Bittensor (TAO) has seen significant bullish momentum recently, pushing its price above the $600 mark.

This ongoing rally follows a breakout from a bullish pattern that had been developing for three months, starting in mid-September. TAO is now nearing validation of this pattern, with the potential for further gains ahead.

Bittensor Has Solid Support

The market sentiment around Bittensor is extremely positive, as evidenced by the surge in Open Interest over the last 24 hours. Open Interest, which measures the combined value of all open contracts in the futures market, hit an all-time high of $180 million. This influx of trader inflows signals strong confidence in TAO’s price potential as more market participants place bets on the asset’s continued rally.

The rise in Open Interest is typically viewed as a bullish indicator. With capital flowing into TAO futures contracts, the market appears to believe that the rally is far from over. This heightened interest could help sustain upward momentum, pushing the price further and validating the bullish pattern in play.

Read More: Top 9 Safest Crypto Exchanges in 2024

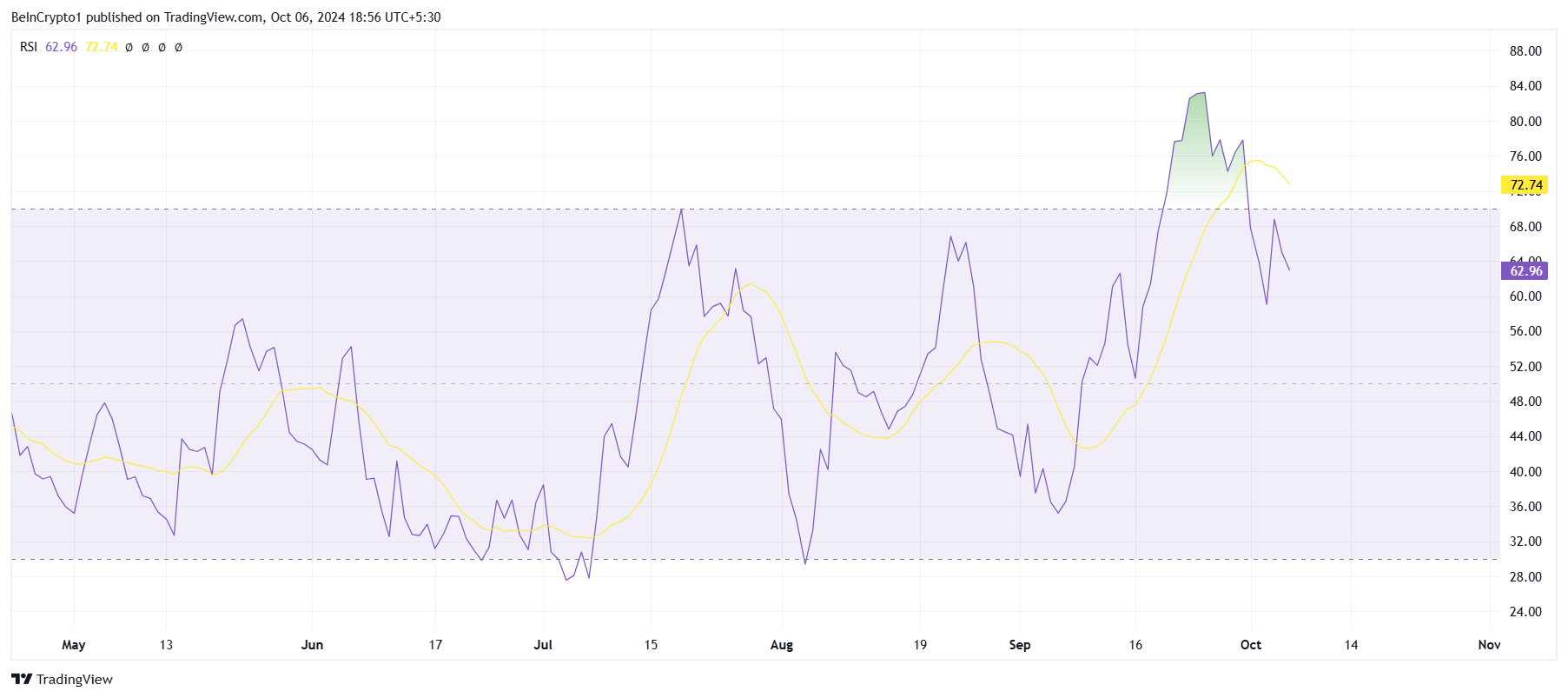

From a macro perspective, Bittensor’s technical indicators suggest that the rally could continue. The Relative Strength Index (RSI), used to gauge the strength of price trends, is currently holding in the bullish zone. While the RSI previously entered the overbought territory, over 70.0 in September, it has since cooled off slightly while remaining well above neutral levels.

This positioning indicates that while some overbuying pressure has been alleviated, the bullish momentum remains intact. The RSI’s current reading suggests that TAO still has room for further gains, reinforcing the broader market sentiment that the price increase could continue.

TAO Price Prediction: Stretching Arms

TAO is currently trading at $554, nearing the $642 target set by the bullish ascending triangle pattern that has formed over the last four months. This pattern suggests a potential 79% price rise upon breakout; a target TAO is approaching.

The combination of strong market sentiment and technical indicators supports this bullish outlook. If TAO can breach $642 and maintain $600 as a support, the rally is likely to continue, further validating the bullish thesis.

Read More: How To Invest in Artificial Intelligence (AI) Cryptocurrencies?

However, failure to breach this key resistance could trigger profit-taking among investors. In such a case, TAO could see a drawdown of $492. If this support level is lost, the bullish outlook would be invalidated, and the price might fall further to $418.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.