Ethereum (ETH) price could benefit from investors’ change in outlook as they move from selling to potentially buying.

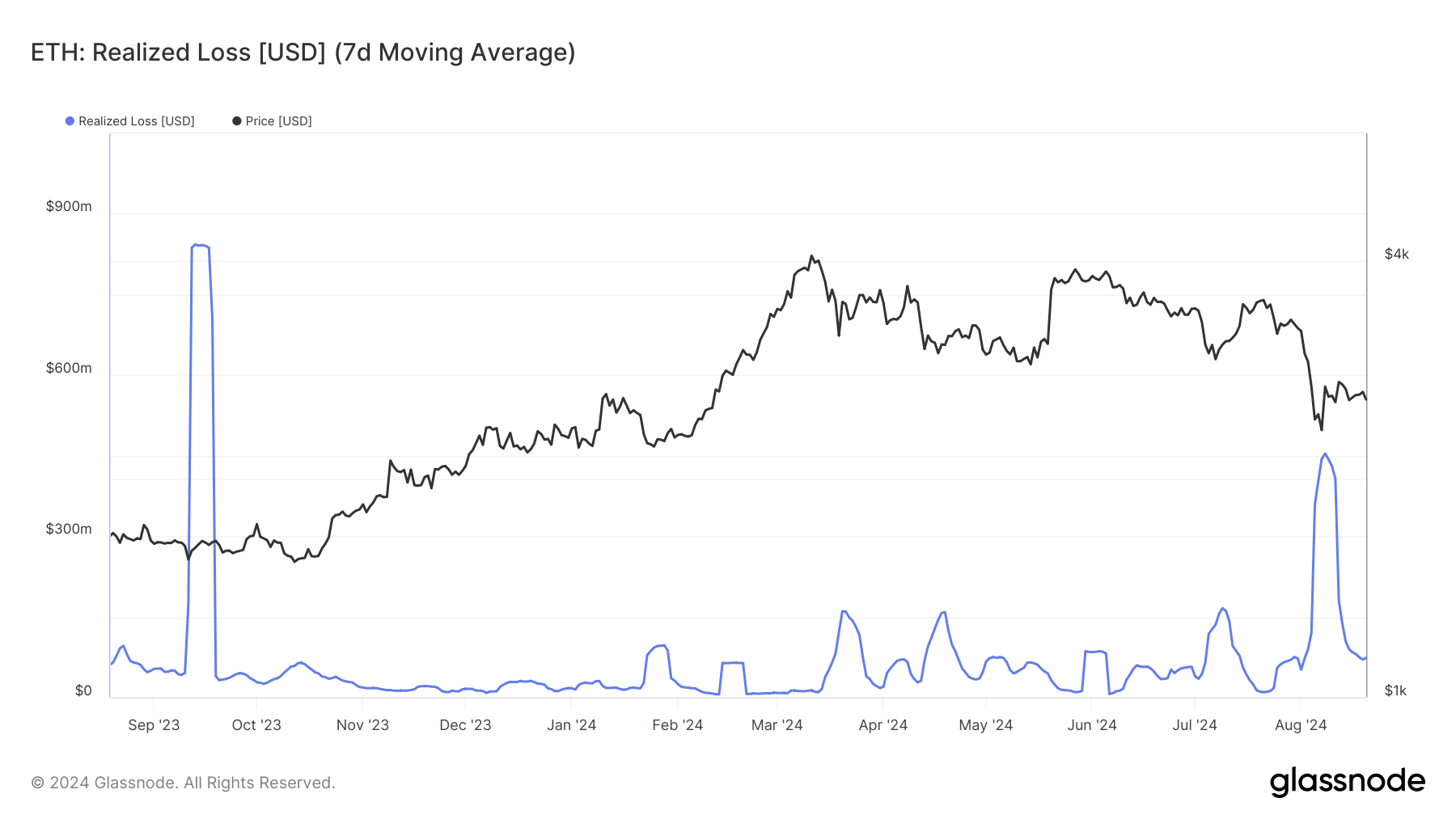

The indications arise from the drop in realized losses, which were at an 11-month high less than two weeks ago.

Ethereum Investor Confidence Could Be Rising

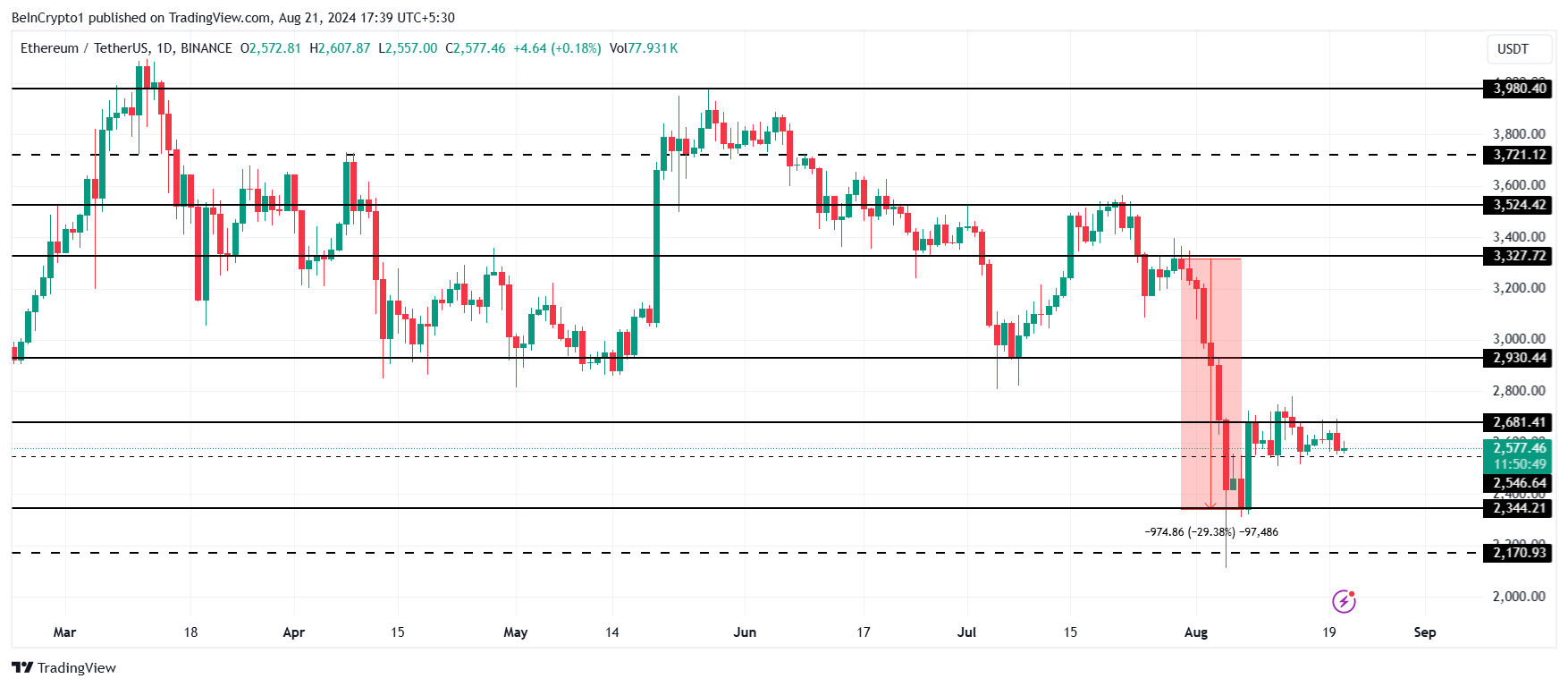

Ethereum’s price could come back from the lows of $2,500 it is currently hovering around. Consolidated under $2,681, the altcoin king has been looking for a breakout, which could come soon.

The reason behind this is the halt in selling. Looking at the realized losses faced by ETH holders in the last three weeks, it can be noted that the July crash created panic. This led to sudden offloading, resulting in sharp losses.

Read more: How to Invest in Ethereum ETFs?

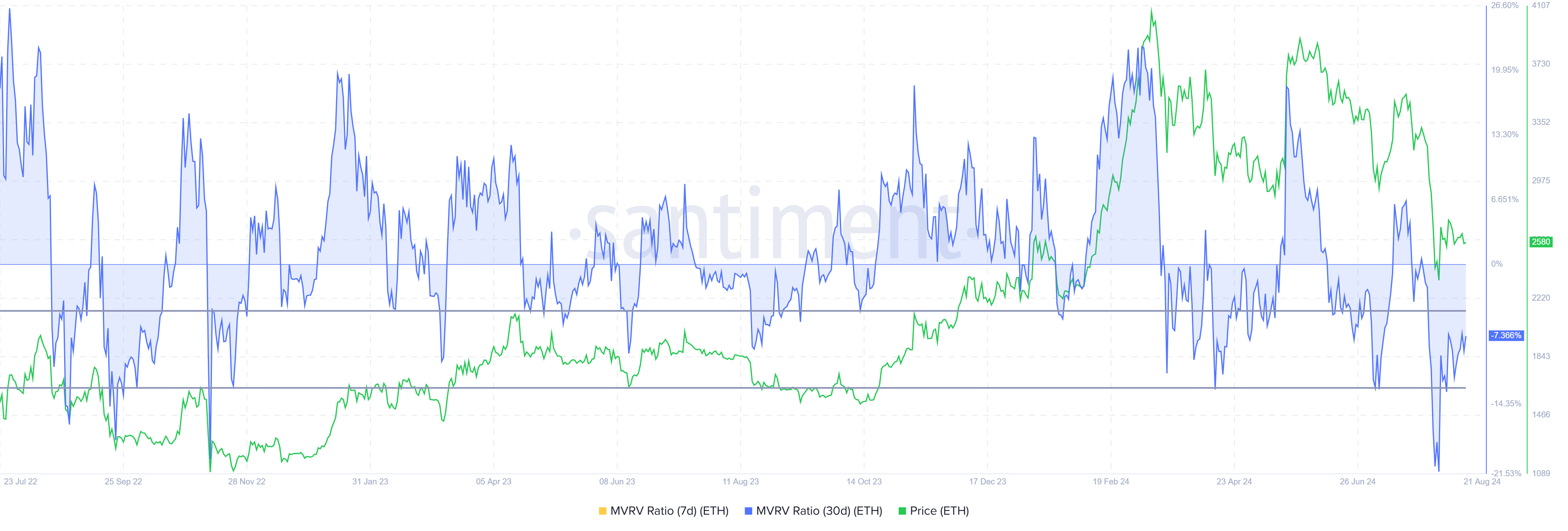

But this has changed considerably in the last ten days, as the price recovered slightly and reinstated the hope of a rise. This is a bullish sign, and the Market Value to Realized Value (MVRV) ratio further fuels this signal.

If ETH holders move to accumulate from here, Ethereum’s price recovery could gain strength.

ETH Price Prediction: Close to Breaking Out

Ethereum’s price at $2,577 is currently stuck moving sideways between $2,681 and $2,546. This short-term consolidation has been holding ETH for the last two weeks.

However, the aforementioned factors point towards a potential breakout from this consolidation. This breach could send ETH rallying toward the next resistance at $2,930, and a rise above this will push ETH to $3,000. A bounce off this resistance could send Ethereum’s price to $3,300, and reaching this point would signal a complete recovery from the July crash.

Read more: Ethereum (ETH) Price Prediction 2024/2025/2030

However, if Ethereum’s price fails to breach $2,930, it could enter another consolidation above $2,681. Prolonged sideways action could invalidate the short-term bullish thesis.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.