Toncoin’s (TON) price is in a short-term uptrend, which is a bullish scenario for the Telegram coin.

The rising demand is also turning traders optimistic, and their changing stance could bring about considerable profits.

Toncoin Is Looking at Gains

Toncoin’s price could continue its uptrend and even breach the month-high resistance at $7.07. This is a key price level as it has been rigorously tested as both resistance and support. But at the moment, breaching it is crucial as it could significantly change the investor’s portfolio.

According to the Global In/Out of the Money (GIOM) indicator, investors bought 803 million TON between $6.16 and $6.85. Currently, the altcoin is changing hands at $6.52, standing close to breaching the upper limit of the range.

Doing so would make this supply, worth over $5.2 billion, completely profitable, triggering demand and a rally.

Read more: 6 Best Toncoin (TON) Wallets in 2024

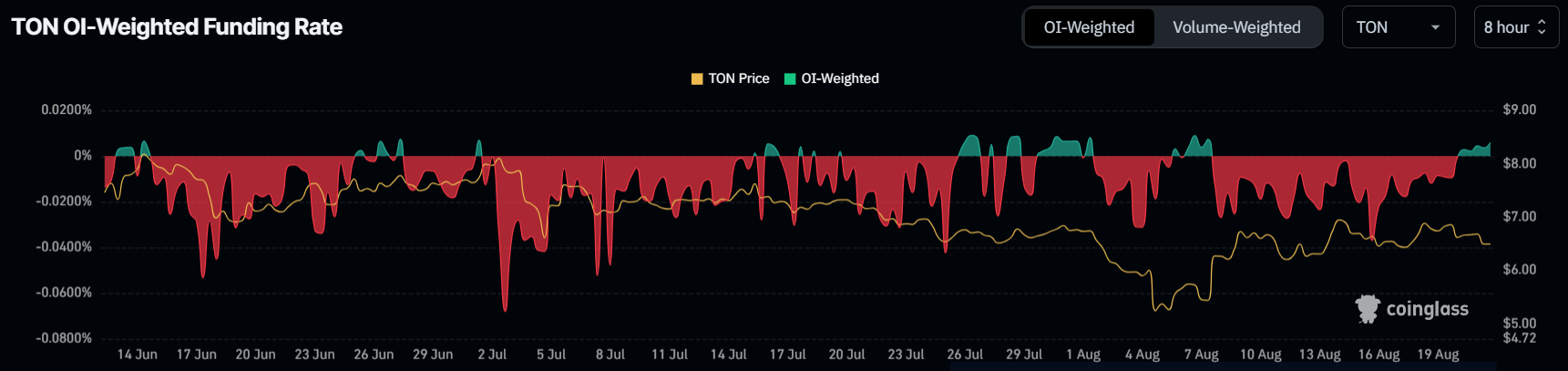

Investors are becoming optimistic about a rise, as visible in the altcoin’s funding rate. The funding rate is turning positive for the first time in two weeks, marking a significant shift in market sentiment. This change suggests that traders are becoming more optimistic, with the cost of holding long positions now outweighing shorts.

This positive funding rate indicates that long contracts are beginning to dominate the market. As traders increasingly favor upward price movements, this shift could signal the potential for a bullish trend in the near future.

TON Price Prediction: Up up, All the Way

Toncoin’s price could continue its ongoing incline as the gradual recovery is painting a path to rally. Plus, the demand could be reinstated once TON crosses the $7.07 resistance.

This would enable a rise to $7.53, an untested level since mid-July. Flipping it into support would allow Toncoin to travel upwards and potentially breach the all-time high of $8.28.

Read more: What Are Telegram Bot Coins?

On the other hand, a failed breach of $7.07 would send the altcoin into consolidation within this resistance and $6.43 support. Losing the uptrend could invalidate the bullish thesis, extending the investors’ wait for profits.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.