Bitcoin (BTC) is set to end October, which initially started rough, on a strong note. Over the past 30 days, BTC has surged by 13%, prompting many analysts to predict that this upward momentum will persist into the Bitcoin November 2024 price outlook.

But what’s driving this optimistic outlook? This in-depth on-chain analysis sheds light on the underlying factors contributing to this bullish sentiment.

Bitcoin Has Many Factors in Its Favor, Analysts Say

For starters, digital asset research firm 10x Research opined that BTC might continue to move upwards. According to the firm’s prediction, Bitcoin’s rally to $73,000 this month is one reason the price can continue to rise.

To support this point, 10x Research mentioned that whenever Bitcoin hits a six-month high, its price increases by at least 40% within the next three months. Based on this sentiment, Bitcoin’s price is likely to surpass $100,000 before the end of January 2025, which also means it could break its all-time high in November.

Besides this, the firm, via its YouTube page, noted that catalysts, including the US elections surging Bitcoin ETF inflows, which run into billions of dollars over the last few weeks, could also play a role.

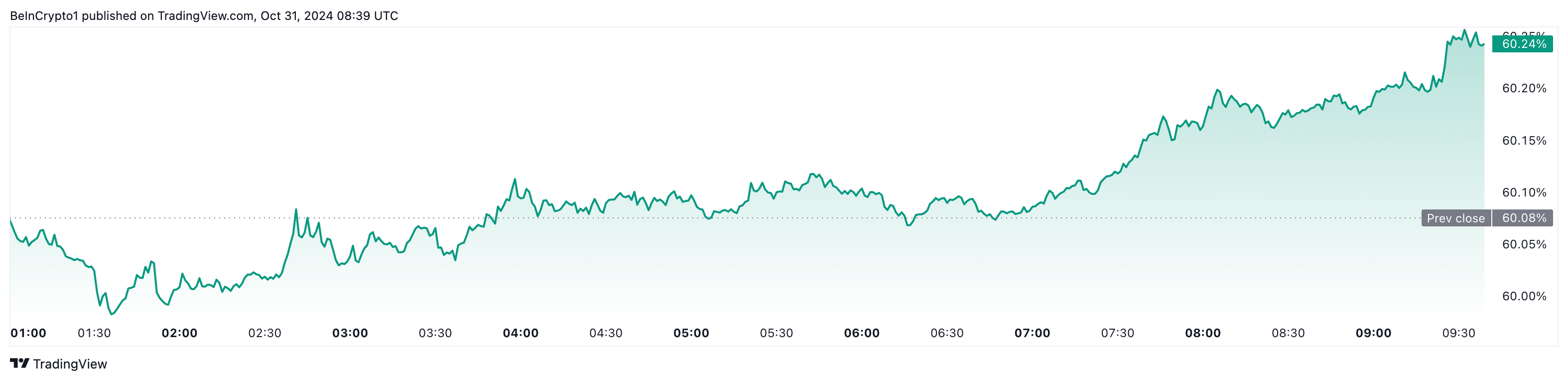

Another factor that could affect Bitcoin’s November 2024 price performance is its dominance. As of this writing, Bitcoin’s dominance has increased to 60%.

Read more: 5 Best Platforms To Buy Bitcoin Mining Stocks After 2024 Halving

High dominance in Bitcoin’s market presence suggests that it is leading the cryptocurrency space, particularly during periods of uncertainty.

This trend often indicates that investors are gravitating toward Bitcoin’s relative stability, opting for its perceived safety in contrast to the higher risks associated with altcoins.

Interestingly, on-chain data from Glassnode also seem to agree with 10x Research’s prediction. According to Glassnode, the Pi Cycle Top, which shows the potential peak BTC might hit, shows that the cryptocurrency could rally to $115,903.

If that is the case, Bitcoin’s November 2024 prediction for Bitcoin could see the price break above its all-time high. Michaël van de Poppe, founder of MN Trading, also seems to agree with the outlook.

“I think $80,000 in November and $90,000-100,000 in December will help Altcoins to outperform strongly as yields are going to drop.” van de Poppe said in a post on X.

BTC Price Prediction: $76,000 Minimum in November?

On the daily chart, Bitcoin still has a bullish technical setup, suggesting that the price could rise well above $72,319. First off, the cryptocurrency has been able to surpass the major resistance at $71,473.

Historically, when Bitcoin’s price gets rejected at this zone, it undergoes a notable correction. For instance, in April, when this happened, BTC dropped by 14% within some days. A similar thing happened in June, which caused Bitcoin’s price to drop by 22% in less than a month.

Furthermore, the Relative Strength Index (RSI), which measures momentum, has continued to ascend. This movement is similar to how it moved during the run-up to the all-time high in March.

Read more: Bitcoin (BTC) Price Prediction 2024/2025/2030

Should this trend continue, BTC could rally above $76,000 in November. On the other hand, a decline below $70,000 in the short term could invalidate this prediction. In that scenario, BTC could decline to $66,448.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.