Bitcoin’s price has been on a steady upward trend since mid-September, rising from $53,000 to $67,000. This impressive growth has stalled the anticipated altcoin season, drawing investor attention and capital toward Bitcoin instead of smaller assets.

As Bitcoin inches closer to forming a new all-time high (ATH), altcoins may remain sidelined for a while longer.

Bitcoin Is Dominating the Market

Bitcoin’s dominance over the crypto market continues to grow, surpassing 59% in October, an increase of 3.45% throughout the month. This rise is primarily due to Bitcoin’s price appreciation, making it an attractive investment option, especially for institutional players.

In a weekend brief, QCP highlighted positive ETF inflows over the last three weeks, which are signaling high institutional demand.

“Bitcoin dominance continues to rise, reaching highs of 59.75% for the week…We believe that the uptrend in bitcoin dominance is likely to persist in the near term as bitcoin approaches its ATH levels,” QCP noted.

If Bitcoin reaches its all-time high of $73,078, its market dominance could surge to 60%, potentially delaying the altcoin season. This rise in Bitcoin’s price and dominance indicates a change in market sentiment, with investors leaning towards BTC’s relative stability. If Bitcoin maintains this upward momentum, altcoins may stay in the background, waiting for a shift in capital flows.

Read more: Which Are the Best Altcoins To Invest in October 2024?

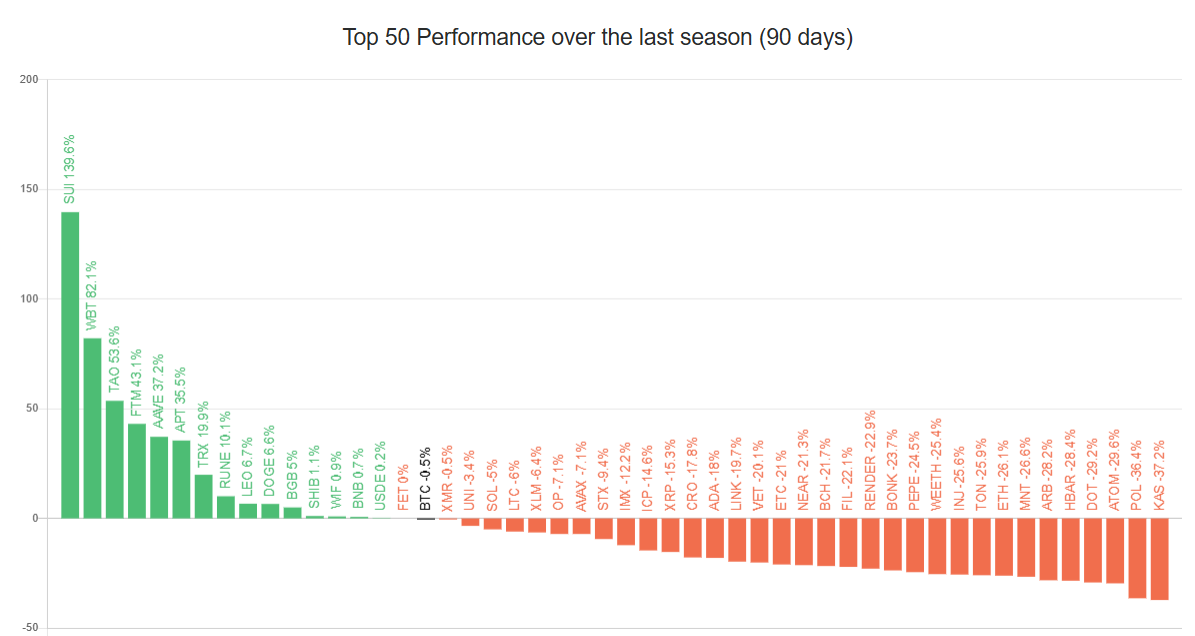

Currently, an altcoin season appears distant due to limited growth across altcoin assets. For an altcoin season to be confirmed, at least 38 altcoins need to outperform Bitcoin over a 90-day period; however, only seven have done so recently.

This minimal growth suggests that altcoins lack the momentum needed for a breakout, as Bitcoin’s upward trend continues to attract the majority of market activity. Without a significant shift in momentum, altcoins may continue struggling to gain investor interest.

BTC Price Prediction: Focusing on the ATH

Bitcoin’s price currently sits at $67,439, inching closer to the critical $70,000 mark. Just 8% away from its ATH of $73,078, BTC has the potential to break new records if current market trends hold.

Spot Bitcoin ETFs have seen inflows of nearly $998 million in the past week. If this level of investment sustains in November, Bitcoin could push through $70,000, likely achieving a new ATH and delaying the altcoin season further.

Read more: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

However, if Bitcoin investors start taking profits around $70,000, the price could dip, potentially pulling BTC down to $65,000. This correction would dampen bullish hopes for an ATH and might open a brief window for altcoin gains.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.