FTX Token (FTT) price has faced a sharp downturn, losing 16% of its value in just 12 hours. This comes after a 92% rally over the past few days, fueled by optimism surrounding FTX’s asset compensation plan. Investors initially reacted positively, but sentiment quickly shifted.

The Delaware District Bankruptcy Court’s approval of FTX’s plan prompted many to lock in profits, putting downward pressure on the token’s price. This volatility seen in FTT’s price suggests that short-term market moves are being driven by speculative trades.

FTX Token Holders Turn Bearish

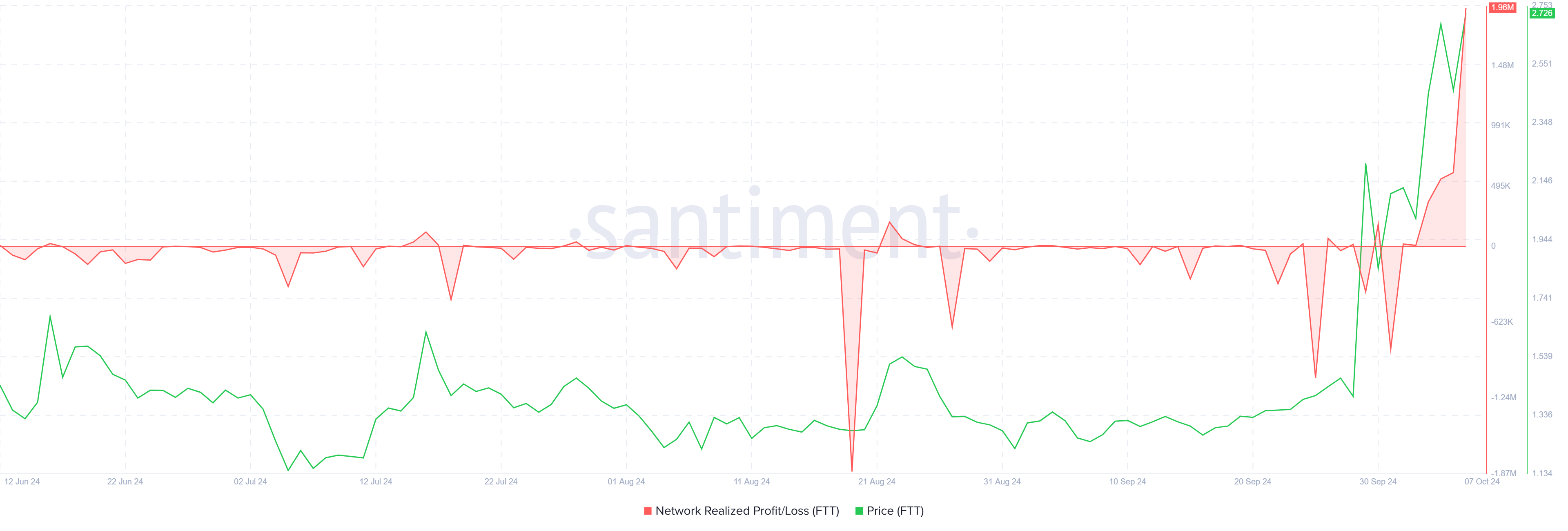

Realized profits for FTT holders have spiked significantly in the last 24 hours as many rushed to sell their holdings. The rally, once driven by speculation over asset compensation, has now turned into a wave of profit-taking.

Even though FTX’s assets have not yet been distributed among creditors, FTT holders are preemptively cashing out, fearing that the compensation plan may not be as favorable as initially hoped. This selling pressure has led to a dramatic drop in the token’s value.

The price drop signals a broader shift in investor sentiment. With many locking in their gains, the market has turned bearish.

The anticipation that the FTX compensation plan would provide substantial relief to token holders initially fueled the rally, but skepticism has since overtaken the market. As a result, the ongoing sell-off could push FTT prices lower, especially if the broader cryptocurrency market remains volatile.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

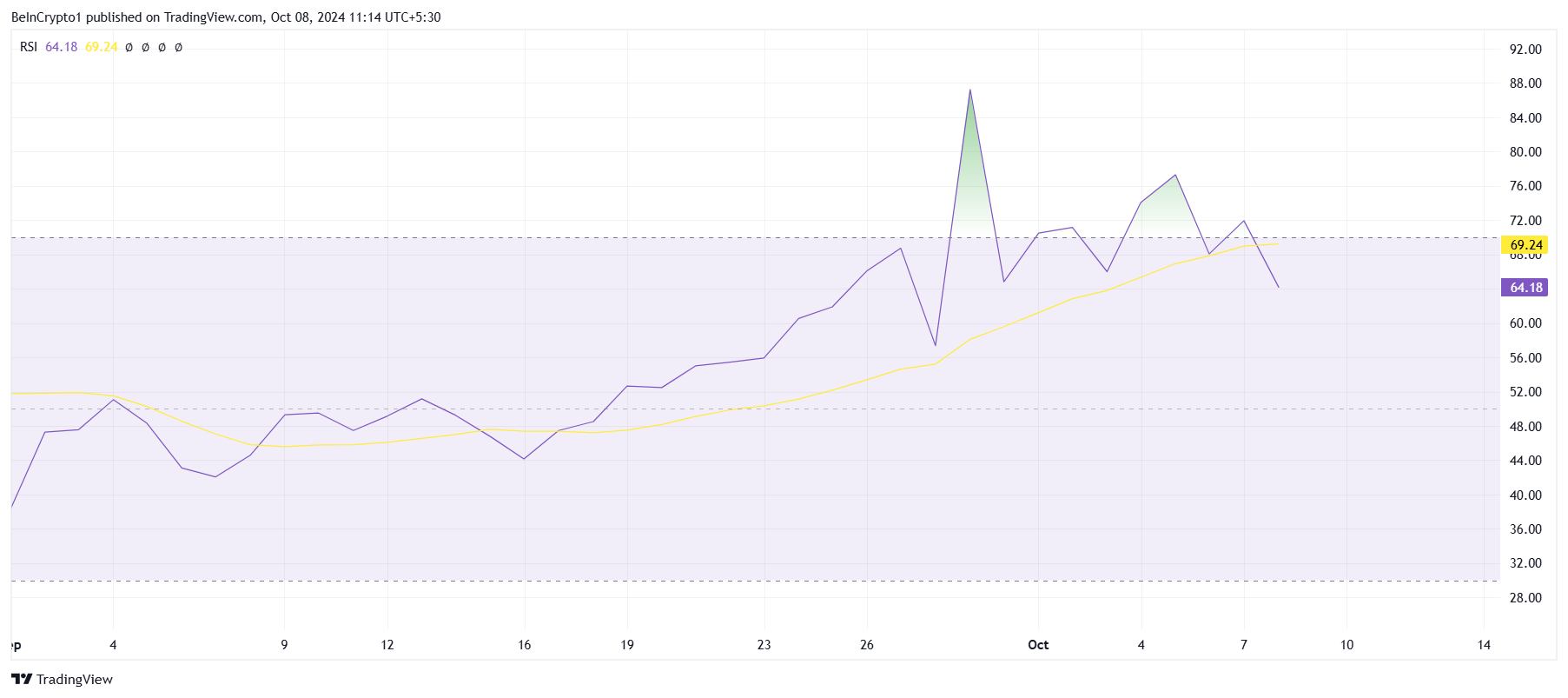

On a macro level, the overall momentum for FTT is beginning to weaken. Technical indicators like the Relative Strength Index (RSI) suggest a reversal in trend.

The RSI, which had previously reached the overbought zone, is now falling back, indicating that the bullish phase may be coming to an end. This shift could mark the beginning of a bearish downtrend, particularly as more investors look to secure their profits.

Additionally, FTT’s high volatility signals that further price fluctuations are likely. The massive intra-day price swings show that traders are actively responding to news and market developments. Given the broader market uncertainty, investors should prepare for continued price instability in the short term.

FTT Price Prediction: Support Ahead

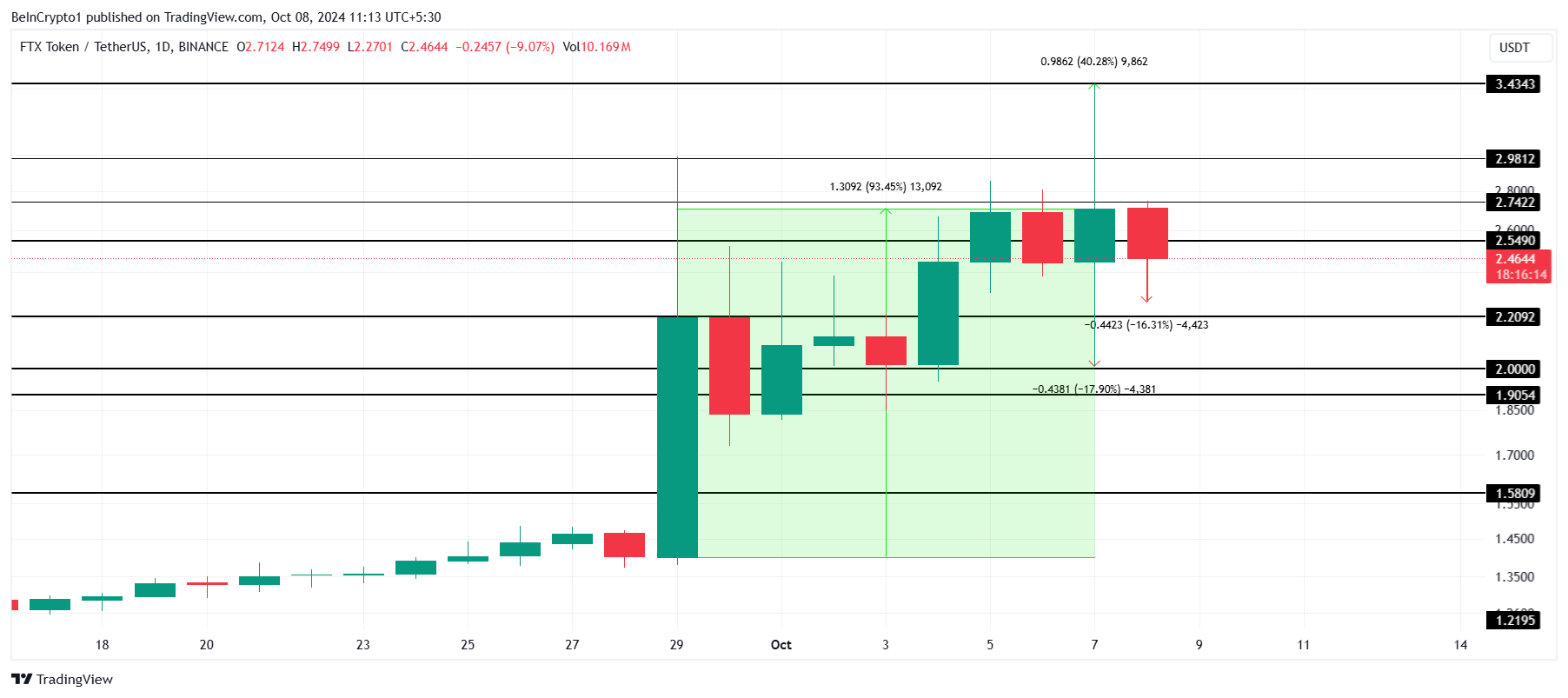

FTT experienced a 93% surge over the last few days, driven by speculation around FTX’s asset compensation plan. However, investor sentiment turned from bullish to skeptical as the court hearing approached. This shift led to the token’s recent sell-off, as holders feared potential downsides in the plan’s execution.

In the past 12 hours, FTT’s price plummeted by 16%, with the token now trading at $2.46. The price whiplash on Tuesday, where FTT rose 40% intra-day only to crash 17%, highlights the high volatility in the market. Such erratic price behavior may continue as investor sentiment fluctuates.

Read more: Who Is John J. Ray III, FTX’s New CEO?

Looking ahead, FTT could continue its downtrend, possibly testing the support level at $2.20. However, if bullish momentum returns, the token could recover, potentially rising to $2.74. Breaching this level would invalidate the bearish outlook, offering a renewed sense of optimism for FTT holders.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.