BNB has posted a 5% gain over the past week, edging closer to its long-term resistance level of $598.90. As of this writing, the altcoin is trading at a seven-day high of $585.50 and appears ready to continue its upward momentum.

Technical indicators suggest a possible breakout above the $598.90 resistance, potentially pushing the price toward the four-month high of $652.90. This analysis explores how realistic this scenario is in the near term

Binance Coin Sees Growth in Bullish Momentum

At its current price, BNB is trading above its 20-day exponential moving average (EMA) and its 50-day small moving average (SMA).

An asset’s 20-day EMA measures its average close price over the last 20 trading days. It is a short-term indicator that reacts quickly to price fluctuations. On the other hand, the 50-day SMA is a longer-term indicator that tracks the asset’s average closing price over the past 50 days.

BNB’s one-day chart reveals that it broke above the 50-day SMA on October 4 and rallied past the 20-day EMA during the trading session on Tuesday. When an asset breaks above the 50-day SMA and subsequently breaches the 20-day EMA, it signals a shift in momentum toward a bullish trend.

Read more: How To Buy BNB and Everything You Need To Know

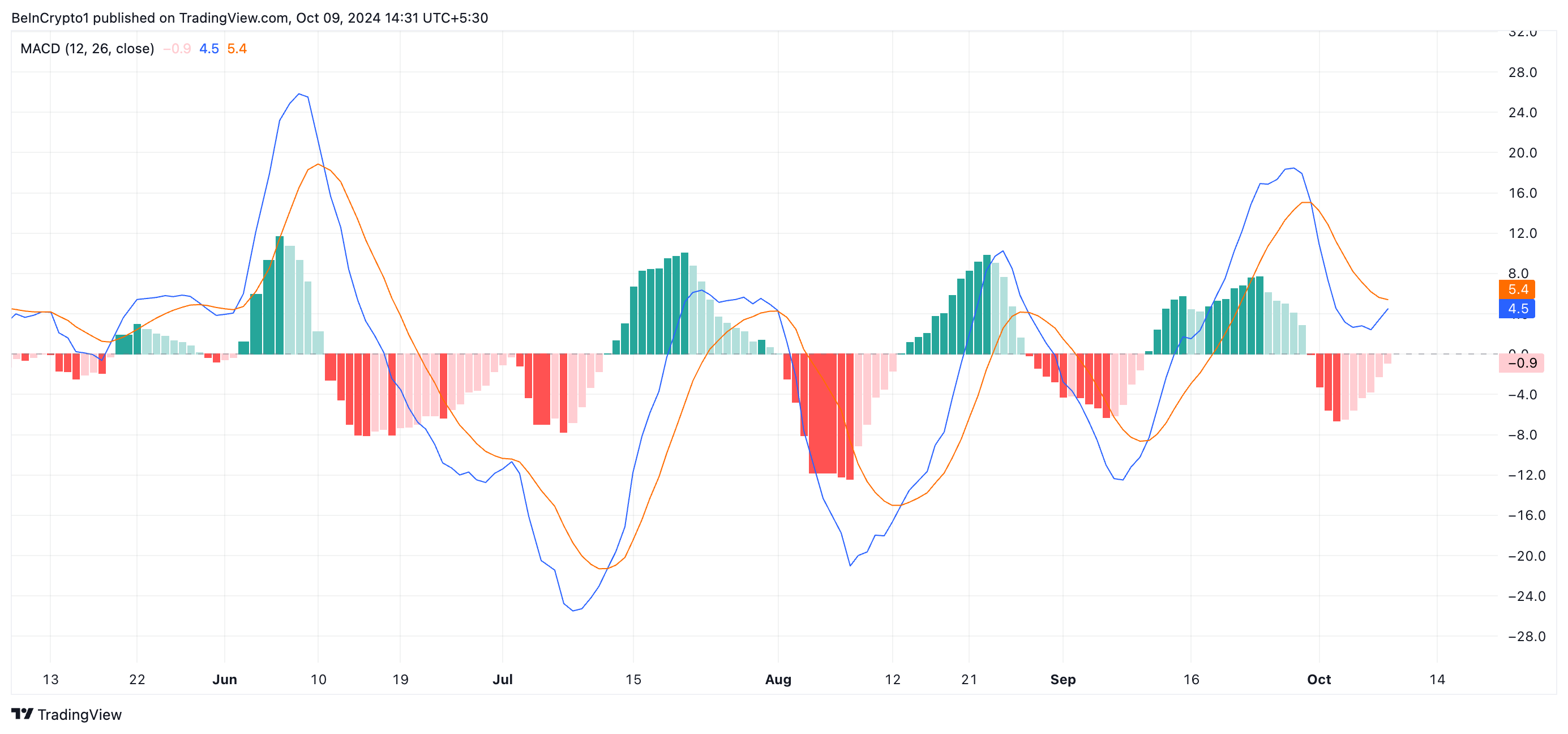

Furthermore, according to BNB’s moving average convergence/divergence (MACD) indicator, its MACD line (blue) is poised to breach its signal line (orange), confirming the bullish outlook.

When an asset’s MACD, which tracks its trend direction and potential price reversal points, is set up this way, it indicates strengthening upward momentum. It suggests that the asset could be entering a sustained bullish phase.

BNB Price Prediction: Coin May Reclaim All-Time High

Sustained demand for BNB coin could propel its price toward the long-term resistance level of $598.90. The altcoin has experienced significant selling pressure at this price point since June, with each attempt to rally beyond it failing.

If successful this time, it would pave the way for BNB’s price to reach $652.90, a high it last saw on June 19. A successful breach of this level would set it on a path to reclaim its all-time high of $721.80.

Read more: BNB Crypto Storage: Best BNB Wallets to Consider in 2024

However, if buying pressure diminishes, BNB’s price could lose its recent gains and drop to the support level of $522.90.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.