The crypto market saw significant developments this week with the launch of spot Ethereum exchange-traded funds (ETFs) in the US and the highly anticipated Bitcoin 2024 Conference.

These events have drawn considerable attention from investors and enthusiasts alike.

ETH’s Price Dips Despite New ETF Launch

On July 23, spot Ethereum ETFs began trading in the US. These financial products provide investors with direct exposure to Ethereum (ETH) through a regulated platform, potentially boosting investment and liquidity in the market.

Despite the optimistic forecasts, Ethereum’s market response was muted. Following the launch, Ethereum’s price dipped to a low of $3,422 before stabilizing at $3,475. This ‘sell-the-news’ effect highlights typical market behavior where significant announcements lead to short-term price drops.

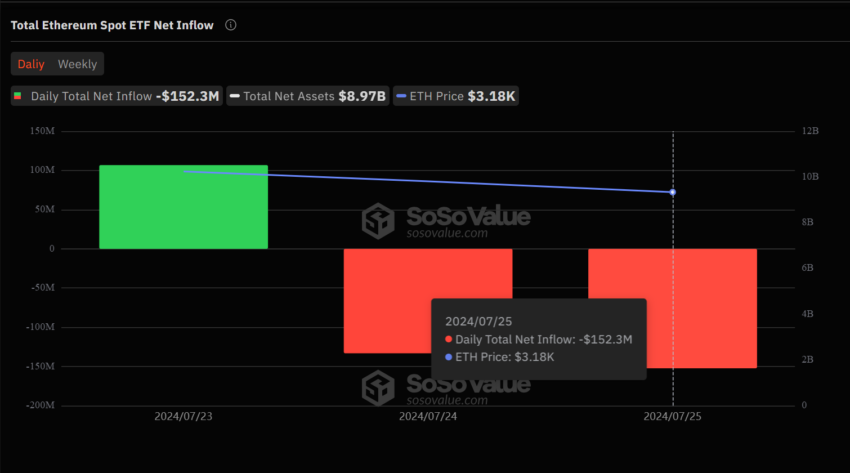

On its inaugural trading day, the total volume for these ETFs exceeded $1 billion. BlackRock’s ETHA led with $266.5 million in inflows, while Bitwise’s ETHW followed with $204 million.

Despite positive inflows for the new ETFs, the Grayscale Ethereum Trust (ETHE) experienced substantial outflows of $484.1 million. As of July 25, these ETFs had a negative cumulative net flow of $178.68 million, primarily due to ETHE’s outflows.

Read more: Ethereum ETF Explained: What It Is and How It Works

Binance Airdrops and the Rise of BANANA Token

Binance recently launched its first project on the Binance Airdrops Portal—the Banana Gun (BANANA) token. This token supports the Banana Gun bot, which offers advanced trading tools for on-chain tokens, providing more trading opportunities for Binance users, especially BNB token holders.

From June 23 to July 5, Binance customers who subscribed their BNB tokens to Simple Earn products qualified for the BANANA token airdrop. Following its listing on July 20, BANANA was available in various trading pairs, including BANANA/BTC and BANANA/USDT.

Despite being categorized as a seed token due to its volatility, BANANA saw a significant price surge, climbing from $55.31 to an all-time high of $78.62 before stabilizing at $63.74. Year-to-date, BANANA has achieved nearly a 500% increase.

Bitcoin 2024 Conference: Politics and Proposals

The Bitcoin 2024 Conference in Nashville, which started from July 25 to 27, has garnered considerable attention this week. This is partly due to former President Donald Trump’s participation as a key speaker.

Additionally, Trump’s campaign team has organized a fundraising event during the conference, with exclusive access priced at $844,600 per seat. High-profile donors also have the opportunity to have photographs taken with Trump, which costs $60,000 per person or $100,000 per couple.

In addition to Trump’s appearance, Wyoming Senator Cynthia Lummis is expected to introduce legislation proposing Bitcoin as a strategic reserve asset for the US. This bill would mandate the Federal Reserve to hold Bitcoin akin to its holdings of gold and foreign currencies, potentially making Bitcoin a crucial element of the US monetary system.

Other notable attendees include presidential candidate Robert F. Kennedy Jr. and various key industry figures. However, Vice President Kamala Harris, initially rumored to speak at the event, will not participate.

Joey Garcia, Director at Xapo Bank, shared the first day of the event with BeInCrypto. He noted a positive atmosphere and strong support for advancing Bitcoin adoption and regulatory frameworks.

“On today’s schedule, there has been a big focus on layer-2 innovations, but from speaking to people on the floor, the number one priority is still protecting and growing your wealth. The concept of ‘superpowering your Bitcoin’ by ensuring that it’s ultra-secure and providing an accessible bridge between the worlds of blockchain and banking, is resonating with everyone we speak to,” Garcia said in an email.

TON and Telegram Announce Major Updates

TON Foundation and Telegram have announced substantial developments this week. On July 18, TON Foundation unveiled “TON Teleport BTC,” a bridge facilitating seamless Bitcoin transfers to the TON Blockchain.

This project enhances Bitcoin’s utility by integrating it with TON’s secure and scalable network. The system ensures secure transactions by automating operations with network validators and smart contracts, eliminating human error and fraud.

Telegram also announced the upcoming launch of a Mini Apps store and an in-app browser with Web3 support by the end of July. This move follows the rising interest in Telegram Mini Apps, which are lightweight, JavaScript-based services within the platform. Telegram’s user base has also surged to 950 million, partly due to popular apps like Catizen, a tap-to-earn game that contributes significantly to the blockchain community and charitable causes.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.