A recent move by a large Solana (SOL) whale to unstake and sell their holdings on Binance has raised concerns about the sustainability of the token’s ongoing price rally. The whale’s actions are particularly significant because, in past instances, similar sales have led to double-digit price drops in SOL.

Will history repeat itself, or will retail trading be enough to sustain the current price rally? This analysis offers insights.

Solana Whale Sells For Gains

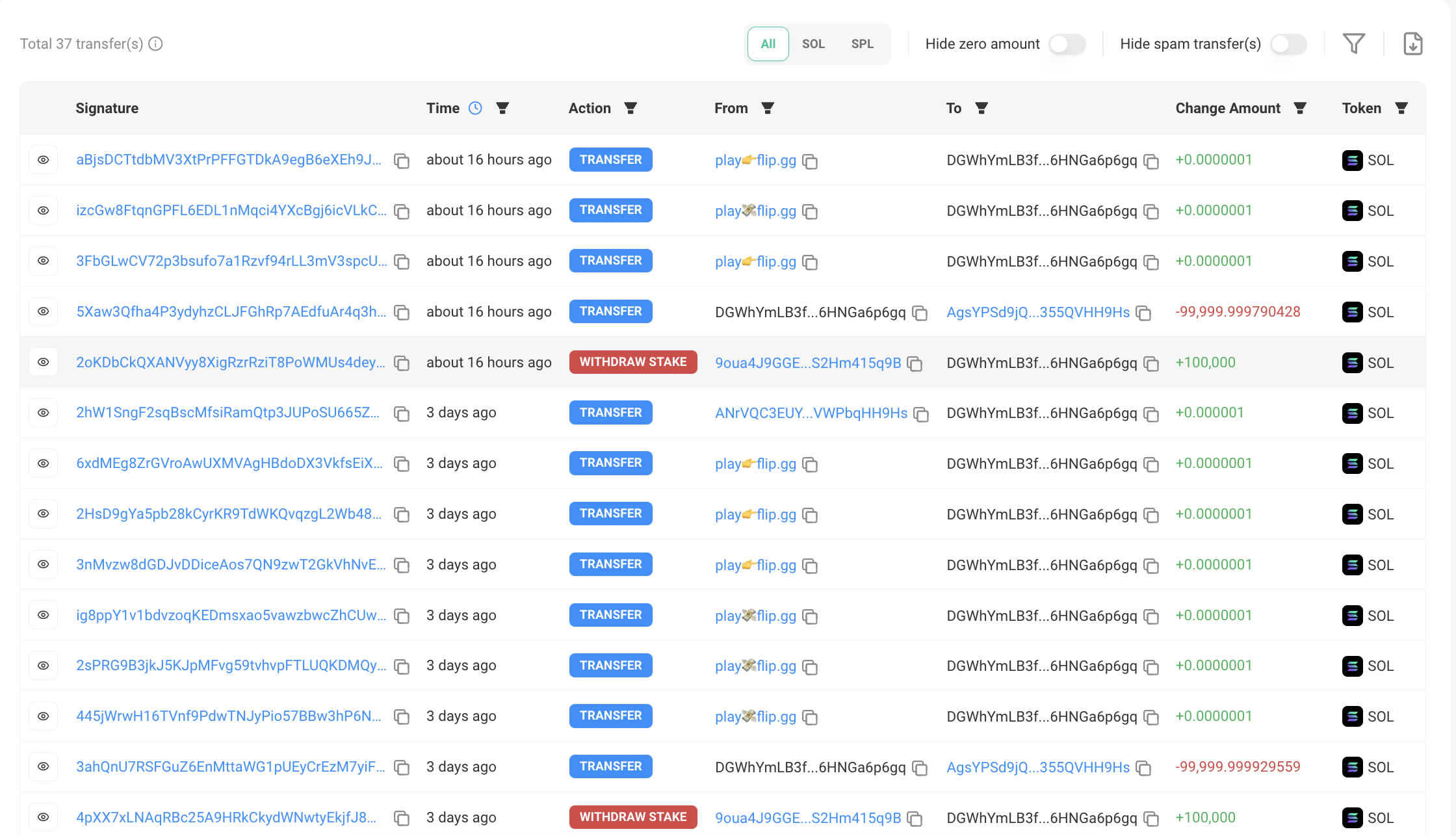

Data from Solscan shows that the Solana whale unstaked 100,000 SOL tokens 15 hours ago and transferred them to leading cryptocurrency exchange Binance. This comes just three days after the same investor unstaked 100,000 SOL tokens and transferred the assets to the same exchange.

Read more: 6 Best Platforms To Buy Solana (SOL) in 2024

The whale’s decision to unstake and move its SOL holdings to Binance may have been fueled by the desire to profit from the altcoin’s current price rally. Trading at $151.88 at press time, Solana’s price has climbed by 9% in the past seven days.

However, this price momentum may face resistance if the whale continues liquidating its holdings. Historically, this whale’s sales have significantly impacted SOL’s price, as seen between June 7 and July 7 when they dumped 1.2 million SOL worth $178 million, causing the price to drop from $170 to $128.

Despite this, bullish indicators still dominate. The Parabolic Stop and Reverse (SAR) indicator, with its dots below SOL’s price, signals a strong upward trend. Additionally, the Chaikin Money Flow (CMF), currently at 0.27, indicates high buying pressure, suggesting that the market’s bullish bias toward Solana remains intact, at least for now.

SOL Price Prediction: The Whale Versus Other Holders

Sustained buying pressure from other market participants may offset the impact of the Solana whale’s actions. If this buying momentum continues, SOL’s price could rise toward resistance at $160.09. A successful breach of this critical resistance level would pave the way for SOL to trade at $188.74.

Read more: Solana (SOL) Price Prediction 2024/2025/2030

However, if the whale persists in liquidating its holdings for profits, history may repeat itself. In that scenario, Solana’s price could drop by 27%, trading around $110.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.