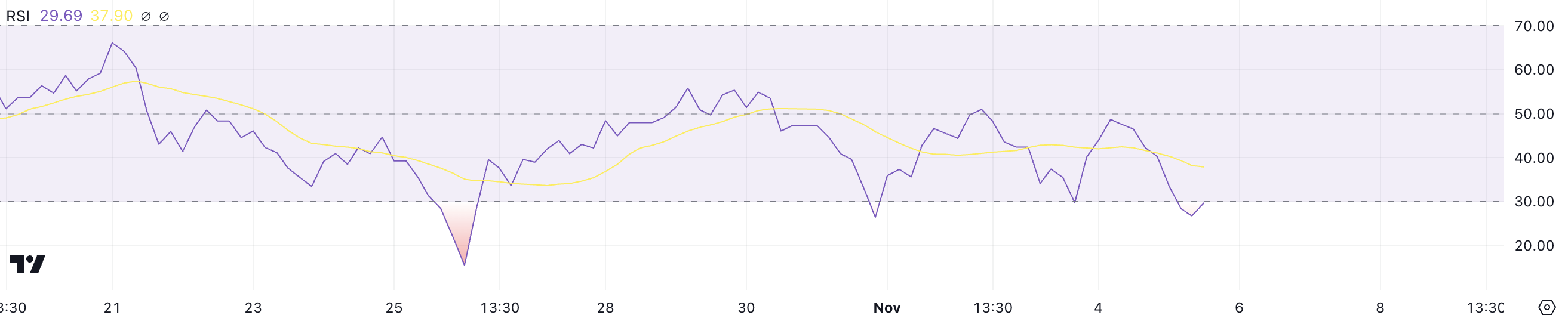

Toncoin (TON) price appears to be under pressure, with recent technical indicators pointing toward a possible oversold stage. The Relative Strength Index (RSI) shows signs that selling momentum has dominated, although a rebound could be on the horizon.

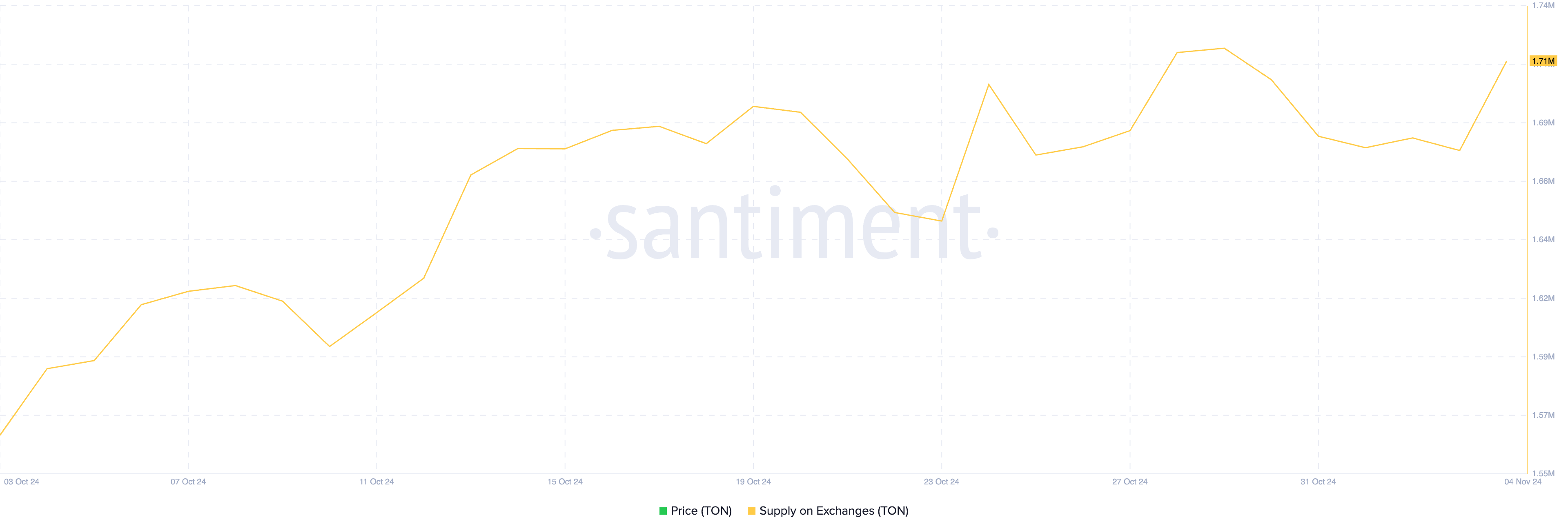

Meanwhile, a recent increase in TON’s supply on exchanges suggests that some holders may be preparing to sell, adding potential short-term pressure.

TON RSI Shows An Oversold Stage

TON’s RSI is currently at 29.69, slightly up from its recent low of 26 just a few days ago. This level suggests that the coin is nearing oversold territory, where selling momentum has been dominant.

RSI, or Relative Strength Index, measures the speed and change of price movements. Levels below 30 indicate oversold conditions, and levels above 70 indicate overbought conditions. An RSI below 30 can signal undervaluation, often hinting at a potential price rebound.

Read more: Top 9 Telegram Channels for Crypto Signals in October 2024

This recent rise in TON’s RSI could mean the price is gearing up for a recovery. However, a rebound may not be immediate, as historical patterns show that TON’s RSI has dipped well below 30 — sometimes as low as 15 — before a reversal occurs.

This suggests that while oversold levels are present, further downward pressure is still possible before a strong recovery takes place.

Holders Just Sent 30,000 TON To Exchanges

Recent data shows that users have transferred around 30,000 TON to exchanges over the last few days. When users send a coin to exchanges, it typically indicates a bearish outlook, as these transfers suggest they may be preparing to sell.

Conversely, when coins are withdrawn from exchanges, it often reflects a bullish sentiment, as users are more likely to hold and avoid selling.

The addition of 30,000 TON on exchanges suggests that some holders may be positioning themselves to sell in the near future, although this amount is relatively modest.

This inflow could lead to slight selling pressure, but it’s not a substantial volume that would likely drive significant price changes on its own.

TON Price Prediction: Possible Rebound Soon?

The TON EMA lines chart reveals a bearish setup, with its price trading below all EMA lines and short-term lines positioned under the long-term ones, signaling a sustained downtrend.

This alignment indicates that sellers are currently in control, and the downtrend may persist. If this pattern continues, TON price is likely to test support around the $4.45 level, where it could seek stabilization.

Read more: 6 Best Toncoin (TON) Wallets in 2024

However, with the RSI suggesting that TON may be entering oversold territory, a potential rebound could be on the horizon. If buying interest picks up and TON reverses its downward trend, it could aim to test resistance at $4.91.

This scenario would depend on a shift in momentum, highlighting the current key levels TON may encounter.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.