Bitcoin’s (BTC) dominance, the metric that gives a sense of the coin’s value relative to other cryptocurrencies, reached a yearly high of 57.70% on August 9. This happened as BTC’s price recovered from its earlier slip below $50,000.

However, at press time, BTC.D, as it is commonly called, has dropped, driving speculation that altcoin season could be close.

Bitcoin Dominance Weakens Despite Its Recent Milestone

Altcoin season is a short period when 75% of the top 50 non-BTC cryptos outperform the number on cryptocurrency. For this to happen, Bitcoin dominance has to drop, and the TOTAL2 market cap must consistently increase.

TOTAL2 is the sum of the market cap of the top 125 altcoins. At press time, Bitcoin dominance has fallen to 56.95% while the TOTAL2 has increased to $890.18 billion.

A few months ago, many altcoins, led by Ethereum (ETH), saw double-digit price increases. However, the rally was short-lived. Additionally, the launch of spot Ethereum ETFs has not delivered the anticipated results, particularly as the TOTAL market cap remains below $1 trillion at press time.

Read More: 7 Best Crypto Exchanges in the USA for Bitcoin (BTC) Trading

More notably, Bitcoin’s price has dropped below $60,000, currently trading at $58,188. This decline has reignited discussions, especially on X, with many speculating that altcoin season could be approaching.

For instance, crypto trader Zen opined that this week could be bullish for altcoins as long as BTC trades between $53,500 and $60,800.

“This week might be bullish for alts. At least against $BTC. For that scenario to be valid Bitcoin should stay more or less stable within 53.5-60.8k range,” Zen wrote on X.

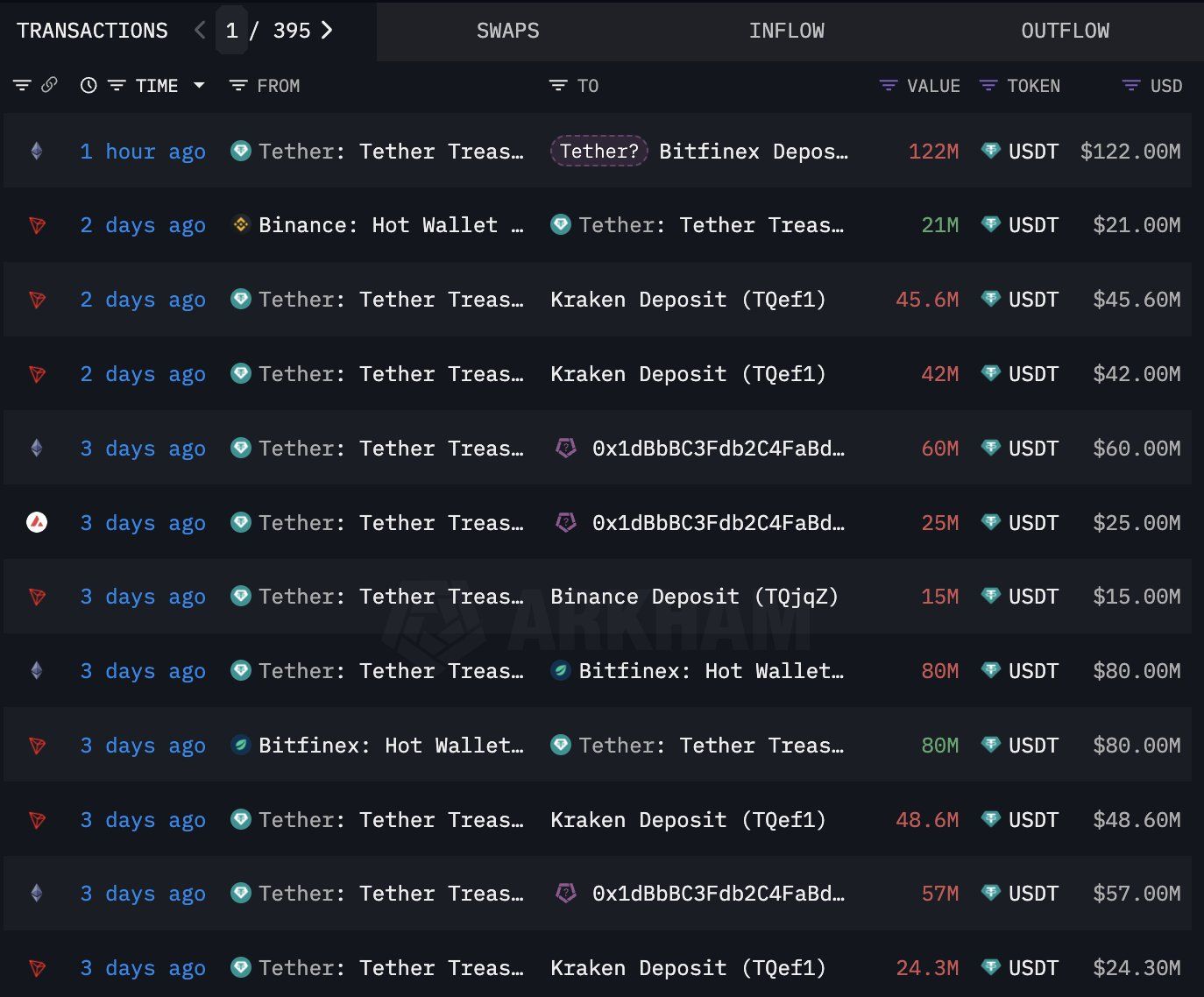

Furthermore, recent events suggest that Zen’s opinion may be valid. According to Lookonchain, institutions whose buying power has been vital to BTC’s price have refrained from buying the coin.

This is happening despite institutions having access to a large number of stablecoins just days ago. If these institutions stop accumulating, Bitcoin’s dominance could decline even further.

Alt Season Set to Take the Lead?

Meanwhile, the TOTAL2 daily chart shows that it is breaking out of the descending trendlines. As seen below, the value hit a series of Lower Lows (LL) between May and early August.

For context, a lower low occurs when a cryptocurrency’s price falls to a new low below its previous one, signaling a continued downtrend. However, at press time, the altcoin market has reached a Lower High (LH), indicating that a significant uptrend could develop if this momentum persists.

Read More: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

However, if Bitcoin bulls come into the picture with another round of accumulation, the prediction may be invalidated, and altcoin season may not come to pass.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.