stands at 0.047%.

The funding rate is a mechanism used in futures markets to ensure that the price of perpetual contracts stays close to the underlying asset’s spot price. When it is positive during a price rally, more traders are taking long positions, betting that the asset’s price will continue to rise. This situation suggests that bullish sentiment is dominating the market.

XRP Price Prediction: Levels To Watch

XRP currently trades at $0.64. If the bullish momentum persists and demand for XRP continues to grow, its price could soon break through the key long-term resistance at $0.66. This level has proven difficult to surpass, with XRP failing to break above it on two occasions since July.

A successful breakout and subsequent retest of this resistance would pave the way for XRP to target its year-to-date high of $0.74.

However, if bullish pressure weakens, XRP’s price may suffer a correction, plummeting below $0.60, invalidating the bullish projection above.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.