Chainlink, a provider of blockchain connectivity solutions, has launched its latest innovation, CCIP Private Transactions.

This feature is based on the Chainlink Cross-Chain Interoperability Protocol (CCIP). It makes it easier for financial institutions to engage with blockchain technology without compromising regulatory compliance.

Chainlink Solves Blockchain’s Privacy and Compliance Gap

The novel solution enhances blockchain interoperability while maintaining data integrity and confidentiality. It operates as the Chainlink blockchain privacy manager, enabling the privacy-preserving feature while addressing the long-standing compliance and confidentiality challenges. Notably, until now, these challenges have hampered institutional blockchain adoption.

The lack of adequate privacy and security protocols for cross-chain transactions is among the primary barriers preventing financial institutions from embracing blockchain. This is because regulations compel financial institutions to maintain strict data privacy standards. Until now, most blockchain platforms have struggled to meet this need.

With Chainlink’s novel CCIP Private Transactions feature, however, institutions will be able to transact across blockchains while maintaining strict data privacy controls. The blockchain privacy manager enables financial institutions to conduct private chain-to-private chain transactions. It ensures that only selected, necessary data is revealed.

Read more: Real World Asset (RWA) Backed Tokens Explained

This functionality also extends to private chain-to-public chain transactions. It offers a layer of privacy that meets both operational needs and regulatory demands.

“Now that private transactions across chains are possible, we expect an even greater influx of institutional adoption of blockchains, CCIP, and the Chainlink standard in general,” Sergey Nazarov, co-founder of Chainlink, said in a press release shared with BeInCrypto.

It is worth mentioning that the Australia and New Zealand Banking Group (ANZ) is one of the first major financial institutions to pilot this feature. The ANZ will use it for cross-chain settlement of tokenized real-world assets (RWAs) under the Monetary Authority of Singapore’s (MAS) Project Guardian initiative.

This collaboration highlights the growing interest of traditional finance (TradFi) institutions in utilizing blockchain for asset management and settlement. This is particularly true as they seek to tap into the benefits of decentralized finance (DeFi).

Chainlink’s CCIP Feature Grows On Institutions

As BeInCrypto reported, Chainlink has been making strides in enhancing blockchain interoperability for institutions. Its collaboration with ANZ on Project Guardian is just one example of how the company is enabling financial institutions to harness the power of blockchain without sacrificing compliance or security. The pilot program with ANZ, which involves the use of tokenized RWAs, displays the value of CCIP in facilitating secure, cross-chain settlements.

Beyond ANZ, other organizations have already begun integrating Chainlink CCIP into their operations. For instance, Mountain Protocol and Ronin Validators have recently adopted Chainlink CCIP to enhance their respective blockchain ecosystems, facilitating secure cross-chain communication.

Similarly, IDA Finance has integrated Chainlink CCIP to streamline asset management, while Swiss firm Taurus has collaborated with Chainlink to bolster its tokenization services. These partnerships demonstrate the growing recognition of Chainlink’s capability to address privacy and interoperability challenges across various sectors.

Read more: What is Tokenization on Blockchain?

Moreover, the introduction of Chainlink Proof of Reserve by 21.co and the use of Chainlink in mitigating vulnerabilities, such as in the recent Bedrock exploit case, highlight the broader scope of Chainlink’s solutions in improving security and transparency in blockchain transactions.

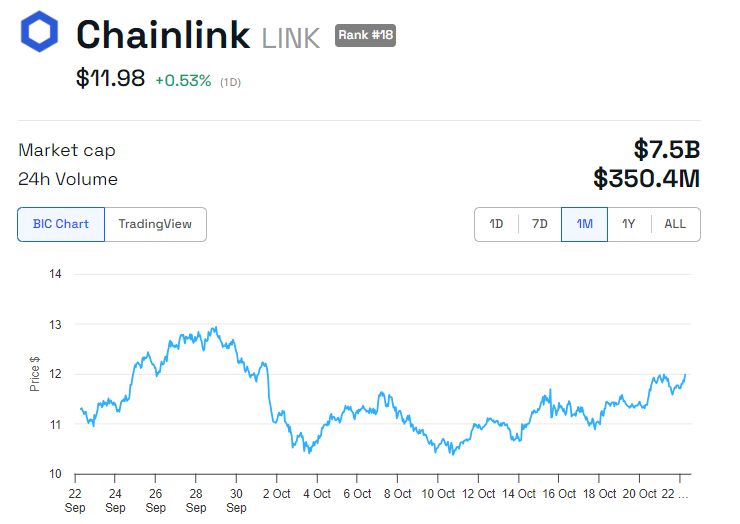

Despite the advancement of CCIP, the community is often disappointed with the lackluster performance of the LINK token. BeInCrypto data shows Chainlink’s LINK token is up by a modest 0.53% on this news. It is trading for $11.98 as of this writing.

Meanwhile, even as Chainlink CCIP progressively takes the spotlight, its heft as a leading decentralized oracle network is under threat. Specifically, it faces strong opposition in the blockchain oracle space from AP13, Band Protocol, Nest Protocol, Phi Labs, and GOracle.

Like Chainlink, these also provide reliable data feeds to smart contracts on various blockchain platforms. In so doing, they effectively contribute to the Oracle space with their novel solutions. They offer unique strengths, ranging from cross-chain capabilities and dAPIs to decentralized price oracles and interoperable solutions.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.