Ethereum (ETH) price is exhibiting both positive and negative signals, with the latter coming from investors.

The positive sentiment, however, comes from the market, which hints at the right conditions for accumulation.

Ethereum Investors Have an Opportunity

Following Ethereum’s price drop, along with the rest of the market, a wave of panic set in. The 8.3% drop in the last 24 hours significantly impacted investors as they moved to sell.

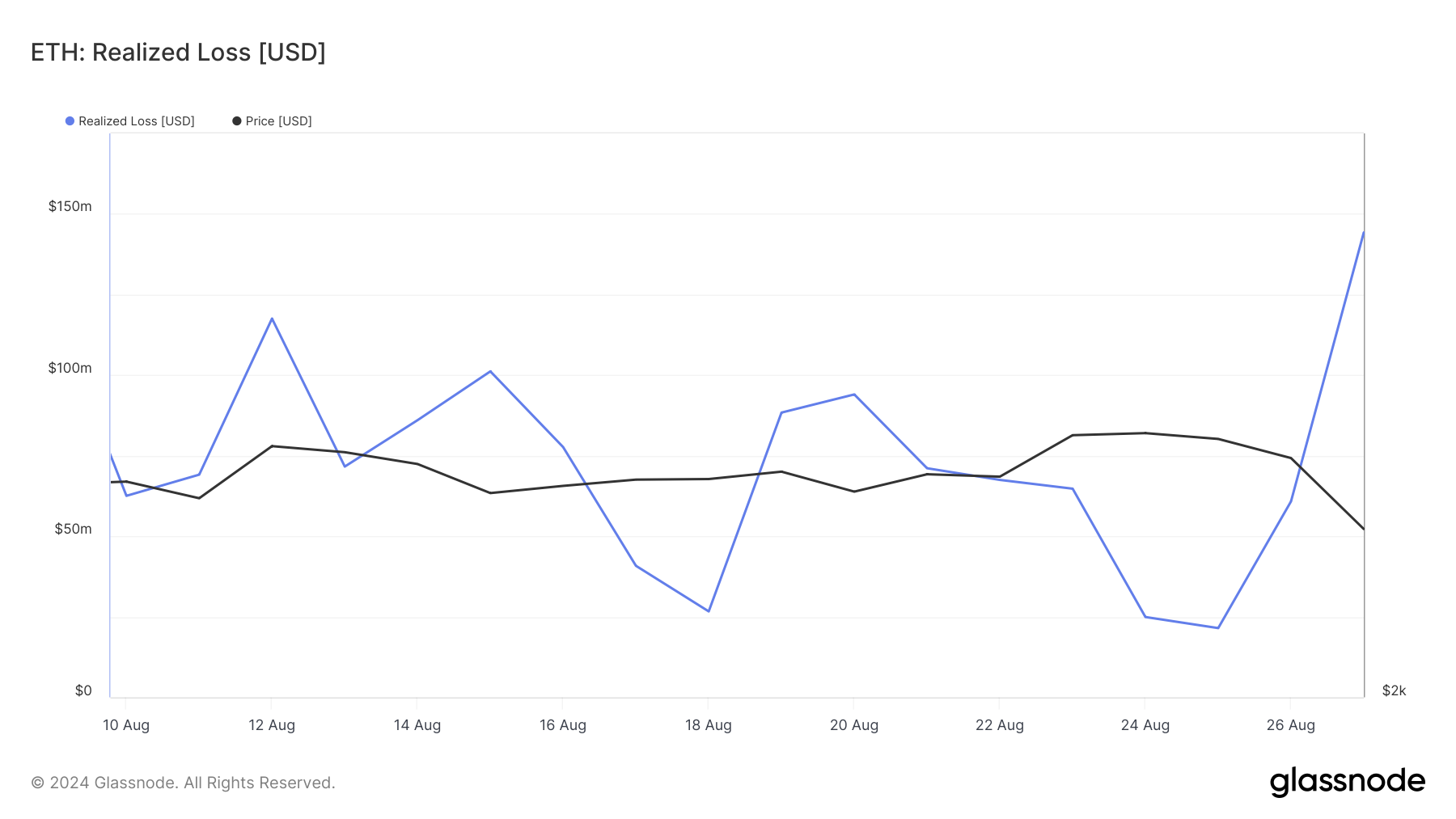

According to the Realized Loss Indicator, over $144 million worth of ETH was sold within a day. The indicator measures the total losses arising from the ETH sold in the last 24 hours.

This attempt was not to secure gains but to offset losses, and as it appears, investors still faced losses.

This panic selling, however, does not encapsulate the sentiment of the broader market. The $144 million losses represent only 0.65% of ETH’s 24-hour trading volume of $22.03 billion.

Read more: How to Invest in Ethereum ETFs?

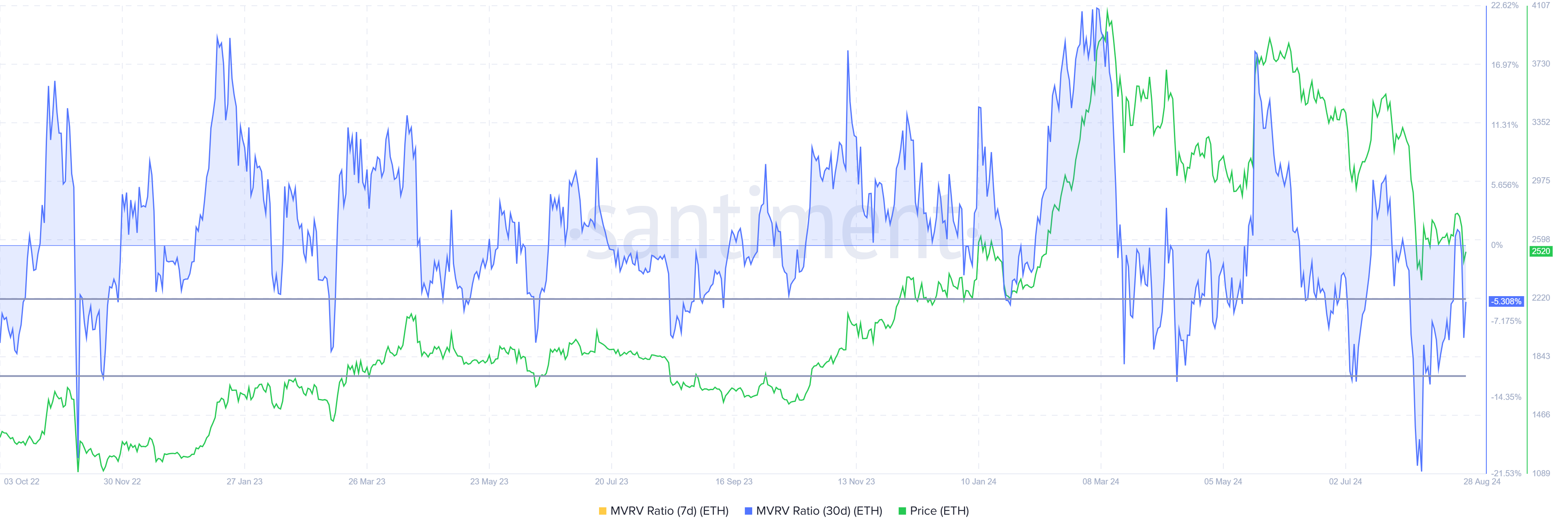

In fact, this drawdown was more of a bullish signal than a bearish one, as noted by the Market Value to Realized Value (MVRV) ratio. The MVRV ratio assesses investor profit and loss throughout the indicator’s measurement.

Currently, Ethereum’s 30-day MVRV stands at -5.3%, indicating losses and possible buying pressure. Investors who bought their ETH in the past month are now facing 5% losses, which could lead to a change in sentiment.

Historically, ETH MVRV between -5% and -12% usually signals the start of rallies and recoveries, marking it as an accumulation opportunity zone. Thus, Ethereum’s price could note a reversal if the buying pressure kicks in.

ETH Price Prediction: Barrier Up Ahead

Ethereum’s price is currently at $2,525 after falling through the supports of $2,681 and $2,546. These levels have provided a solid cushion for ETH, preventing drawdowns throughout August.

In the last 12 hours alone, ETH has recovered by 2.7%, bringing it closer to the support of $2,546. Once tested as support, it will enable a rise beyond $2,681 and place ETH on track to continue recovering the 30% losses of the July crash after reclaiming $3,000.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

On the other hand, since ETH has rigorously tested the area between $2,681 and $2,546 as a consolidation zone, it could be repeated. This would delay the recovery and intensify panic selling, invalidating the bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.