On September 4, Pepe (PEPE) was priced at $0.0000070. As of now, the meme coin has seen a slight increase, trading at $0.0000072.

However, despite hopes for a continued upswing, on-chain analysis indicates that the bounce may be short-lived, with several factors pointing to potential challenges in sustaining the rally.

Pepe Activity Drops, Loses Liquidity to NEIRO

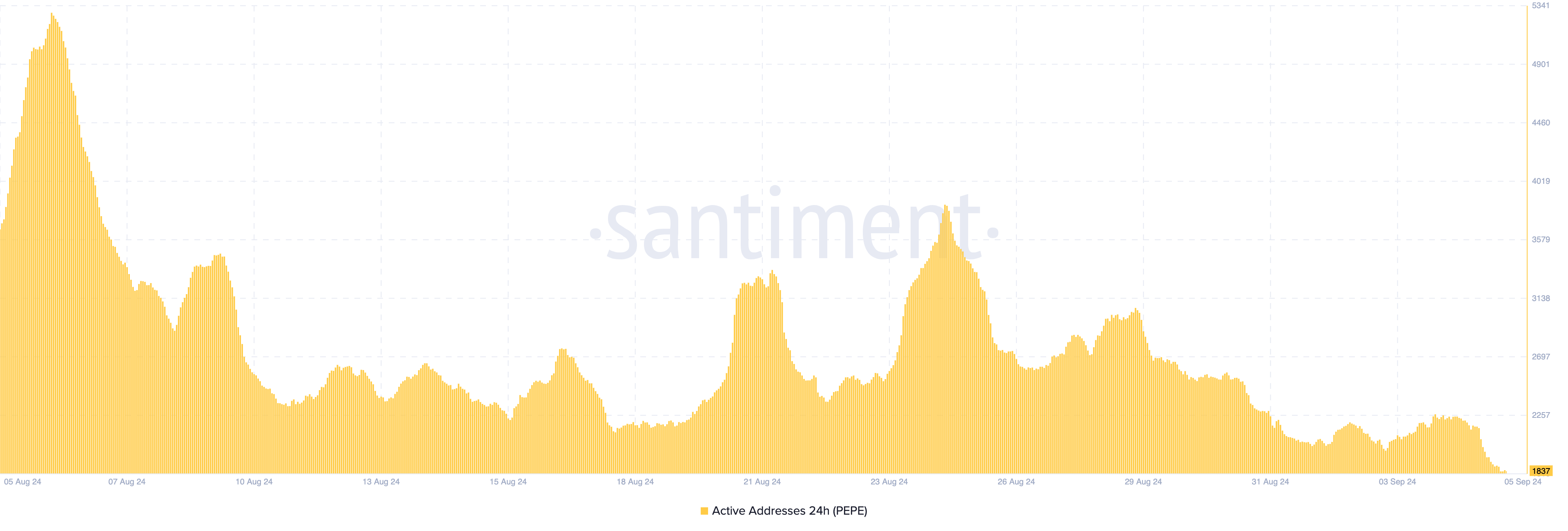

First, Pepe’s active addresses, which hit an impressive peak in the first week of August, have been down to their lowest since February. The active addresses metric is a crucial indicator of any cryptocurrency project as it measures the level of user interaction.

When it increases, it means market participants are actively transacting, which could be a bullish sign. A decrease, on the other hand, is usually not a great sign, as a lack of user participation could foster a stagnant price action or decrease.

For the token, this notable drawdown could stifle the recent recovery efforts. Besides this, the frog-themed meme coin seems to be playing second fiddle to NEIRO, another meme coin on Ethereum that burst into the limelight recently.

Read more: 5 Best Pepe (PEPE) Wallets for Beginners and Experienced Users

Specifically, while the crypto’s price is moving sideways, NEIRO recorded a staggering 87% increase in the last 24 hours. This disparity suggests that liquidity that PEPE had previously enjoyed could be moving to the Dogecoin-inspired cryptocurrency.

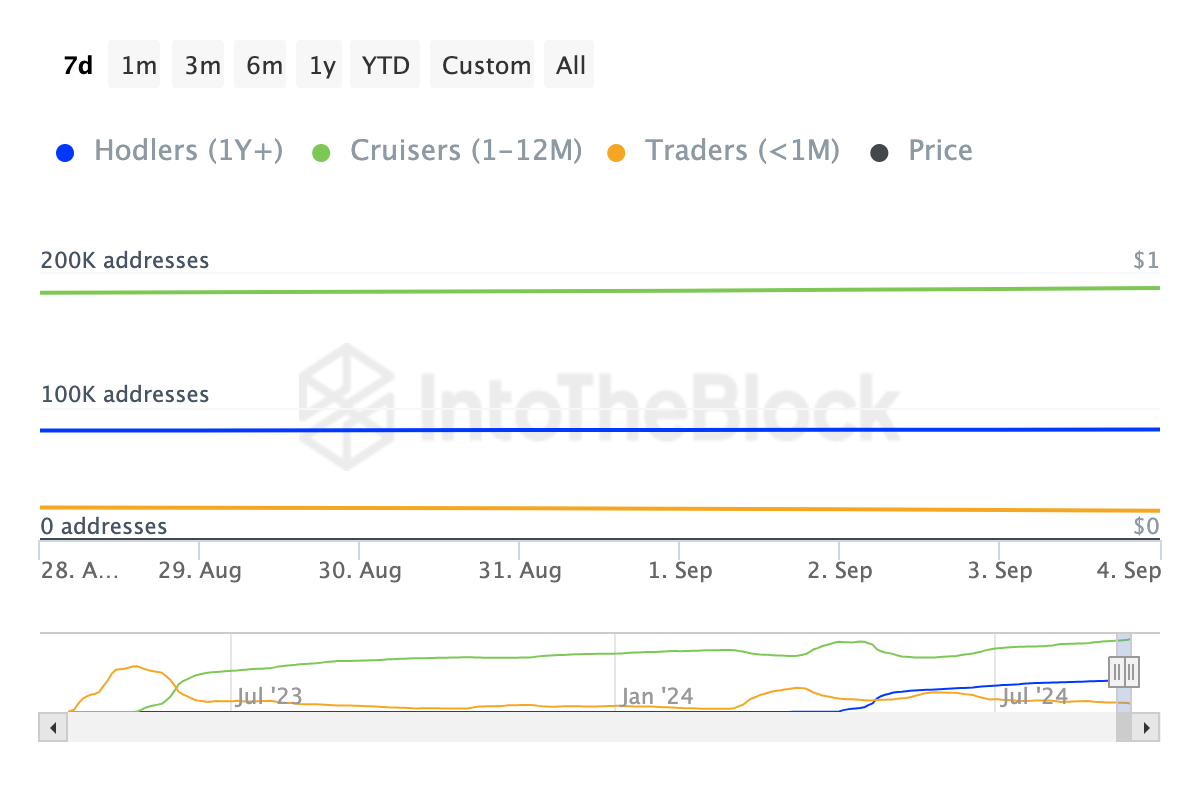

Furthermore, the Addresses by Time Held metric reinforces this sentiment. Based on IntoTheBlock’s data, the number of addresses that have held the token for the last 30 days has decreased by 20%.

Usually, when this metric increases, it means the short-term holders are buying. Therefore, this decline implies that this cohort might have pitched their tent somewhere else as PEPE’s price underperforms.

PEPE Price Prediction: $0.0000069 Looms Again

Technical analysis of the daily chart shows that PEPE formed a head-and-shoulders pattern. This pattern is bullish to bearish and suggests that an uptrend is nearing its end. As seen in the image below, a notable resistance seems to be around $0.0000077 near the left and right shoulders.

Thus, if the cryptocurrency approaches this trendline, it could encounter an obstacle that halts its upward movement. Once this happens, the price might pull back.

Read more: Pepe (PEPE) Price Prediction 2024/2025/2030

Looking at the chart above, if this thesis comes to pass, PEPE could drop to $0.0000069. However, if the token rises above $0.0000077, the analysis would be invalidated. In this case, the meme coin’s price could increase to $0.0000079, with a potential target of $0.00000897.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.