Like many altcoins, Binance Coin (BNB) did not escape Monday’s market bloodbath as the price nearly slid below $400. Two days later, the altcoin’s value has increased and is close to retesting the psychological $500 region.

However, as the coin attempts to reach this landmark, it finds itself at a critical juncture that could either confirm or nullify the prediction.

Crucial Test Ahead for Binance Coin

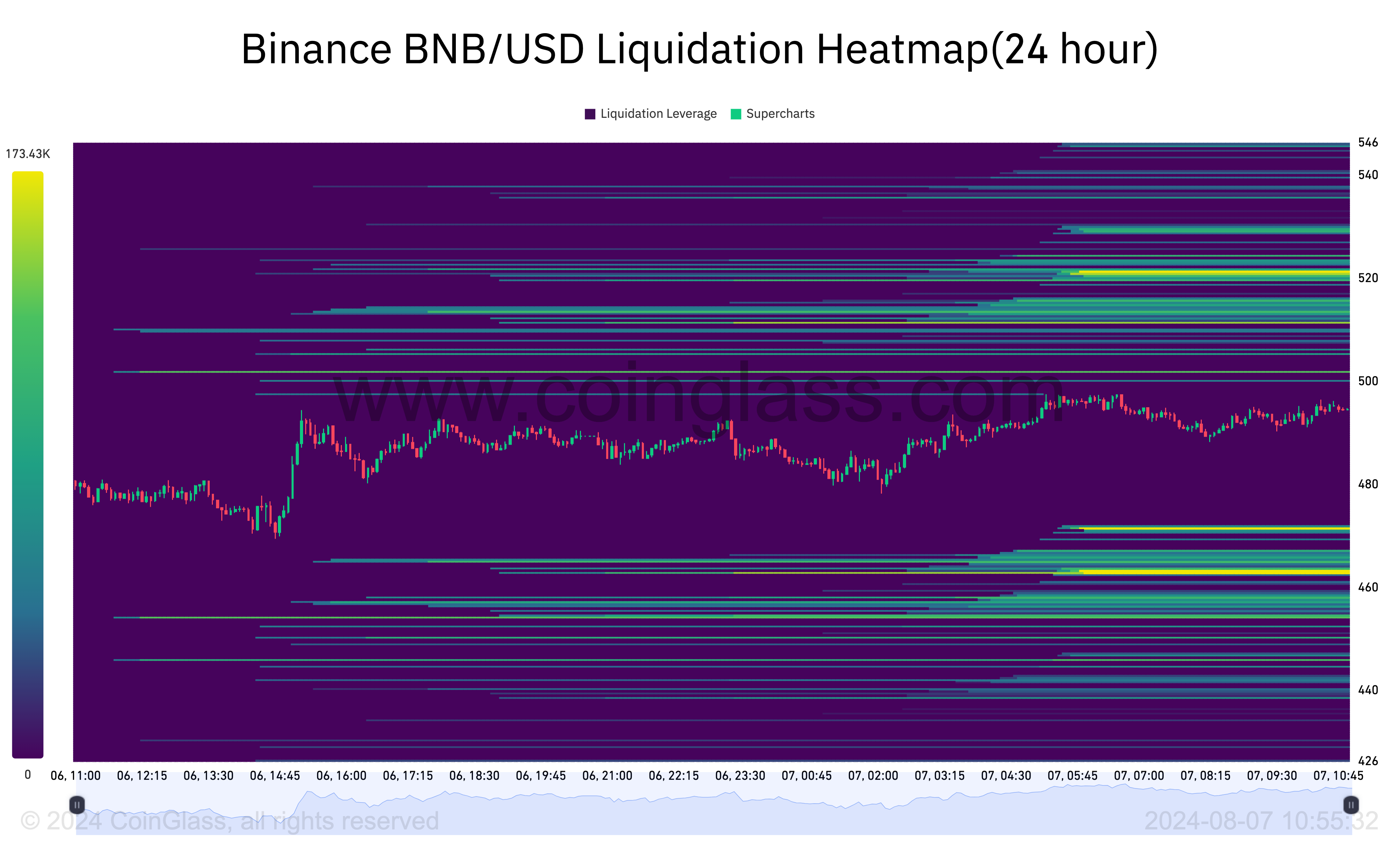

According to the liquidation heatmap, a high concentration of liquidity is located at $520.65, and another one is at $463.23. In simple terms, the heatmap spots price levels where large-scale liquidations may occur.

As more liquidity enters a price range, the colors change from purple to yellow. Typically, when there is high liquidity at a level, the price tends to move in that direction either as support or resistance.

On the upside, BNB’s price may increase to $520 if buying pressure increases. However, rejection, as the price moves upwards, could see the coin draw down to $463.23.

Read more: How To Buy BNB and Everything You Need To Know

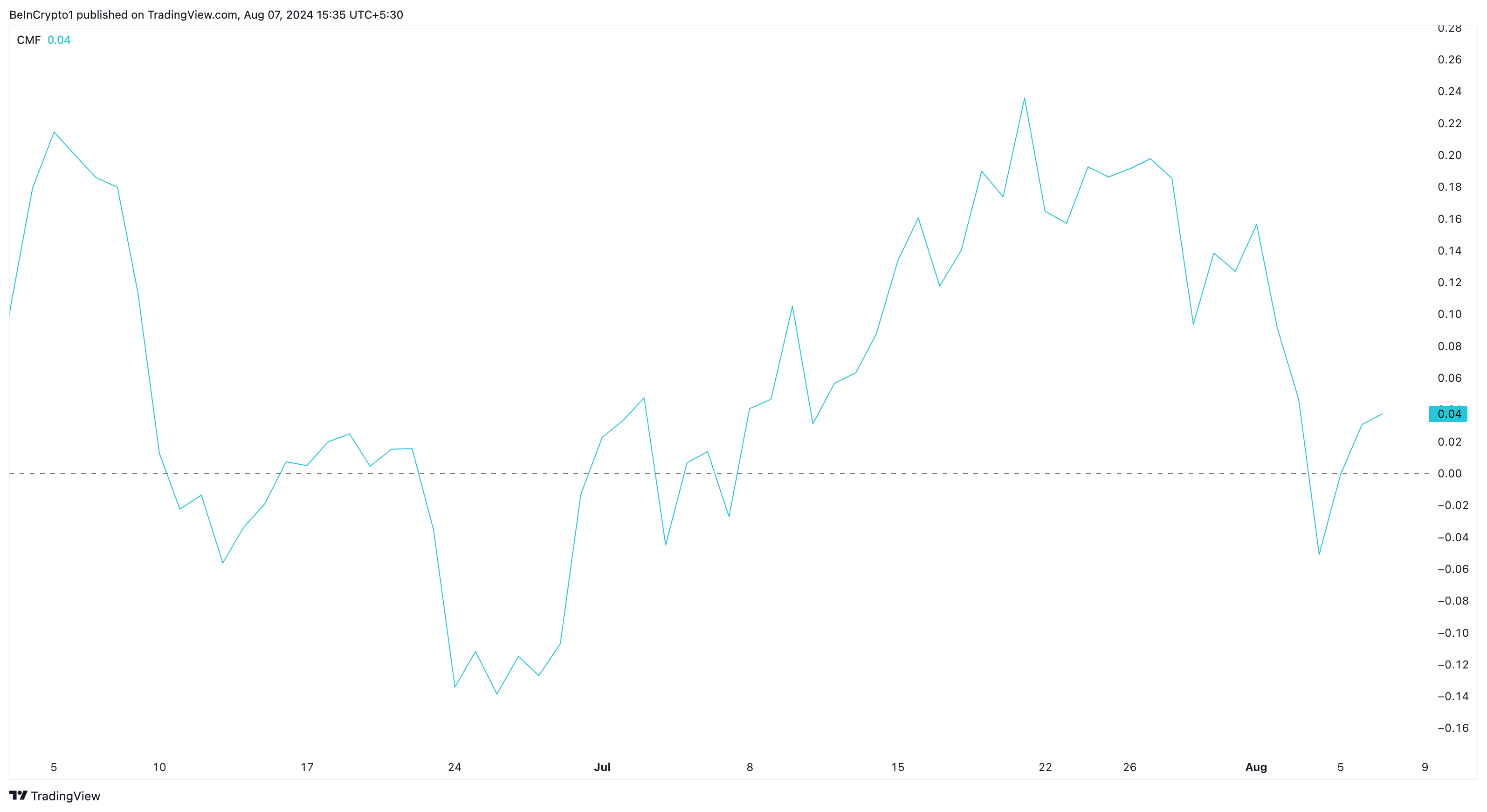

However, a look at the Chaikin Money Flow (CMF) shows that the price trend favors an upswing. CMF shows whether a cryptocurrency is experiencing net accumulation or distribution.

Using a volume-weighted approach, accumulation is higher than distribution if the reading is above the zero line. A negative rating indicates that market participants are distributing more than they are accumulating.

As seen below, the CMF on BNB’s daily chart is 0.04, indicating that investors have accumulated a higher volume than those that have distributed it.

Should this continue, BNB’s price may be able to retest $500 and probably near $520 in the coming days.

BNB Price Prediction: Dynamics Favor Consolidation

According to the daily chart, bears seized control of the BNB price from July 31 up until August 5. However, bulls have countered the steep 31% correction with aggressive buying, leading to a notable recovery.

Despite the bullish potential, the Moving Average Convergence Divergence (MACD) remains in the negative region. The MACD measures momentum and helps traders spot price trends, exit, and entry levels/

If the reading is positive, momentum can be termed bullish and could drive a continuous upswing. This negative divergence between the MACD and BNB’s price suggests that the uptrend is not strong. If this remains the case, BNB could keep swinging sideways and probably trade between $478.60 and $490.

Read more: Binance Coin (BNB) Price Prediction 2024/2025/2030

However, a surge in buying pressure could change things and give the coin the upper hand in reaching the overhead resistance positioned at $524.60. Meanwhile, another flash crash could see the coin price drop as low as $404.30.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.