Cardano (ADA) price is currently showing signs of a potential consolidation phase as large transactions have surged and then stabilized over the past few weeks.

In the end of September, ADA saw a significant spike in large on-chain transactions exceeding $100,000. However, after this peak, large transactions steadily declined, signaling that major market participants may be cooling off their activity.

ADA Large Transactions Shows a Consolidation Phase

On September 26, ADA witnessed a significant spike in its number of large transactions, reaching a monthly high of 5,070. Large transactions refer to on-chain transfers with a value exceeding $100,000, and monitoring these transactions is essential for understanding market behavior, especially as they often involve institutional investors or major market participants.

These larger players can significantly impact price movements, and their activity provides key insights into market trends and liquidity. The increase in ADA’s large transactions on September 26 coincided with a positive price movement, where ADA’s price surged, reaching over $0.40 between September 26 and September 27.

This correlation suggests that the influx of high-value transactions may have contributed to or reflected a growing market interest in ADA during that period.

Read more: How To Buy Cardano (ADA) and Everything You Need To Know

However, after this peak, the number of large transactions started to decline steadily, dropping to 2,300 on October 6 and slightly recovering to 3,000 by October 7. This decrease in high-value on-chain activity could indicate a cooling-off period.

Without strong large-scale transaction activity, ADA might not be in a clear upward or downward trend, suggesting that market participants are waiting for new developments or clearer signals before making their next significant moves. This period of lower transaction volume could mean that ADA is in a holding pattern, with traders waiting for the next catalyst.

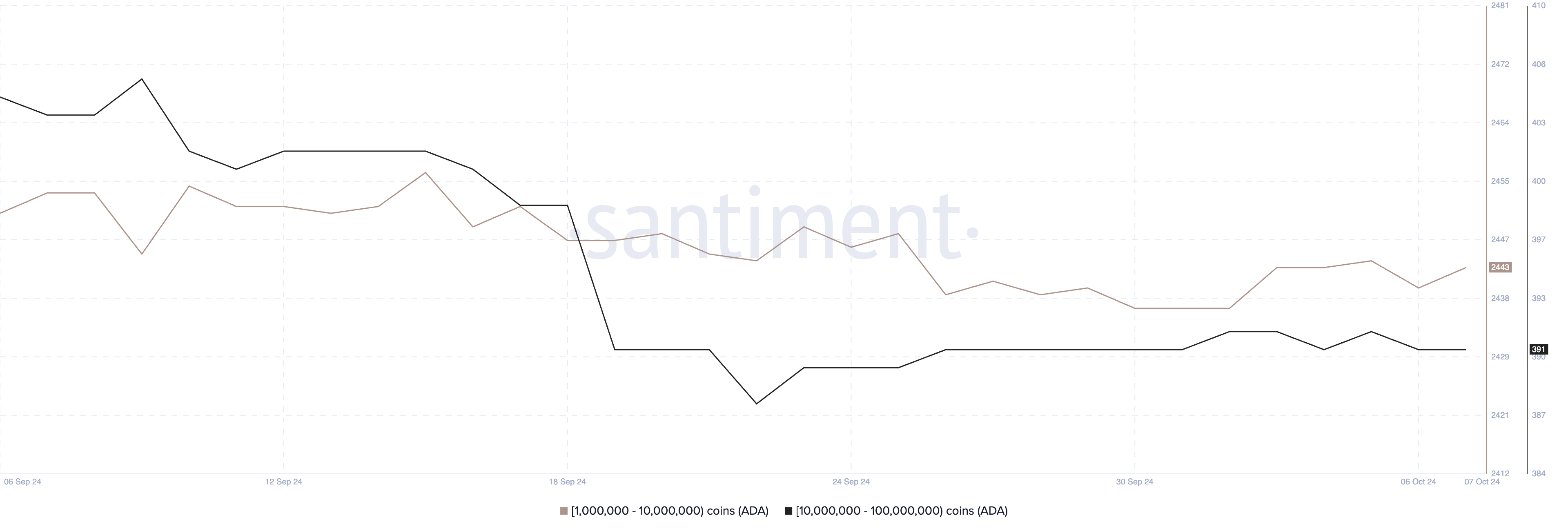

Cardano Whales Are Stable In The Last Few Days

Between September 6 and September 22, ADA whales reduced their holdings, with the number of addresses holding between 10 million and 100 million ADA dropping from 405 to 388. However, since September 22, the number of ADA addresses holding between 1 million and 100 million ADA has become relatively stable.

Currently, 2,443 addresses hold between 1 million and 10 million ADA, while 391 addresses hold between 10 million and 100 million ADA, signaling little change in their positions.

This stability indicates that ADA whales have halted their selling or buying activity, suggesting that they are in a wait-and-see mode. The lack of significant movement could imply that these large holders are waiting for clearer market conditions or signals before making their next moves, likely assessing whether to re-enter or continue reducing their positions.

This pause in whale activity often points to uncertainty, where major players prefer to stay on the sidelines, awaiting a more decisive market direction before acting.

ADA Price Prediction: Trend Direction Is Still Not Clear

ADA’s price chart is currently showing a mild downtrend, though it’s not particularly strong, as the EMA lines remain very close to one another. This closeness between the lines suggests that ADA could be entering a consolidation phase around the $0.34 level.

Exponential Moving Average (EMA) lines are key technical indicators that smooth out price data, giving more weight to recent prices. Traders commonly use EMA lines to identify trends. When EMA lines are close together, it typically indicates a lack of strong momentum in either direction, reinforcing the idea that ADA is in a period of consolidation.

Read more: Who Is Charles Hoskinson, the Founder of Cardano?

The ADA price has already broken a key support level at $0.34, signaling the possibility of further downside movement. If the downward trend continues, ADA could potentially head toward testing the next major support at $0.27.

This would mark a deeper correction in price if selling pressure increases. However, should a reversal to the upside occur, ADA would likely first test the $0.36 resistance level, followed by a challenge of the $0.41 level.

A move up to $0.41 would represent a potential 20% gain from its current price, offering an attractive target for traders if bullish momentum builds. The closeness of the EMA lines shows that the market is awaiting clearer signals before a stronger trend emerges in either direction.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.