Solana’s price recently breached the $161 barrier for the first time in over two months, signaling a strong bullish momentum. The altcoin’s price surge attracted attention from traders, but despite the optimism, there are growing concerns about a potential bearish reversal.

Heavy sell pressure is building, which could threaten the bullish momentum that propelled SOL past key resistance levels.

Solana Traders Are at Risk

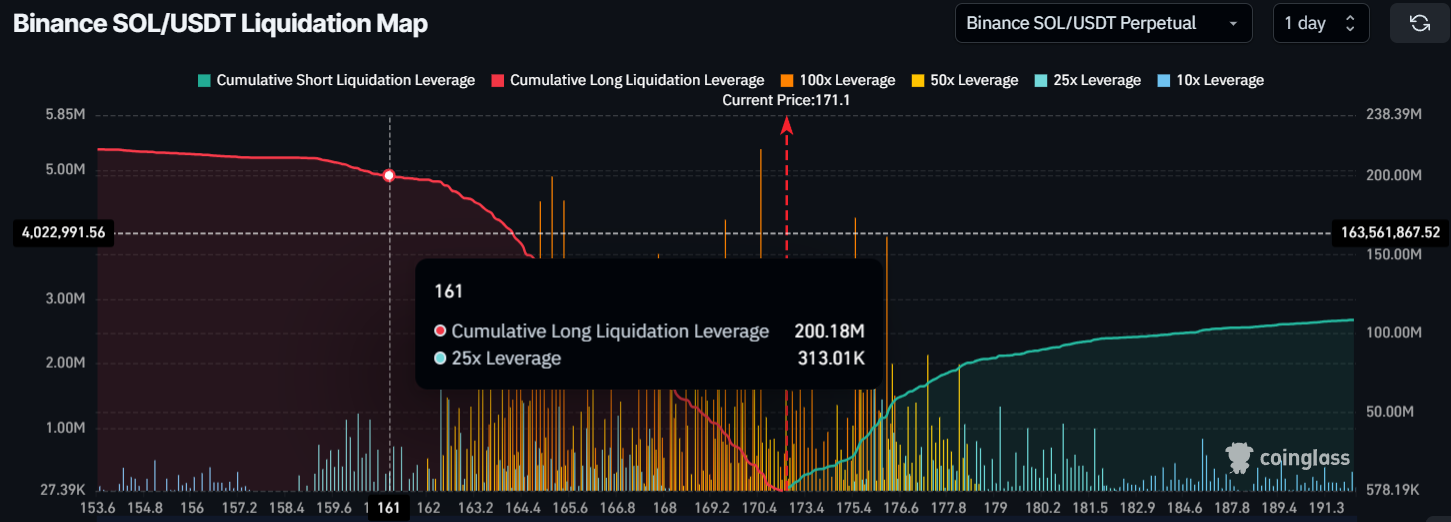

Currently, the liquidation map shows that Solana traders are leaning bullish, with a higher number of long contracts compared to short positions. While this reflects confidence in Solana’s upward trajectory, it also poses a significant risk if the market turns. If Solana’s price corrects and drops to the $161 support level, more than $200 million in long contracts could be liquidated. This heavy liquidation would impact market sentiment and potentially trigger more selling, exacerbating the price decline.

The presence of more long contracts means traders are betting on the continuation of the bullish trend. However, this creates a vulnerability. A sudden price drop could trigger a cascade of liquidations, amplifying the downward movement. If the sell-off gains momentum, traders may scramble to close their positions, further weakening Solana’s price.

Read more: 7 Best Platforms To Buy Solana (SOL) in 2024

From a technical perspective, Solana’s macro momentum is at a crucial point. The Relative Strength Index (RSI) is nearing the overbought zone, which typically signals a potential reversal. Historically, when Solana reached these levels, the market faced significant drawdowns. If the RSI crosses into the overbought zone, it could trigger a pullback that sends SOL to the $161 support level.

Additionally, the broader crypto market is showing signs of caution, with other major assets experiencing pullbacks. Solana’s momentum could be tested if the altcoin market turns bearish. A failure to maintain its current levels could result in a broader decline, with Solana at risk of revisiting key support areas.

SOL Price Prediction: Bowing Down

Solana is currently facing resistance at $175, a level it has not approached in nearly three months. After managing to break past the $161 barrier for the first time since August, the altcoin is showing signs of strength. However, the market’s vulnerability to a drawdown cannot be ignored. A potential decline could send Solana back to its critical $161 support level.

If Solana loses the $161 support, the next key level to watch is $155. A failure to hold above $155 would deepen the bearish outlook, signaling a further downside for the altcoin. Traders should closely monitor these support levels as a break could lead to further losses.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

On the other hand, if Solana manages to break the resistance at $175, the price could surge toward $186. Breaching this level would invalidate the bearish thesis and restore confidence in the altcoin’s bullish momentum.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.