Cardano (ADA) price has trended downward over the past few days. Trading at $0.34, the popular altcoin has witnessed a 3% fall since Monday.

On-chain data suggests that Cardano may face a price correction of up to 21% in the near term. This analysis delves into why this may happen and highlights the price targets ADA holders need to watch.

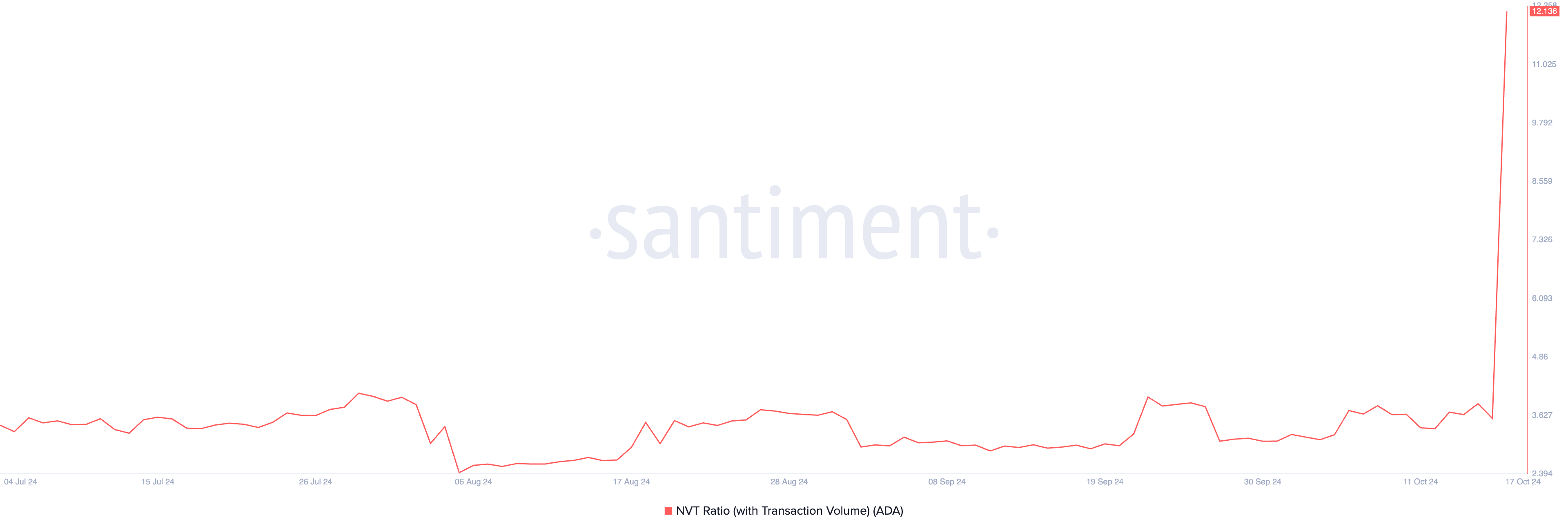

Cardano High NVT Ratio Poses Significant Risks

As of this writing, Cardano’s Network Value to Transactions (NVT) ratio, which assesses its valuation, sits at its highest level since February 2023. Per Santiment’s data, this is 12.13.

When an asset’s Network Value to Transactions (NVT) ratio spikes, it indicates it may be overvalued. It signals that its price is relatively high compared to the amount of activity on its network. Historically, an inflated NVT ratio is often followed by an asset’s price correction, as it means that the rally is not backed by actual demand.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

The combination of ADA’s falling price and rising NVT ratio reflects negative market sentiment. Its holders are selling their assets, leading to lower transaction volume and contributing to its price decline.

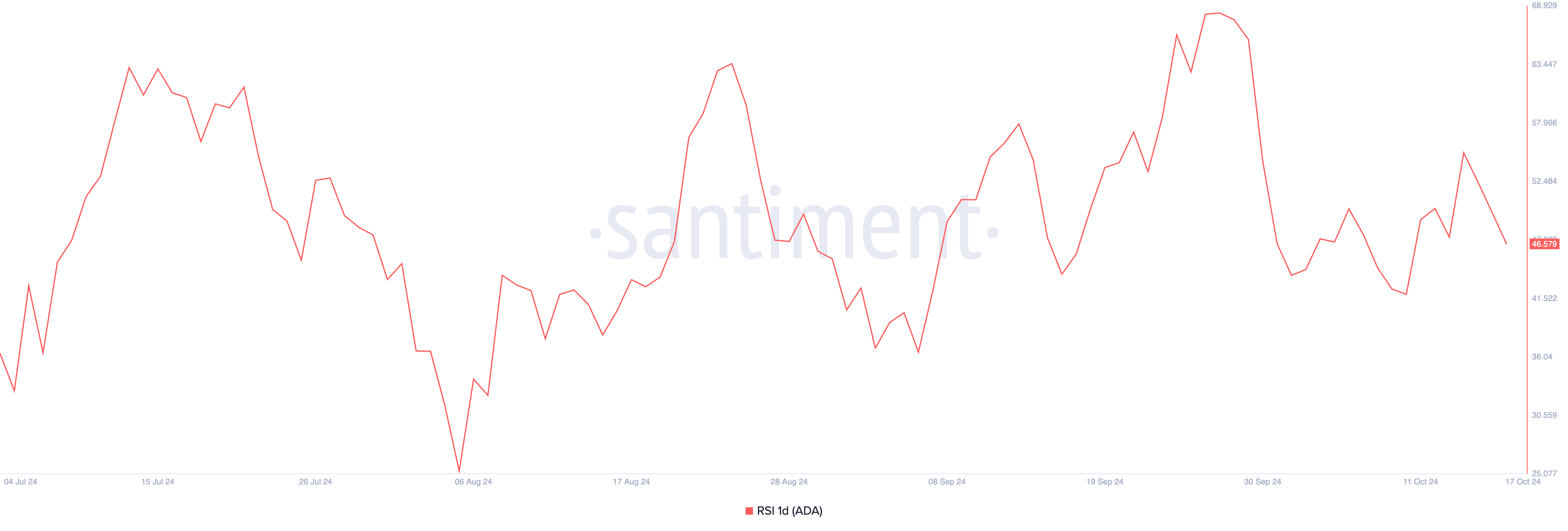

Cardano’s declining Relative Strength Index (RSI) supports this bearish outlook. At press time, this indicator is in a downward trend and below the 50-neutral line at 48.57.

This RSI value indicates that buying pressure is decreasing in the Cardano market, and sellers are becoming more dominant. Traders might interpret this as a warning that the price could continue to fall, causing them to sell more, thereby exacerbating the price decline.

ADA Price Prediction: Will It Drop 21% Over the Next Few Days?

Cardano is currently trading at $0.3469 and is testing the support level at $0.3479. A rise in selling pressure could lead to a breakdown of this support, potentially causing Cardano’s price to plummet by 21% to its August 5 low of $0.27.

Read more: Who Is Charles Hoskinson, the Founder of Cardano?

On the other hand, if buying activity picks up and ADA bulls can successfully defend this support line, the coin may initiate a bullish trend toward $0.47, a high it last reached in June.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.