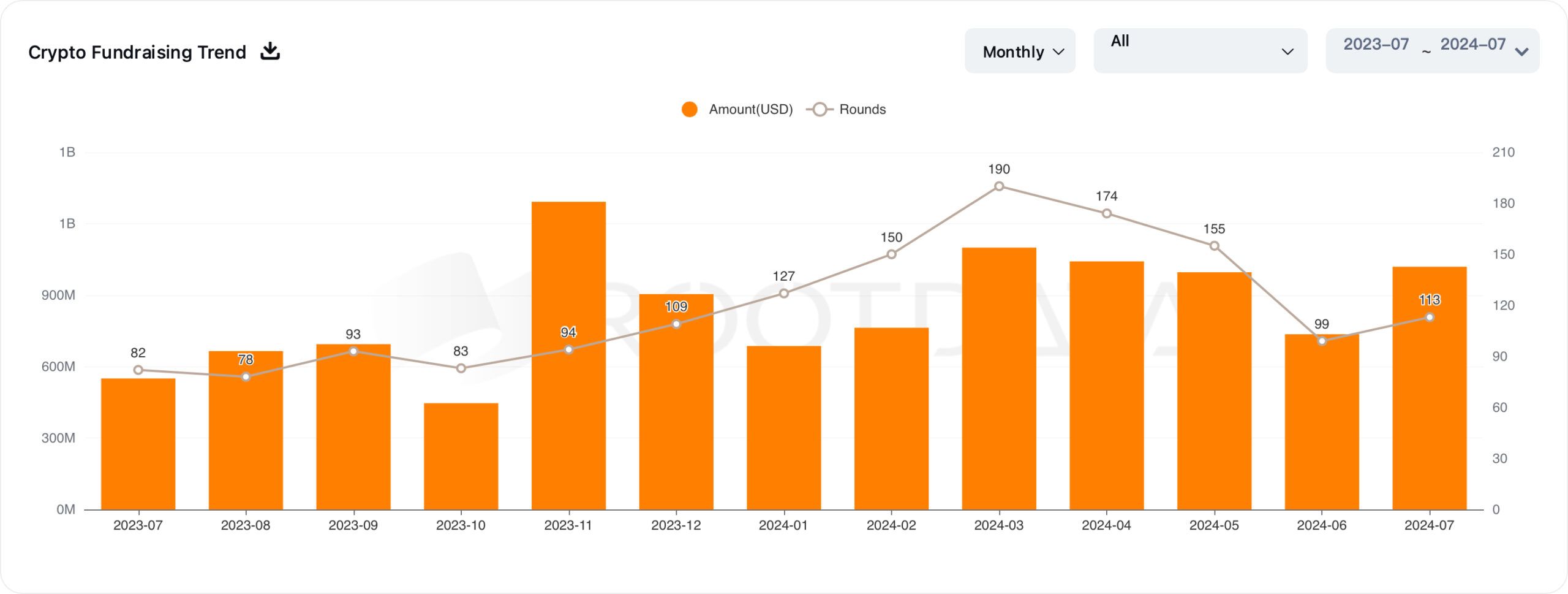

The fundraising activity witnessed a notable shift in July. RootData shows 113 publicly disclosed crypto venture capital investments, a 12% increase from June’s 99.

Total investment value hit surpassed $1 billion, significantly exceeding June’s $735 million.

Crypto VC Investments Increase in July

Venture capital activity is often used to gauge major investors’ interest in the crypto market. Recent data maintains a positive growth trajectory when viewed year over year.

As mentioned, publicly disclosed crypto VC projects marked a 12% increase compared to the previous month. This makes July the third-highest month for crypto funding rounds this year, trailing only March and May, which had 190 and 155 rounds, respectively.

The total fundraising amount in July was $1.01 billion, reflecting a 26.5% increase from the $735 million raised in June 2024.

Read more: Best Investment Apps in 2024

The rise in funding volume shows mirrors the strong confidence in the crypto sector, even with economic uncertainties. Additionally, the way funds are spread across different sectors is changing, pointing to new priorities and trends in the industry.

“The year of 2023 was challenging for Web3 VCs with a significant decline in funding largely due to the collapse of FTX and Alameda, and investors shifting their focus toward AI-related startups. With the AI sector beginning to cool off, the crypto market can regain some momentum. Investors are now increasingly interested in projects that emphasize real-world applications of DLTs and address key challenges in the crypto industry, such as liquidity fragmentation across various blockchains and the difficulty of achieving scalability without compromising security of decentralization,” Rodrigo Pinto Pinheiro, Digital Assets and DeFi Quantitative Analyst at 3Comma Capital, told BeInCrypto.

The blockchain infrastructure sector, including Layer-1 and Layer-2 solutions, secured almost 20% of total July investments, followed by DeFi at 5.8%. CeFi saw the lowest at about 2.2%.

It is important to note that these figures do not include merger and acquisition deals.

Mining and AI Take Center Stage

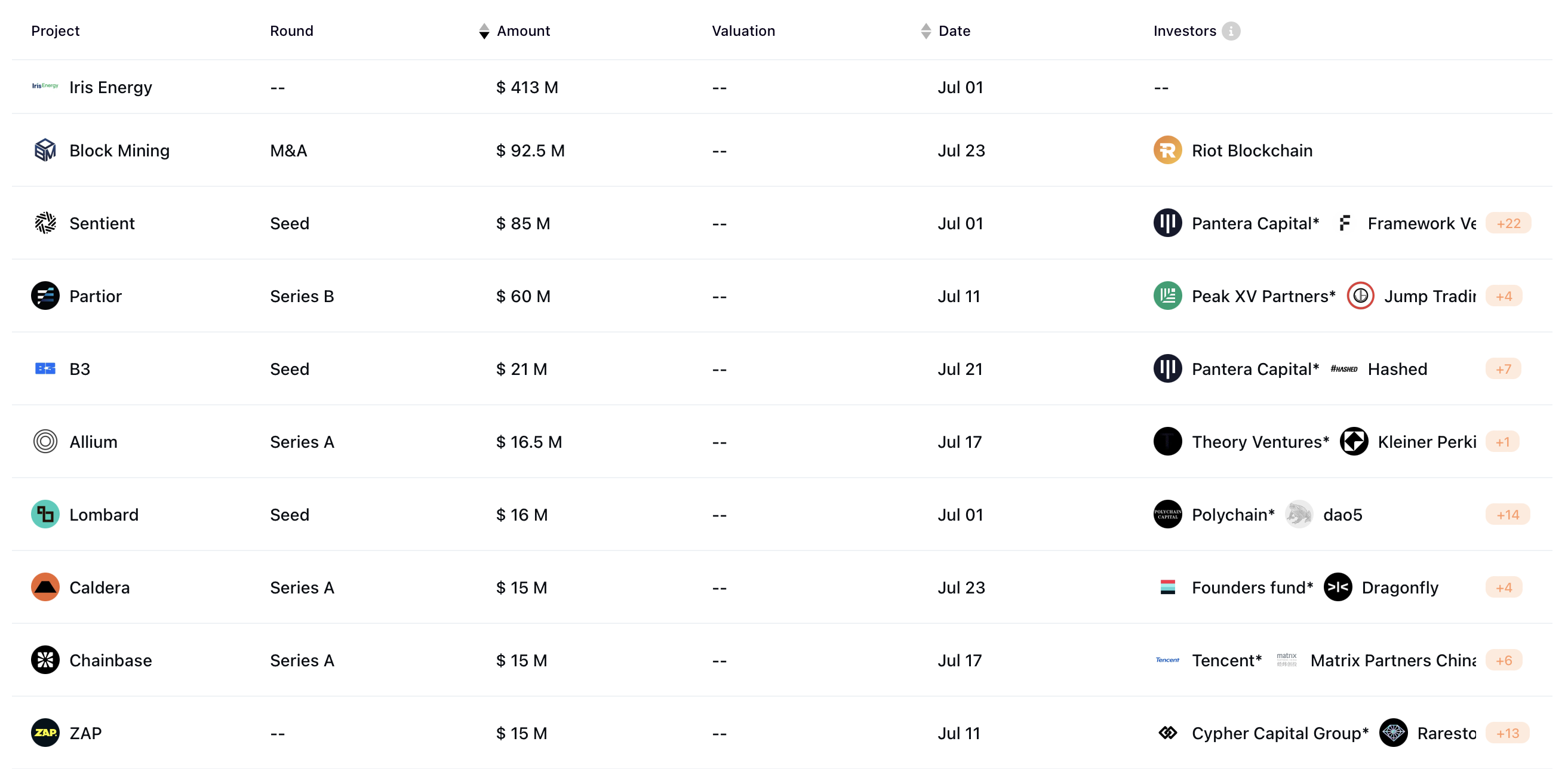

The most notable event in July was Iris Energy raising $413 million through stock offerings. The company also secured $257 million in Q1 and another $44.8 million between March 31 and May 15. These funds will support the company’s growth and expansion plans after the Bitcoin halving event, which affected mining profitability.

Following Iris, Block Mining secured a $92.5 million M&A deal. Riot Platforms bought a Kentucky-based Bitcoin miner for $18.5 million in cash and $74 million in Riot stock. Block Mining can earn up to $32.5 million more by adding power capacity through 2025. This deal boosts Riot’s hash rate, expands their geographic reach, and gives them access to new energy markets.

“In assessing potential acquisition partners, it became evident that Riot Platforms not only shares our vision for an energy-efficient Bitcoin miner, but also a complementary culture that values teamwork, creativity, and a relentless pursuit of excellence. Together, we are excited to leverage our collective strengths and expertise to build Bitcoin-first data centers that will propel us to the forefront of the industry,” said Michael Stoltzner, CEO and Co-founder of Block Mining.

Ethan Vera, Chief Operating Officer at Luxor, highlighted a broader trend in the industry. He noted that institutional Bitcoin miners are increasingly converging with the data center and AI sectors. As of Monday, Bitcoin mining economics have hit an all-time low, prompting some miners to pivot to AI compute due to their access to large electricity contracts. This shift benefits international operators in EMEA and Latam regions, who are quickly expanding their operations by leveraging low-cost machines and power.

Read more: Is Crypto Mining Profitable in 2024?

Artificial intelligence (AI) protocol Sentient secured $85 million in a round led by Pantera Capital and Framework Ventures, making it the most successful round among blockchain infrastructure projects. Sentient Labs will use the capital to speed up the development of its open-source AI platform.

“There is a need to return to the earlier era of open-source AI and find a way to monetize open models. Sentient has developed OML as a cryptographic primitive to solve this problem, creating an inclusive economy for community-built open AGI. Our protocol allows contributors to truly own the models they help create and reward them when it’s used. In the ideal version we are working on, the model will be loyal and won’t be able to run without giving rewards to the contributors,” Himanshu Tyagi, Core Contributor at Sentient, told BeInCrypto.

The startup also plans to expand its team by hiring experts in AI research and blockchain engineering, and aims to establish partnerships with top academic institutions and industry leaders.

Other major crypto investments included blockchain payment network Partior, which raised $60 million from traditional banking giants JPMorgan and Standard Chartered. Smaller rounds were seen across various sectors, such as DeFi and GameFi. Gaming projects like B3, Allium, and Bitcoin restaking protocol Lombard secured $21 million, $16.5 million, and $16 million, respectively.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.