Telegram’s tap-to-earn game Catizen has launched its token, CATI, which is now available for trading on Binance and other major exchanges.

As part of Season 1’s distribution, 150 million tokens were airdropped to users following a two-month delay.

Citizen CATI Token Available for Trading

Trading for CATI tokens, which run on TON blockchain, began at 6 a.m. ET on Friday. On Thursday, users could start registering CATI deposits in non-custodial wallets, and at 6 a.m. ET today, eligible participants received tokens based on their game activity, according to the development team.

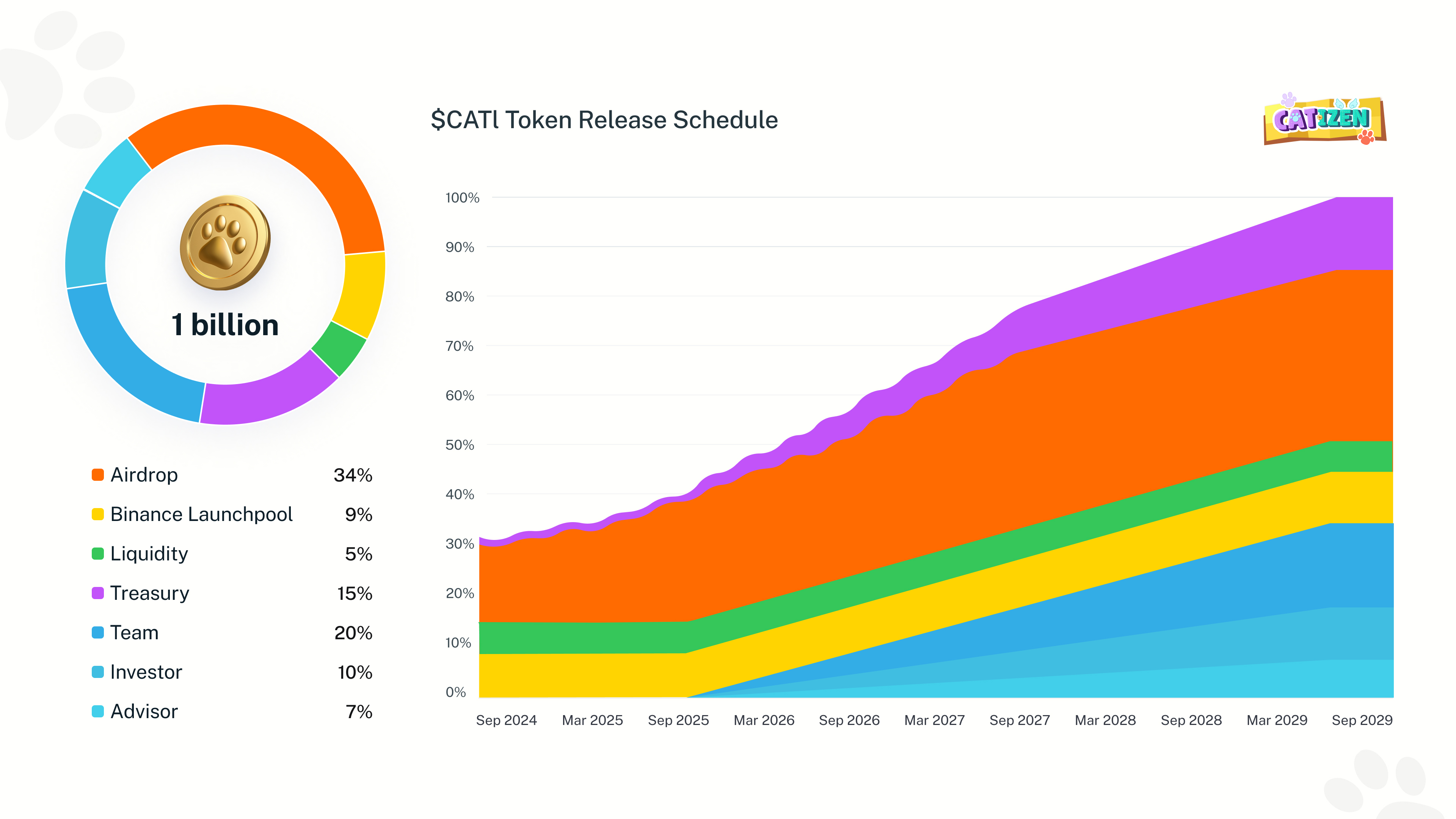

A total of 340 million CATI have been set aside for airdrops, with 190 million still to be distributed in quarterly campaigns. Pluto Studio, the developer behind Catizen, started the airdrop process on September 14, allowing players to view their token allocations. Users were also able to claim and stake CATI tokens on select exchanges before the official token generation event on Friday.

Some players remained frustrated with the allocation, expecting a larger distribution. The eligibility criteria for some players also faced criticism.

“There will be a total of 19 seasons. Each season will last 90 days. The community will receive 1% per season. We’ll be playing your game for 5 years just to get 19% of CATI — this feels incredibly unfair,” one X user wrote.

Read more: What Is Catizen?

The team has set aside 5% of the remaining CATI supply for liquidity and allocated 15% to the treasury. They assigned another 20% to the team, 10% to investors, and 7% to advisors, all under a 12-month cliff and a 48-month release schedule.

Catizen claims over 39 million users in total, with 18 million active monthly users. According to Telegram CEO Pavel Durov, the game brought in more than $16 million in revenue from in-app purchases in July.

“Catizen introduced millions of people to blockchain, because it uses TON-based smart contracts for its in-game rewards. Their team also built tools for other developers to easily launch their games on Telegram and TON. Well done, Catizen team,” he wrote.

Unlike other Telegram-based games, Catizen features unique mechanics: instead of just tapping the screen to earn coins, players manage a virtual cat café. Visitors come to interact with the cats, and players earn money in return.

Read more: How to Play Catizen: A Step-by-Step Guide

The project’s team has committed to donating 1% of Catizen’s revenue to charity. In August, they contributed to “People for the Ethical Treatment of Animals” (PETA) to support homeless cat rescues. According to BeInCrypto data, CATI is currently trading at $0.92.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.